New York State Estate Tax

Welcome to an in-depth exploration of the New York State Estate Tax, a complex yet crucial aspect of estate planning within the Empire State. This comprehensive guide aims to demystify the intricacies of this tax, offering a detailed breakdown of its mechanisms, implications, and strategic considerations. By understanding the estate tax landscape in New York, individuals can make informed decisions to protect their wealth and ensure a smooth transition for their beneficiaries.

Unraveling the Complexity of New York State Estate Tax

The estate tax in New York is a levy imposed on the transfer of a deceased individual’s assets, often referred to as their estate. This tax is distinct from the federal estate tax, showcasing the state’s unique approach to managing wealth distribution after death. With a threshold that often changes based on economic conditions and legislative decisions, navigating the New York State Estate Tax requires a keen understanding of its nuances.

Key Components and Thresholds

New York’s estate tax is triggered when the value of an individual’s estate exceeds a certain threshold. As of 2023, this threshold stands at $5,930,000, meaning estates valued below this amount are generally exempt from the state tax. However, this threshold is subject to change, influenced by factors such as inflation adjustments and legislative amendments.

It's worth noting that New York State operates a pick-up tax, which effectively means that the state estate tax rates mirror the federal estate tax rates. This ensures consistency and simplifies the calculation process for individuals and estate planners. The current federal estate tax exemption, as of the 2023 tax year, is $12.92 million, providing a substantial buffer before estate taxes become applicable at the federal level.

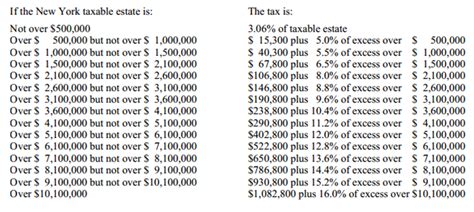

Calculation and Rate Structure

The calculation of New York State Estate Tax involves a progressive rate structure, with rates increasing as the value of the estate grows. The current rates, effective for estates valued over the threshold, range from 0.8% to 16%. This progressive nature ensures that larger estates contribute a greater proportion of their value to the state.

To illustrate, consider an estate valued at $7 million. The first $5,930,000 would be exempt from the state tax, as it falls below the threshold. The remaining $1,070,000 would be taxed at a rate that increases progressively, with the highest rate applying to the portion of the estate exceeding $10,930,000. This complex calculation underscores the importance of precise valuation and strategic planning to minimize the tax burden.

Impact and Strategic Considerations

The New York State Estate Tax can significantly impact the value of an estate that is passed on to beneficiaries. For high-net-worth individuals and families, this tax can represent a substantial financial burden, potentially reducing the wealth that would otherwise be inherited. Therefore, strategic planning becomes essential to mitigate the tax’s impact and preserve the value of the estate.

One common strategy to reduce the estate tax burden involves gift-giving. By gifting assets during one's lifetime, individuals can reduce the value of their estate, potentially pushing it below the taxable threshold. This strategy not only reduces the estate's tax liability but also ensures that the recipient can enjoy the benefits of the gift immediately, rather than waiting for inheritance.

| Estate Value | Taxable Amount | Estimated Tax |

|---|---|---|

| $6,000,000 | $70,000 | $560,000 |

| $8,000,000 | $2,070,000 | $2,632,400 |

| $12,000,000 | $6,070,000 | $8,742,800 |

Another approach is the use of trusts, which can be structured to minimize tax implications. For instance, a revocable living trust allows the grantor to maintain control over the assets during their lifetime, while also providing tax advantages and flexibility in estate planning. Additionally, irrevocable trusts can be used to remove assets from the estate, offering protection from estate taxes.

Estate Planning Strategies for New York Residents

Given the intricacies of the New York State Estate Tax, effective estate planning becomes a critical endeavor for residents. Here, we delve into some advanced strategies that can help individuals minimize their tax liability and maximize the value of their estate for their beneficiaries.

Charitable Planning

One effective strategy to reduce estate taxes is through charitable planning. Donors can make significant contributions to qualified charitable organizations, which not only supports their favorite causes but also provides tax benefits. Gifts to charity can be made during one’s lifetime or as part of an estate plan, and they can significantly reduce the taxable value of an estate.

For instance, an individual with an estate valued at $8 million could consider gifting $2 million to charity. This would not only support a charitable cause but would also reduce the taxable estate to $6 million, potentially saving a substantial amount in estate taxes. Additionally, charitable contributions can be made through donor-advised funds, charitable remainder trusts, or charitable lead trusts, offering flexibility and tax advantages.

Life Insurance and Estate Planning

Life insurance is a powerful tool in estate planning, especially for individuals seeking to provide financial security for their loved ones after their passing. When structured appropriately, life insurance proceeds can be used to pay estate taxes, ensuring that the bulk of the estate’s assets are passed on to beneficiaries without being diminished by tax liabilities.

