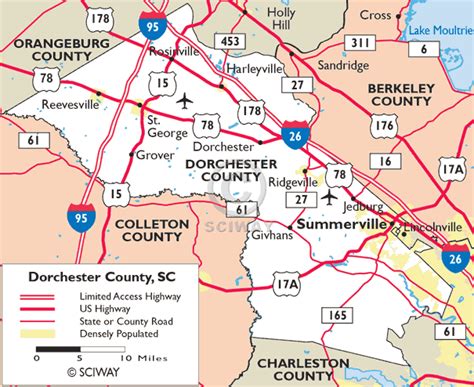

Dorchester County Sc Property Tax

Welcome to Dorchester County, a vibrant and thriving community nestled in the heart of South Carolina. With its rich history, diverse landscapes, and a thriving local economy, Dorchester County offers a unique blend of small-town charm and modern opportunities. One crucial aspect of living in this beautiful county is understanding the property tax system, which plays a significant role in shaping the community's growth and development. In this comprehensive guide, we will delve into the intricacies of Dorchester County's SC Property Tax, providing you with all the information you need to navigate this essential aspect of local governance.

Unveiling Dorchester County’s Property Tax Landscape

Dorchester County, like many other counties across the United States, relies on property taxes as a primary source of revenue to fund essential services and infrastructure. These taxes are integral to the smooth functioning of the community, impacting various aspects of daily life, from education and healthcare to road maintenance and public safety.

The SC Property Tax system in Dorchester County is designed to ensure fair and equitable taxation, considering the unique characteristics of each property. From residential homes to commercial establishments and agricultural lands, every property owner contributes to the county’s prosperity.

Understanding the Assessment Process

The journey of property taxation begins with the assessment phase. Dorchester County employs a team of dedicated assessors who are responsible for determining the fair market value of each property within the county. This process is meticulous and involves several key steps:

- Data Collection: Assessors gather extensive data about each property, including its physical characteristics, location, and any recent improvements or alterations.

- Market Analysis: They conduct a thorough analysis of the local real estate market, considering factors like recent sales, rental rates, and economic trends to determine the property’s value accurately.

- Assessment Notice: Once the assessment is complete, property owners receive an official notice detailing the assessed value of their property. This notice serves as a crucial document for understanding the upcoming tax liability.

It’s important to note that property assessments are conducted periodically, typically every few years, to ensure that tax obligations remain aligned with the current market conditions.

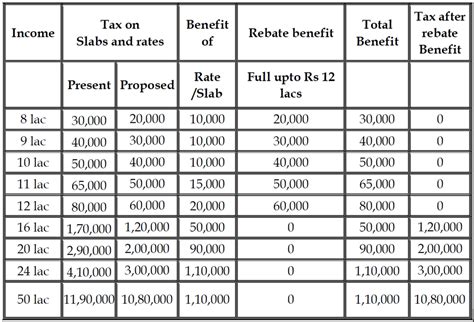

Tax Rates and Calculations

The assessed value of a property forms the basis for calculating the SC Property Tax liability. Dorchester County, like many counties, applies a millage rate to determine the final tax amount. A millage rate represents the number of dollars owed per thousand dollars of assessed property value.

For instance, if a property is assessed at 200,000 and the millage rate is set at 100 mills, the property owner would owe 2,000 in property taxes. This calculation is a straightforward and transparent process, ensuring that property owners understand their financial obligations.

| Millage Rate (Per $1,000 of Assessed Value) | Actual Tax Amount |

|---|---|

| 100 mills | $1,000 |

| 200 mills | $2,000 |

| 300 mills | $3,000 |

The millage rate is determined by the county's governing bodies, taking into account the budget requirements and the community's needs. It is important to stay informed about any changes to the millage rate, as it directly impacts your property tax bill.

Payment Options and Deadlines

Dorchester County offers a range of convenient payment options for SC Property Tax bills. Property owners can choose to pay their taxes in full or opt for installment plans to spread out the payments over a specified period. This flexibility ensures that taxpayers can manage their financial obligations effectively.

The county provides clear guidelines on payment deadlines, typically allowing for payments to be made throughout the year. However, it’s essential to note that missing payment deadlines may result in penalties and interest charges. Staying informed about the payment schedule and adhering to the deadlines is crucial to avoid any additional costs.

Tax Exemptions and Relief Programs

Dorchester County recognizes the diverse needs of its residents and offers a range of tax exemptions and relief programs to ease the financial burden on certain property owners. These initiatives aim to support vulnerable populations and promote community growth.

- Homestead Exemptions: Dorchester County provides homestead exemptions to eligible homeowners, reducing their taxable property value. This exemption is particularly beneficial for low-income individuals and families, helping them manage their property tax obligations more affordably.

