Indiana Auto Sales Tax

The Indiana auto sales tax is a crucial aspect of the state's tax system, impacting both residents and businesses alike. This tax is an essential revenue stream for the state government and is used to fund various public services and infrastructure projects. Understanding the intricacies of this tax is vital for anyone considering purchasing a vehicle in Indiana.

Understanding the Indiana Auto Sales Tax

The auto sales tax in Indiana is a transaction-based tax imposed on the purchase of motor vehicles, including cars, trucks, motorcycles, and recreational vehicles. It is a percentage-based tax, calculated on the purchase price of the vehicle, and is paid at the time of registration.

The state of Indiana sets the sales tax rate, which applies uniformly across the state. However, it's important to note that in addition to the state sales tax, some counties and municipalities may also impose their own local sales taxes, leading to a higher overall tax burden for vehicle purchasers.

As of the most recent information available, the state sales tax rate for auto sales in Indiana stands at 7%. This rate is subject to change, so it's crucial to verify the current rate with the Indiana Department of Revenue before finalizing any vehicle purchases.

Calculating the Auto Sales Tax

To calculate the auto sales tax in Indiana, you simply multiply the purchase price of the vehicle by the applicable tax rate. For example, if you purchase a car for 25,000 and the sales tax rate is 7%, the sales tax amount would be 1,750.

It's important to note that the sales tax is typically calculated after any applicable trade-in value or rebates have been applied to the purchase price. This means that the tax is based on the net price of the vehicle, which could be lower than the sticker price.

Additionally, there are certain exemptions and special considerations for specific types of vehicles or purchasers. For instance, some disabled individuals may qualify for tax exemptions, and certain types of government or non-profit organizations may also be exempt from paying sales tax on vehicle purchases.

| Vehicle Type | Sales Tax Rate |

|---|---|

| Motor Vehicles (Cars, Trucks) | 7% |

| Motorcycles | 7% |

| Recreational Vehicles (RVs) | 7% |

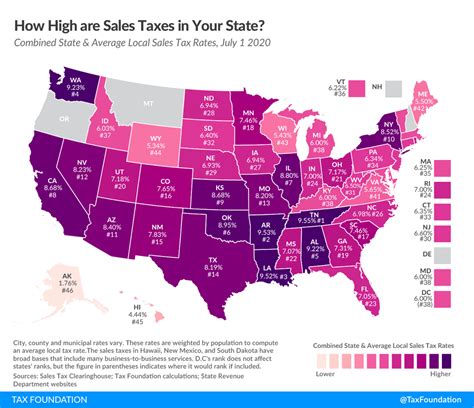

Comparing Indiana’s Auto Sales Tax with Other States

Indiana’s auto sales tax rate of 7% is relatively average compared to other states in the US. While some states have lower rates, others impose significantly higher taxes on vehicle purchases.

For instance, neighboring states like Ohio and Kentucky have sales tax rates of 6.25% and 6%, respectively. However, it's important to consider that these states may have different local tax rates or additional fees, which could impact the overall tax burden.

On the other end of the spectrum, states like California and Washington have some of the highest auto sales tax rates, with California's rate reaching as high as 10% in some counties. This demonstrates the wide variation in sales tax rates across the country, emphasizing the importance of understanding the tax landscape in your specific state.

Regional Variations in Sales Tax Rates

It’s worth noting that within Indiana itself, there can be regional variations in sales tax rates due to the potential for local governments to impose additional taxes. While the state sales tax rate remains uniform, local taxes can increase the overall tax burden on vehicle purchases.

For instance, cities like Indianapolis and Evansville may have additional city-level taxes that are applied on top of the state sales tax. These variations can significantly impact the total cost of purchasing a vehicle, so it's crucial to research the specific tax rates in your area.

| State | Sales Tax Rate |

|---|---|

| Indiana | 7% |

| Ohio | 6.25% |

| Kentucky | 6% |

| California | Varies (Up to 10% in some counties) |

| Washington | Varies (Up to 10.4% in some cities) |

The Impact of Auto Sales Tax on Vehicle Purchases

The auto sales tax significantly influences the cost of purchasing a vehicle in Indiana. For many consumers, this tax represents a substantial portion of the overall expense, especially when purchasing a high-value vehicle.

For instance, consider a scenario where a consumer is looking to purchase a new vehicle priced at $35,000. With a 7% sales tax rate, the tax amount would be $2,450. This tax burden can be a significant consideration for buyers, potentially impacting their purchasing decisions or budget allocations.

Strategic Considerations for Buyers

Given the substantial impact of the auto sales tax, buyers may consider various strategies to optimize their vehicle purchases. One common approach is to time their purchase to coincide with tax-free holidays or promotional periods, which can offer significant savings.

Additionally, exploring financing options can also help mitigate the impact of the sales tax. By spreading the cost of the vehicle over time through loans or lease agreements, buyers can manage the financial burden more effectively, especially when considering the added sales tax.

It's also worth noting that the sales tax on vehicle purchases is often a factor in negotiations with dealerships. Buyers can use the potential tax savings as a leverage point in their discussions, potentially securing a better deal on the vehicle's purchase price.

Future Implications and Potential Changes

The landscape of auto sales taxes is subject to change, and Indiana is no exception. While the current sales tax rate of 7% has been stable for some time, there is always the potential for legislative changes or economic shifts that could impact the tax structure.

For instance, if the state government faces budgetary constraints or seeks to fund specific projects, they may consider raising the sales tax rate. On the other hand, economic downturns or changes in federal tax policies could also lead to potential reductions in the sales tax rate.

It's also worth considering the potential impact of technological advancements and the shift towards electric vehicles (EVs). As the market for EVs grows, states may consider offering tax incentives or rebates to encourage the adoption of these environmentally friendly vehicles. Such incentives could significantly alter the tax landscape for vehicle purchasers in Indiana.

Conclusion

The Indiana auto sales tax is a significant consideration for anyone looking to purchase a vehicle in the state. With a current rate of 7%, this tax can represent a substantial portion of the overall cost of a vehicle purchase. Understanding the intricacies of this tax, including potential regional variations and future implications, is vital for making informed purchasing decisions.

As with any tax-related matter, it's essential to consult with tax professionals or the Indiana Department of Revenue for the most up-to-date and accurate information. The landscape of auto sales taxes can evolve quickly, so staying informed is key to making the best financial decisions when purchasing a vehicle in Indiana.

What is the current auto sales tax rate in Indiana?

+The current state sales tax rate for auto sales in Indiana is 7% as of the most recent information available.

Are there any exemptions or special considerations for the auto sales tax in Indiana?

+Yes, there are certain exemptions and special considerations for specific types of vehicles or purchasers. For instance, some disabled individuals may qualify for tax exemptions, and certain types of government or non-profit organizations may also be exempt from paying sales tax on vehicle purchases.

How do I calculate the auto sales tax on a vehicle purchase in Indiana?

+To calculate the auto sales tax, multiply the purchase price of the vehicle by the applicable tax rate. For example, if the purchase price is 25,000 and the tax rate is 7%, the sales tax amount would be 1,750.

Are there any potential changes to the auto sales tax rate in Indiana in the near future?

+The auto sales tax rate in Indiana is subject to change, so it’s important to stay informed. While there are no immediate plans for changes, the tax landscape can evolve quickly, influenced by various economic and legislative factors.

Can I negotiate the auto sales tax when purchasing a vehicle in Indiana?

+The auto sales tax is a mandatory tax set by the state, so it cannot be negotiated directly. However, you can use the potential tax savings as a leverage point in your negotiations with dealerships to potentially secure a better deal on the vehicle’s purchase price.