Poll Tax Definition U.s. History

The Poll Tax, a term often encountered in the study of U.S. history, is a specific type of taxation that has left an indelible mark on the nation's political and social landscape. This tax, which is levied on individuals regardless of their income or property ownership, played a significant role in shaping the American political system and has a complex and controversial legacy.

Understanding the Poll Tax

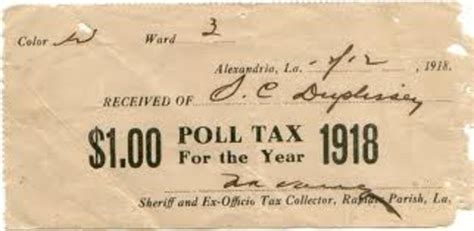

A Poll Tax, in its simplest form, is a head tax, meaning it is a fixed sum of money levied on every adult, irrespective of their financial status. It was a common form of taxation in the United States, particularly during the 19th and early 20th centuries. The tax was typically imposed annually, and failure to pay could result in legal consequences, including the inability to vote or access certain public services.

The origins of the Poll Tax can be traced back to colonial times when it was used as a means to raise revenue for local governments. Over time, it became a tool with broader implications, especially in the context of voting rights and political participation.

The Poll Tax and Voting Rights

One of the most significant impacts of the Poll Tax was its influence on voting rights. In the post-Civil War era, many Southern states implemented Poll Taxes as a requirement for voting, effectively disenfranchising a large portion of the population, particularly African Americans. This was a strategy employed to maintain white supremacy and prevent newly emancipated slaves and their descendants from exercising their constitutional right to vote.

The Poll Tax, along with other barriers such as literacy tests and grandfather clauses, formed part of the Jim Crow laws, which were designed to systematically exclude African Americans from political participation. These laws, including the Poll Tax, were a direct challenge to the 15th Amendment, which guarantees the right to vote regardless of "race, color, or previous condition of servitude."

The impact of these laws was profound. In some states, the Poll Tax, combined with other restrictions, resulted in a significant decrease in the voter turnout among African Americans. For instance, in the 1940s, Alabama's African American population represented nearly half of the state's residents, yet they accounted for only about 2% of registered voters.

Challenging the Poll Tax

The unconstitutionality of the Poll Tax as a voting requirement was a topic of significant debate and legal challenge. One of the most notable cases was Harper v. Virginia Board of Elections (1966), which ruled that a state’s Poll Tax violated the Equal Protection Clause of the 14th Amendment. This landmark decision was a significant victory for voting rights advocates and marked a turning point in the struggle for equal political participation.

The Harper decision, along with the passage of the 24th Amendment in 1964, which explicitly banned Poll Taxes in federal elections, effectively removed this barrier to voting in the United States. However, the legacy of the Poll Tax and other discriminatory voting practices continues to influence contemporary discussions on voter suppression and access to the ballot.

The Impact and Legacy

The Poll Tax’s influence on U.S. history is multifaceted. While it was primarily a tool of racial discrimination and voter suppression, it also had broader economic and social implications.

Economic Implications

For many individuals, especially those living in poverty, the Poll Tax represented a significant financial burden. In an era when many struggled to make ends meet, the tax could be a significant barrier to basic civic participation. This economic aspect of the Poll Tax is often overlooked, but it underscores the broader impact of such policies on the most vulnerable members of society.

Social and Political Impact

Beyond its economic implications, the Poll Tax had profound social and political consequences. It exacerbated existing racial tensions and reinforced the notion of white supremacy. The tax also contributed to a sense of political alienation and disempowerment among those who were unable to vote, impacting their sense of civic duty and trust in the political system.

The legacy of the Poll Tax continues to be felt in contemporary discussions on voting rights and political participation. It serves as a reminder of the ongoing struggle for equal access to the ballot and the need for vigilant protection of voting rights.

Modern Relevance

While the Poll Tax as a voting requirement has been abolished, its memory serves as a cautionary tale in modern political discourse. Today, debates over voter ID laws, early voting, and mail-in ballots often evoke echoes of the Poll Tax era, raising questions about the potential for modern-day voter suppression.

The study of the Poll Tax in U.S. history provides valuable insights into the complex interplay of politics, race, and social justice. It reminds us of the fragility of democratic ideals and the ongoing need to protect and expand voting rights for all citizens.

| Amendment | Impact on Poll Tax |

|---|---|

| 14th Amendment | The Equal Protection Clause was cited in Harper v. Virginia Board of Elections to strike down Poll Taxes. |

| 15th Amendment | Guarantees the right to vote regardless of race, but Poll Taxes were used to circumvent this right. |

| 24th Amendment | Explicitly banned Poll Taxes in federal elections, a significant step towards voting equality. |

How did the Poll Tax impact voter turnout in the South?

+

The Poll Tax, combined with other barriers like literacy tests, significantly decreased voter turnout among African Americans in the South. For instance, in Alabama, African Americans accounted for nearly half of the population but only about 2% of registered voters in the 1940s.

What was the legal basis for challenging the Poll Tax as a voting requirement?

+

The Harper v. Virginia Board of Elections case (1966) challenged the Poll Tax under the Equal Protection Clause of the 14th Amendment, arguing that it violated the principle of equal protection under the law.

Are there any modern-day equivalents to the Poll Tax?

+

While the Poll Tax itself has been abolished, modern-day debates over voter ID laws, early voting restrictions, and mail-in ballot regulations often raise concerns about potential voter suppression, reminiscent of the Poll Tax era.