Consider a scenario where an individual has an estate valued at $10 million and a life insurance policy with a $2 million death benefit. If structured as an irrevocable life insurance trust, the proceeds from the policy can be used to pay the estate taxes, effectively reducing the taxable estate to $8 million. This strategy not only preserves the estate's value but also provides a significant tax advantage.

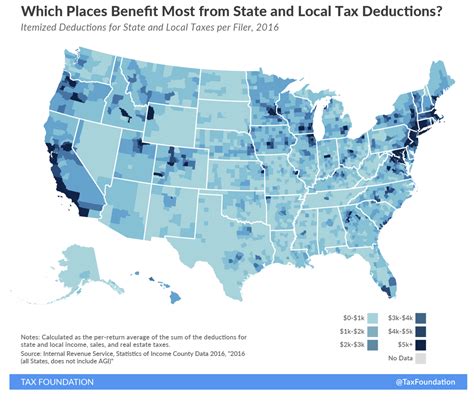

Estate Planning with Real Estate

For individuals with significant real estate holdings, estate planning becomes even more complex. However, there are strategies to minimize the tax burden and ensure a smooth transition of these assets. One approach is to gift real estate during one’s lifetime, which can reduce the taxable value of the estate. This strategy is particularly beneficial if the real estate is valued at a significant amount, potentially pushing the estate over the taxable threshold.

Alternatively, selling real estate within the estate can be an effective strategy. By selling the property and distributing the proceeds to beneficiaries, the estate can avoid potential capital gains taxes and reduce the overall value of the estate. This strategy is particularly advantageous if the real estate is expected to appreciate significantly over time, as the sale locks in the current value and avoids future capital gains taxes.

The Role of Estate Planning Professionals

Estate planning is a complex field, and navigating the nuances of the New York State Estate Tax requires expert guidance. Certified financial planners, tax advisors, and estate planning attorneys play a crucial role in helping individuals craft strategies that align with their financial goals and personal circumstances.

Financial Planners and Tax Advisors

Financial planners with expertise in estate planning can offer valuable insights into the best strategies to minimize tax liability. They can help individuals understand the implications of different planning approaches, such as gifting, using trusts, and incorporating life insurance policies. By working with a financial planner, individuals can ensure their estate plan is aligned with their long-term financial goals and personal values.

Tax advisors, on the other hand, focus on the tax implications of estate planning decisions. They can provide detailed analyses of the potential tax liabilities associated with different strategies, helping individuals make informed choices. Tax advisors can also assist with the complex calculations involved in determining the estate tax burden, ensuring accuracy and compliance with state and federal regulations.

Estate Planning Attorneys

Estate planning attorneys play a critical role in drafting the legal documents that form the foundation of an estate plan. They ensure that the wishes of the individual are legally binding and enforceable, providing peace of mind that the estate will be distributed as intended. Attorneys can also offer guidance on the legal aspects of gifting, trust formation, and other strategies to reduce estate taxes.

Furthermore, estate planning attorneys can help individuals navigate the complexities of probate, which is the legal process that validates a will and oversees the distribution of assets. By working with an attorney, individuals can ensure that their estate plan is structured to minimize the time and costs associated with probate, providing a smoother transition for their beneficiaries.

Conclusion: A Comprehensive Approach to Estate Planning

Estate planning is a multifaceted process that requires a deep understanding of personal finances, tax laws, and legal structures. For residents of New York State, the complexities of the estate tax add an additional layer of consideration. However, with the right strategies and professional guidance, individuals can effectively navigate these complexities and ensure their wealth is protected and transferred efficiently.

From charitable planning to strategic use of life insurance and real estate, there are numerous avenues to explore when crafting an estate plan. The key is to work with a team of experts, including financial planners, tax advisors, and estate planning attorneys, to develop a comprehensive strategy that aligns with personal goals and minimizes tax implications. By doing so, individuals can rest assured that their legacy is secure and their beneficiaries are well provided for.

FAQ

How does the New York State Estate Tax threshold change over time?

+

The threshold for the New York State Estate Tax is subject to annual adjustments, primarily based on inflation. These adjustments are made to ensure that the tax remains relevant and to account for changes in the value of money over time. As a result, the threshold can increase or decrease slightly from year to year.

Are there any exemptions or special considerations for certain types of assets in the New York State Estate Tax calculations?

+

Yes, New York State does offer certain exemptions and special considerations for specific types of assets. For instance, qualified retirement plans, such as 401(k)s and IRAs, are exempt from the estate tax. Additionally, assets owned jointly with a spouse or transferred to a surviving spouse are also generally exempt from the state estate tax.

What happens if the estate is valued above the taxable threshold but the beneficiaries are unable to pay the estate tax?

+

If an estate exceeds the taxable threshold and the beneficiaries are unable to pay the estate tax, the estate itself may be subject to additional taxes and penalties. In such cases, it is crucial for the executor of the estate to explore options such as selling assets or taking out a loan to cover the tax liability. It’s important to consult with a tax professional to navigate this situation effectively.