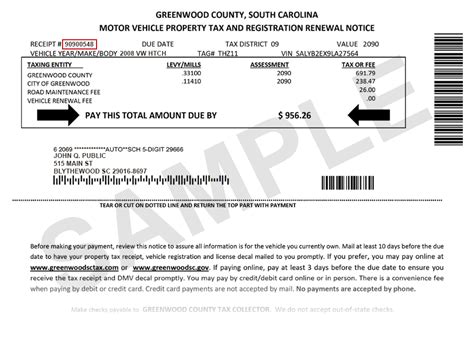

Taxes On Car In Sc

In South Carolina, understanding the taxation system for vehicles is essential for both residents and those considering a move to the state. The tax structure for cars in South Carolina is unique and consists of several components, including a one-time sales tax, an annual registration fee, and additional taxes based on the vehicle's age and value. This article aims to provide a comprehensive guide to navigating the tax landscape for cars in South Carolina, ensuring that you are well-informed about the financial obligations associated with vehicle ownership in the Palmetto State.

Understanding the Sales Tax Structure

When purchasing a new or used vehicle in South Carolina, you’ll encounter a one-time sales tax that is applied to the purchase price. This sales tax rate varies depending on the county where the vehicle is registered. For instance, in Charleston County, the sales tax rate is 8%, while in Greenville County, it stands at 7%. It’s crucial to factor in this sales tax when budgeting for your vehicle purchase, as it can significantly impact the overall cost.

South Carolina offers a tax relief program known as the Sales Tax Exemption for Certain Vehicles. This program exempts certain types of vehicles from sales tax, including:

- Vehicles purchased by active-duty military personnel

- Electric vehicles

- Vehicles purchased through certain state-run programs

- Vehicles donated to a qualified nonprofit organization

To take advantage of this exemption, you'll need to provide specific documentation to the South Carolina Department of Revenue. The process and required paperwork vary based on the type of vehicle and your eligibility criteria.

Annual Registration Fees and Additional Taxes

In addition to the one-time sales tax, car owners in South Carolina are subject to an annual registration fee. This fee is determined by the weight of the vehicle and can range from approximately 10 for vehicles weighing less than 2,500 pounds to 100 for those weighing over 10,000 pounds. The registration fee is typically paid once a year, coinciding with the vehicle’s registration renewal.

South Carolina also imposes an additional tax on older vehicles, known as the Vehicle Use Tax. This tax applies to vehicles that are:

- Over 5 years old

- Registered in South Carolina for the first time

The Vehicle Use Tax is calculated based on the vehicle's fair market value and is subject to a sliding scale. For example, a vehicle with a fair market value of $10,000 would be taxed at a rate of 1.5%, resulting in a tax amount of $150. This tax is due when the vehicle is initially registered in the state.

Taxation on Electric and Hybrid Vehicles

South Carolina offers incentives for the adoption of electric and hybrid vehicles. While these vehicles are exempt from the one-time sales tax, they are subject to an annual fee of 120 for electric vehicles and 75 for hybrid vehicles. This fee is in place to offset the revenue lost from the sales tax exemption and ensure fairness across all vehicle types.

Tax Credits and Incentives

South Carolina provides several tax credits and incentives to promote sustainable transportation and support certain vehicle purchases. These include:

- Clean Fuels Tax Credit: A credit for the purchase of alternative fuel vehicles or the installation of charging infrastructure.

- Disabled Veteran Vehicle Registration Fee Exemption: Active-duty military personnel and veterans with a disability rating of 50% or more are exempt from the annual registration fee.

- Low-Emission Vehicle Tax Credit: A credit for the purchase of a vehicle that meets specific low-emission standards.

To claim these credits or exemptions, you'll need to complete the appropriate forms and provide supporting documentation to the South Carolina Department of Revenue.

Performance Analysis and Future Implications

The taxation system for cars in South Carolina has had a significant impact on vehicle ownership and the state’s revenue. According to the South Carolina Department of Revenue, the state collected over $1.2 billion in vehicle-related taxes in the fiscal year 2022. This revenue stream plays a crucial role in funding various state programs and infrastructure projects.

Looking ahead, the state's taxation system is expected to undergo some changes. There are discussions underway to rework the sales tax structure, potentially introducing a flat tax rate across all counties to simplify the process for both residents and businesses. Additionally, with the growing popularity of electric and hybrid vehicles, the state may consider adjusting the annual fees to ensure a sustainable revenue stream.

Furthermore, as the automotive industry continues to evolve, South Carolina may explore new tax incentives to encourage the adoption of advanced vehicle technologies and promote environmental sustainability. These potential changes will likely be influenced by both economic factors and the state's commitment to supporting its residents and businesses.

What is the average cost of vehicle-related taxes in South Carolina for a typical car owner?

+The average cost of vehicle-related taxes in South Carolina can vary significantly based on several factors, including the vehicle’s value, weight, and age. For a typical car owner, the cost could range from a few hundred dollars to over a thousand dollars per year, including the sales tax, annual registration fee, and any additional taxes. It’s essential to calculate these costs when budgeting for vehicle ownership in the state.

Are there any ways to reduce the tax burden when purchasing a vehicle in South Carolina?

+Yes, there are a few strategies to consider. Firstly, if you’re purchasing a used vehicle, aim to find one that is under 5 years old to avoid the Vehicle Use Tax. Additionally, exploring tax-exempt vehicles, such as electric or hybrid cars, can provide significant savings. Lastly, if you’re eligible for any tax credits or exemptions, be sure to claim them to reduce your overall tax liability.

How often do I need to pay the annual registration fee for my vehicle in South Carolina?

+The annual registration fee for your vehicle in South Carolina is typically due once a year, coinciding with the renewal of your vehicle’s registration. This fee is determined by the weight of your vehicle and can range from approximately 10 to 100. It’s essential to stay up-to-date with your registration renewal to avoid penalties and ensure your vehicle remains legally registered.

Can I claim the Clean Fuels Tax Credit if I install a home charging station for my electric vehicle?

+Yes, if you install a home charging station for your electric vehicle, you may be eligible for the Clean Fuels Tax Credit. This credit is designed to encourage the adoption of alternative fuel vehicles and the installation of charging infrastructure. Be sure to review the specific guidelines and requirements to ensure you qualify for the credit.

What happens if I fail to pay the annual registration fee for my vehicle in South Carolina?

+If you fail to pay the annual registration fee for your vehicle in South Carolina, you may face penalties and fines. Additionally, your vehicle registration could be considered delinquent, which may result in the suspension of your driving privileges. It’s crucial to stay on top of your registration fees to avoid these consequences and maintain legal vehicle ownership.