New York State Tax Refund

The New York State Department of Taxation and Finance plays a crucial role in managing the financial landscape of the state, and one of its key responsibilities is the processing and issuance of tax refunds. Tax refunds are an important aspect of the financial ecosystem, offering a boost to individuals and families while contributing to the overall economic health of the region. This article delves into the intricacies of the New York State tax refund process, exploring the various factors that influence refund amounts, the timelines involved, and the steps individuals can take to maximize their refunds.

Understanding the New York State Tax Refund Process

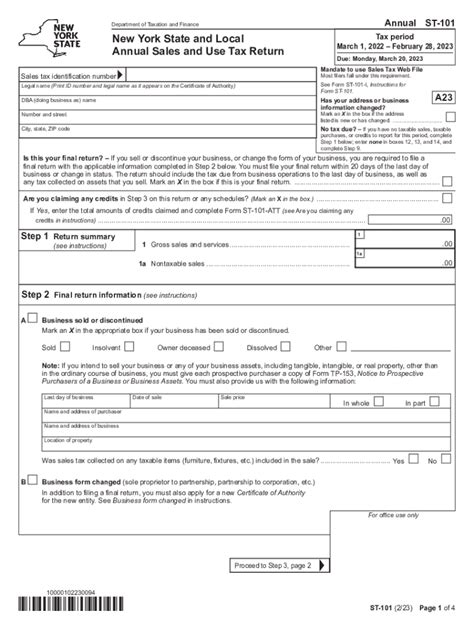

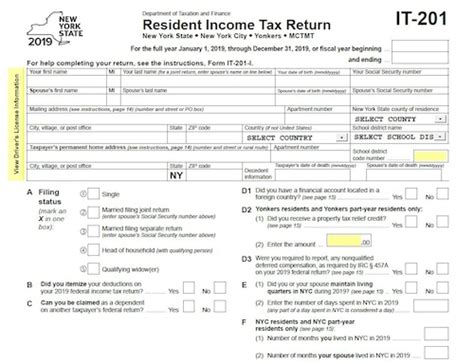

The New York State tax refund process begins with the submission of individual tax returns. Residents of the state are required to file their taxes annually, providing a comprehensive overview of their income, deductions, and tax liabilities. The tax return serves as the basis for calculating the refund amount, which is the difference between the total tax paid and the actual tax liability.

The New York State tax system is known for its complexity, with a range of tax credits, deductions, and exemptions that can significantly impact the final refund amount. These include the New York State Child and Dependent Care Credit, the Real Property Tax Credit, and various income tax credits. Understanding these credits and ensuring eligibility can lead to substantial savings and larger refunds.

Key Factors Influencing Refund Amounts

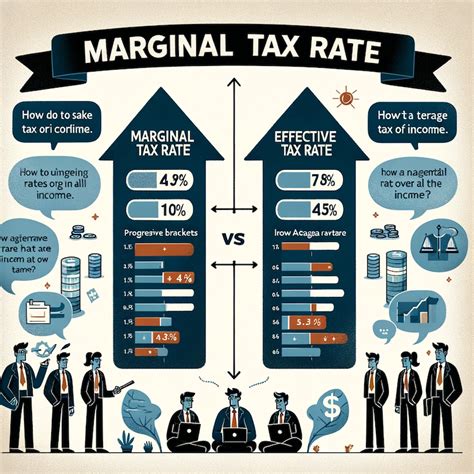

Several factors come into play when determining the size of a New York State tax refund. One of the most significant is the taxpayer’s income level. Higher income individuals often have more opportunities for deductions and credits, which can result in larger refunds. Additionally, the presence of dependents, mortgage interest payments, and charitable contributions can all influence the refund amount.

Another critical factor is the taxpayer's filing status. New York State offers different tax brackets and rates based on whether the filer is single, married filing jointly, or head of household. This status can significantly impact the refund amount, as it determines the applicable tax rate and the availability of certain credits and deductions.

| Filing Status | Tax Bracket (Single) | Tax Bracket (Married Jointly) |

|---|---|---|

| Single | 4% on income over $11,650 | Not applicable |

| Married Filing Jointly | Not applicable | 4% on income over $23,300 |

| Head of Household | 4% on income over $16,400 | Not applicable |

Timelines and Processing Times

The New York State Department of Taxation and Finance aims to process tax refunds within a specific timeframe. Generally, refunds are issued within 4-6 weeks of filing for those who choose direct deposit. However, this timeline can vary based on the complexity of the tax return and the volume of refunds being processed during a given period.

It's worth noting that the state may request additional information or documentation from taxpayers, which can delay the refund process. Responding promptly to such requests is crucial to ensure a timely refund. Additionally, for those who choose to receive their refund via check, the processing time may be slightly longer due to the manual handling involved.

Maximizing Your New York State Tax Refund

Maximizing your New York State tax refund requires a strategic approach and a thorough understanding of the state’s tax laws and regulations. Here are some key strategies to consider:

Utilize Available Tax Credits and Deductions

New York State offers a variety of tax credits and deductions that can significantly reduce your tax liability and increase your refund. These include the New York State Child and Dependent Care Credit, which provides a credit for qualifying childcare expenses, and the Real Property Tax Credit, which offers a credit for property taxes paid.

Additionally, individuals can take advantage of federal tax credits that are also applicable in New York State, such as the Child Tax Credit and the Earned Income Tax Credit. Understanding the eligibility criteria and ensuring you claim all applicable credits is essential for maximizing your refund.

Explore Tax Preparation Options

The complexity of the New York State tax system can make it challenging to navigate without professional assistance. Consider utilizing tax preparation software or engaging the services of a certified tax professional. These options can help you identify all available deductions and credits, ensuring you don’t miss out on any opportunities to maximize your refund.