- Veteran’s Exemptions: As a token of gratitude, the county offers tax exemptions to honorably discharged veterans. These exemptions recognize the service and sacrifice of veterans, providing them with financial relief.

- Agricultural Assessment Programs: For property owners engaged in agricultural activities, Dorchester County offers special assessment programs. These programs consider the unique characteristics of agricultural lands, ensuring fair taxation and supporting the local farming community.

The Impact of Property Taxes on the Community

The SC Property Tax system in Dorchester County extends beyond individual obligations; it has a profound impact on the community as a whole. The revenue generated from property taxes is a vital resource for funding essential services and driving local development.

Funding Essential Services

Property taxes are the lifeblood of many crucial services that enhance the quality of life for Dorchester County residents. Here’s a glimpse at how property tax revenue is allocated:

- Education: A significant portion of property tax revenue goes towards funding local schools, ensuring that students receive the best possible education. This investment in education shapes the future of the community.

- Public Safety: Property taxes contribute to maintaining a robust public safety infrastructure, including police and fire departments. These services are vital for protecting residents and their properties.

- Healthcare: Property tax revenue plays a role in supporting local healthcare facilities and initiatives, ensuring that residents have access to quality healthcare services.

- Infrastructure Development: From road improvements to water and sewage systems, property taxes fund the maintenance and development of essential infrastructure, enhancing the overall livability of the county.

Promoting Community Growth

Beyond funding essential services, Dorchester County’s SC Property Tax system also drives community growth and development. The revenue generated contributes to initiatives that enhance the county’s attractiveness and livability.

- Economic Development: Property tax revenue supports economic development efforts, attracting businesses and creating job opportunities. This, in turn, boosts the local economy and enhances the community’s prosperity.

- Recreational Facilities: The county utilizes property tax funds to develop and maintain recreational facilities, such as parks, sports fields, and community centers. These amenities enhance the quality of life for residents and promote a healthy, active lifestyle.

- Environmental Initiatives: Dorchester County recognizes the importance of environmental conservation. Property tax revenue supports initiatives aimed at preserving natural resources, protecting wildlife, and promoting sustainable practices.

Ensuring Transparency and Accountability

Dorchester County is committed to maintaining transparency and accountability in its SC Property Tax system. The county’s government and tax authorities provide extensive resources and information to keep residents informed about tax policies, assessment processes, and payment procedures.

Additionally, the county encourages resident participation and feedback, ensuring that the tax system remains responsive to the community’s needs and concerns. This commitment to transparency fosters trust and ensures that property taxes are utilized effectively for the betterment of Dorchester County.

Conclusion: Navigating Dorchester County’s Property Tax Landscape

Understanding Dorchester County’s SC Property Tax system is essential for every property owner in the community. From the assessment process to tax calculations, payment options, and exemptions, this guide has provided a comprehensive overview of the key aspects of property taxation in Dorchester County.

By staying informed and engaged, property owners can navigate the tax landscape with confidence, ensuring they meet their obligations while also taking advantage of available exemptions and relief programs. Remember, property taxes are not just a financial obligation; they are an investment in the community’s growth and development, shaping the future of Dorchester County for the better.

How often are property assessments conducted in Dorchester County?

+

Property assessments in Dorchester County are typically conducted every 5 years. However, the county may conduct reassessments more frequently in certain circumstances, such as significant property improvements or changes in market conditions.

Are there any online tools available to estimate property tax liabilities in Dorchester County?

+

Yes, Dorchester County provides an online property tax estimator tool on its official website. This tool allows property owners to input their assessed property value and the current millage rate to estimate their tax liability. It’s a convenient way to get an estimate before receiving the official tax bill.

What happens if I miss the property tax payment deadline in Dorchester County?

+

Missing the property tax payment deadline in Dorchester County may result in late fees and interest charges. It’s important to stay informed about the payment schedule and adhere to the deadlines to avoid additional costs. The county may also initiate collection actions if taxes remain unpaid for an extended period.

How can I apply for a tax exemption or relief program in Dorchester County?

+

To apply for tax exemptions or relief programs in Dorchester County, you can visit the county’s official website or contact the tax assessor’s office. They will provide you with the necessary forms and guidelines to apply for the specific exemption or program you are eligible for. It’s important to gather the required documentation and submit your application within the specified timeframe.

Can I appeal my property assessment in Dorchester County if I believe it is inaccurate?

+

Yes, Dorchester County provides a process for property owners to appeal their assessments if they believe they are inaccurate or unfair. The appeal process typically involves submitting documentation and evidence to support your case. It’s important to review the appeal guidelines and deadlines carefully and seek professional advice if needed.