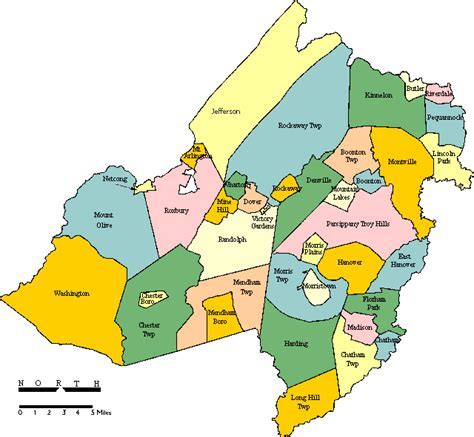

Monmouth County Tax Records

Welcome to this in-depth exploration of Monmouth County Tax Records, a comprehensive guide designed to provide you with an expert understanding of this essential aspect of property ownership and management in Monmouth County, New Jersey.

Unveiling the Complexities of Monmouth County Tax Records

Diving into the realm of tax records can be daunting, especially when navigating the unique landscape of a specific county. Monmouth County, with its vibrant communities and diverse properties, presents a complex yet fascinating system of taxation. This guide aims to demystify these complexities, offering a transparent and informative journey through the world of tax assessments, payments, and everything in between.

In Monmouth County, tax records are not merely numerical data; they are a reflection of the county's economic landscape, its growth, and its commitment to fairness and transparency. As we delve deeper, we'll uncover the processes, the key players, and the intricate details that make up this vital component of property ownership.

Understanding Tax Assessments: A Foundation for Property Owners

At the heart of Monmouth County’s tax system lies the assessment process. Tax assessments are the cornerstone upon which property taxes are calculated. These assessments determine the value of each property within the county, ensuring a fair and equitable distribution of the tax burden.

The Monmouth County Tax Assessor's Office plays a pivotal role here. Their expertise and methodology are instrumental in assigning values to properties, considering factors like size, location, improvements, and market trends. This process ensures that each property owner contributes their fair share to the county's revenue, fostering a sense of community and responsibility.

| Assessment Period | Frequency |

|---|---|

| General Reassessment | Every 6 years |

| Limited Assessments | Annually |

For property owners, understanding these assessments is crucial. It provides insight into the value of their property, allowing them to make informed decisions about maintenance, improvements, and potential sales. Moreover, it ensures that any disputes or challenges to the assessed value can be addressed promptly and fairly.

Navigating Tax Payments: A Step-by-Step Guide

Once assessments are complete, property owners navigate the world of tax payments. This process, while seemingly straightforward, requires attention to detail and timely action.

Monmouth County offers a user-friendly Online Tax Payment Portal, providing property owners with a convenient and secure method to manage their tax obligations. This portal allows for real-time tracking of payments, ensuring transparency and peace of mind.

| Payment Due Dates | Installment Amount |

|---|---|

| February 1st | 1st Installment |

| May 1st | 2nd Installment |

| August 1st | 3rd Installment |

| November 1st | 4th Installment |

Additionally, the county provides various payment options, including credit card, eCheck, and direct deposit. This flexibility ensures that property owners can choose the method that best suits their financial preferences and needs.

For those who prefer a more traditional approach, the Monmouth County Tax Collector's Office is readily available to assist with in-person payments and inquiries. Their team of professionals is dedicated to ensuring a smooth and efficient payment process, addressing any concerns or queries promptly.

Exploring Tax Relief Programs: A Support System for Property Owners

Recognizing the diverse needs of its property owners, Monmouth County offers a range of tax relief programs. These initiatives are designed to support homeowners, especially those facing financial challenges or unique circumstances.

One such program is the Homestead Rebate, which provides eligible homeowners with a rebate on their property taxes. This initiative aims to ease the tax burden, making homeownership more affordable and sustainable. To qualify, homeowners must meet certain income and residency requirements, as outlined by the Monmouth County Board of Taxation.

Additionally, the county offers Veterans Exemptions and Senior Citizen Deductions. These programs honor the contributions of veterans and support the financial well-being of senior citizens, respectively. By reducing the taxable value of their properties, these initiatives provide much-needed relief, ensuring that our veterans and seniors can continue to call Monmouth County home.

For those facing financial hardships, the Monmouth County Property Tax Assistance Program offers a lifeline. This program provides temporary relief to homeowners who have experienced unforeseen financial challenges, ensuring that they can maintain their property ownership during difficult times.

The Role of Technology: Enhancing the Tax Record Experience

In today’s digital age, technology plays a pivotal role in streamlining and enhancing the tax record experience. Monmouth County has embraced this evolution, implementing innovative solutions to improve efficiency and accessibility.

The Monmouth County Tax Records Online Portal is a prime example of this. This portal provides property owners with instant access to their tax records, assessments, and payment histories. It also offers a platform for secure communication with the tax office, allowing for quick resolution of queries and concerns.

Furthermore, the county utilizes advanced data analytics to ensure accuracy and fairness in tax assessments. By leveraging technology, Monmouth County can identify potential errors, inconsistencies, and anomalies, ensuring that every property owner receives a fair and accurate assessment.

Conclusion: A Comprehensive Approach to Tax Records

Monmouth County’s approach to tax records is a testament to its commitment to transparency, fairness, and community well-being. From the meticulous assessment process to the innovative use of technology, every aspect is designed to simplify and enhance the property ownership experience.

As we've explored, Monmouth County Tax Records are more than just numbers on a page. They are a reflection of the county's dedication to its residents, its properties, and its future. By understanding and navigating this system, property owners can embrace their role as stakeholders, contributing to the vibrant community that is Monmouth County.

Frequently Asked Questions

How often are properties reassessed for tax purposes in Monmouth County?

+

Properties in Monmouth County undergo a general reassessment every 6 years. However, limited assessments may occur annually to account for significant changes or improvements to a property.

What payment options are available for property taxes in Monmouth County?

+

Monmouth County offers a range of payment options, including credit card, eCheck, and direct deposit. Property owners can choose the method that best suits their financial preferences.

Are there any tax relief programs available for homeowners in Monmouth County?

+

Yes, Monmouth County provides several tax relief programs. These include the Homestead Rebate, Veterans Exemptions, Senior Citizen Deductions, and the Property Tax Assistance Program, each designed to support homeowners in unique circumstances.

How can I access my tax records and payment history in Monmouth County?

+

You can access your tax records and payment history through the Monmouth County Tax Records Online Portal. This secure platform provides instant access to your records and offers a convenient way to communicate with the tax office.