Tax preparation software often comes with built-in tools and calculators that simplify the process of claiming credits and deductions. Additionally, a tax professional can provide personalized advice and guidance based on your specific circumstances, ensuring you receive the maximum refund possible.

Keep Accurate Records

Maintaining accurate and organized records is crucial for both filing your tax return and claiming deductions and credits. Keep track of all relevant documentation, including receipts for eligible expenses, property tax statements, and any other supporting documents. This ensures you have the necessary evidence to back up your claims and reduces the likelihood of errors or discrepancies.

Stay Informed About Tax Law Changes

Tax laws and regulations are subject to change, and staying informed about these changes can impact your refund. Keep an eye on updates from the New York State Department of Taxation and Finance and consider subscribing to their newsletters or following their social media accounts. This will ensure you are aware of any new deductions, credits, or changes to tax rates that could affect your refund.

Consider Tax-Efficient Strategies

Implementing tax-efficient strategies throughout the year can have a significant impact on your tax refund. For example, contributing to a retirement account, such as a 401(k) or IRA, can reduce your taxable income and potentially increase your refund. Similarly, maximizing your use of flexible spending accounts (FSAs) or health savings accounts (HSAs) can provide tax benefits and increase your refund.

Common Challenges and How to Overcome Them

Despite best efforts, there may be challenges that arise during the New York State tax refund process. Here are some common issues and strategies to overcome them:

Addressing Errors and Delays

Errors on your tax return can lead to delays in processing or even a denial of your refund. Common errors include incorrect social security numbers, miscalculations of income or deductions, and missing signatures. To avoid these issues, carefully review your tax return before submission and consider utilizing tax preparation software or a tax professional to minimize the risk of errors.

If your refund is delayed due to an error, the New York State Department of Taxation and Finance will typically contact you with instructions on how to correct the error. Respond promptly to these communications to ensure your refund is processed as soon as possible.

Dealing with Identity Theft

Identity theft is a growing concern, and unfortunately, it can also impact your tax refund. If you believe your personal information has been compromised and used to file a fraudulent tax return, it’s crucial to take immediate action. Contact the New York State Department of Taxation and Finance and follow their procedures for reporting and resolving identity theft issues.

In such cases, the state may require additional documentation and evidence to verify your identity and process your legitimate refund. Stay vigilant and proactive to protect your financial well-being.

Understanding Refund Status and Tracking

Knowing the status of your refund is essential for planning and financial management. The New York State Department of Taxation and Finance provides online tools and resources to help taxpayers track their refund status. Utilize these resources to stay informed about the progress of your refund and estimate when it will be issued.

In some cases, refunds may be delayed due to issues beyond your control, such as system updates or high volumes of refunds being processed. Stay patient and continue to monitor the status of your refund through the provided channels.

The Future of New York State Tax Refunds

The landscape of tax refunds in New York State is constantly evolving, influenced by changing economic conditions, legislative decisions, and technological advancements. As the state aims to improve efficiency and enhance the taxpayer experience, several key trends and developments are worth noting:

Digital Transformation

The New York State Department of Taxation and Finance is embracing digital transformation to streamline the tax refund process. This includes the development of user-friendly online portals and mobile apps that allow taxpayers to file their returns electronically, check refund status, and receive real-time updates.

The state is also exploring the use of blockchain technology to enhance security and transparency in the tax refund process. This could lead to faster processing times and reduced instances of fraud.

Enhanced Taxpayer Services

The department is committed to providing improved taxpayer services, including expanded hours of operation for call centers and the implementation of live chat and video conferencing options for taxpayers seeking assistance. These initiatives aim to make the tax refund process more accessible and convenient for residents.

Data-Driven Insights

By leveraging advanced analytics and data-driven insights, the New York State Department of Taxation and Finance is working to identify trends and patterns in tax refunds. This information can help the state optimize its refund processes, identify areas for improvement, and better serve taxpayers.

Tax Policy Reforms

The state is continually evaluating its tax policies to ensure they are fair, efficient, and aligned with the needs of its residents. This includes periodic reviews of tax rates, brackets, and deductions to ensure they remain competitive and beneficial to taxpayers.

Conclusion

The New York State tax refund process is a critical aspect of the state’s financial ecosystem, offering much-needed financial relief to residents. By understanding the factors that influence refund amounts, adhering to timelines, and implementing strategic approaches, individuals can maximize their refunds and contribute to their financial well-being. As the state continues to innovate and improve its processes, taxpayers can look forward to a more efficient and accessible tax refund experience.

What is the average processing time for a New York State tax refund?

+The average processing time for a New York State tax refund is typically 4-6 weeks. However, this timeline can vary based on the complexity of the return and the volume of refunds being processed.

How can I track the status of my New York State tax refund?

+You can track the status of your New York State tax refund by visiting the Department of Taxation and Finance’s website and using their online refund status tool. You’ll need to provide your Social Security number and the exact amount of your refund to check its status.

What should I do if my New York State tax refund is delayed or I haven’t received it within the expected timeframe?

+If your New York State tax refund is delayed or you haven’t received it within the expected timeframe, you should first check the status of your refund using the online tool. If it indicates a delay, you can contact the Department of Taxation and Finance for further assistance. They may require additional documentation or information to process your refund.

Can I receive my New York State tax refund via direct deposit instead of a check?

+Yes, you can choose to receive your New York State tax refund via direct deposit. When filing your tax return, you’ll have the option to provide your bank account information for direct deposit. This can expedite the refund process and reduce the risk of lost or stolen checks.