Ca Capital Gains Tax

Capital gains tax (CGT) is a crucial aspect of the tax system in many countries, including the United Kingdom. It is a tax levied on the profit made from the sale of assets, such as stocks, property, or business assets. Understanding capital gains tax is essential for individuals and businesses alike, as it can significantly impact their financial planning and overall tax obligations.

Understanding Capital Gains Tax in the UK

In the UK, capital gains tax is applied to the profit made when an individual or a trust disposes of assets that have increased in value. This disposal can take various forms, including selling, transferring, or even giving away the asset. The UK’s tax year runs from 6th April to 5th April the following year, and CGT is calculated based on the difference between the sale price and the original cost of the asset, known as the acquisition cost.

The UK's tax system offers an annual capital gains tax allowance, which allows individuals to make a certain amount of capital gains tax-free each year. For the tax year 2023-24, this allowance stands at £12,300. Any profits exceeding this threshold are subject to CGT at varying rates, depending on the individual's income tax bracket.

For most assets, the capital gains tax rate is either 10% or 20%, with the lower rate applying to residential property gains. However, the rates can vary for different asset types and depending on the individual's income. It's important to note that CGT is calculated separately from income tax, and it is not possible to offset losses against other income sources.

Examples of Assets Subject to CGT

A wide range of assets can fall under the scope of capital gains tax. Here are some common examples:

- Residential properties: Any profit made from selling a second home or a buy-to-let property is subject to CGT.

- Shares and stocks: Profits from selling shares or investments in a portfolio are taxable.

- Business assets: Gains from the sale of business premises, equipment, or intellectual property are taxable.

- Art, antiques, and collectibles: Profits from the sale of valuable items like art pieces or rare collectibles are subject to CGT.

- Land and agricultural property: Gains from selling land or agricultural properties are taxable.

It's worth noting that certain assets, such as a person's primary residence or certain gifts and inheritances, may be exempt from capital gains tax.

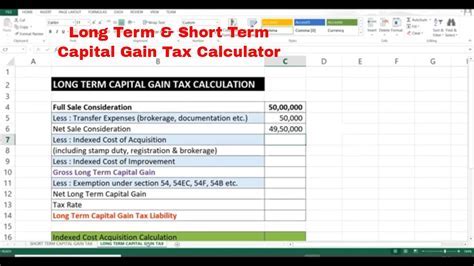

Capital Gains Tax Rates and Calculation

The capital gains tax rates in the UK are dependent on the individual’s income tax bracket. For the tax year 2023-24, the rates are as follows:

| Income Tax Band | Capital Gains Tax Rate |

|---|---|

| Basic Rate (up to £50,270) | 10% |

| Higher Rate (£50,271 - £150,000) | 20% |

| Additional Rate (over £150,000) | 20% |

The calculation of capital gains tax involves several steps. First, the acquisition cost of the asset is subtracted from the disposal proceeds to determine the capital gain. This gain is then reduced by any allowable expenses and deductions. The resulting figure is then subject to the applicable CGT rate, depending on the individual's income tax bracket.

Reporting and Paying Capital Gains Tax

Individuals are responsible for reporting and paying their capital gains tax. The UK tax system provides two main ways to do this:

Self Assessment

For individuals with complex tax affairs, including those with capital gains tax liabilities, Self Assessment is the primary method of reporting and paying taxes. The deadline for filing a Self Assessment tax return is 31st January following the end of the tax year. This allows individuals to declare their capital gains and pay the corresponding tax.

Capital Gains Tax on Property Disposals

For the disposal of residential properties, a specific CGT reporting and payment process is in place. Individuals must report and pay the tax within 30 days of the sale or transfer. This can be done online through the HMRC’s Capital Gains Tax on Property Disposals service.

Tax Payment Options

There are various payment options available for capital gains tax, including direct debit, credit or debit card, and payment by cheque. Individuals can also choose to pay by installment if the tax liability exceeds £5,000.

Reducing Capital Gains Tax

There are several strategies individuals can employ to reduce their capital gains tax liability. These include:

- Using the annual capital gains tax allowance: By timing asset disposals, individuals can ensure that their gains fall within the annual CGT allowance, reducing or eliminating the tax liability.

- Gifting assets: Transferring assets to a spouse or civil partner can be an effective way to reduce CGT, as gains are usually exempt between spouses.

- Making use of losses: If an individual has made a capital loss on one asset, they can offset this against a capital gain on another asset to reduce their overall tax liability.

- Entrepreneurs' Relief: For business owners, Entrepreneurs' Relief can significantly reduce the CGT rate from 20% to 10%, subject to certain conditions.

Future Implications and Considerations

Capital gains tax is an evolving area of tax law, and it is essential to stay informed about any changes or updates. The UK government may introduce new initiatives or amend existing rules, which can impact tax liabilities. Additionally, the annual capital gains tax allowance and tax rates may be subject to change, so it is crucial to keep an eye on tax announcements and budget updates.

Furthermore, individuals should consider the long-term implications of their financial decisions. For instance, holding onto an asset for a longer period may increase its value, but it could also result in a higher capital gains tax liability upon disposal. Planning and seeking professional advice can help individuals navigate these complexities and make informed financial choices.

What is the difference between capital gains tax and income tax?

+Capital gains tax is levied on the profit made from the sale of assets, while income tax is applied to an individual’s income, including wages, salaries, and other forms of income. CGT is calculated separately from income tax, and losses cannot be offset against other income sources.

Are there any exemptions from capital gains tax?

+Yes, certain assets are exempt from capital gains tax. This includes a person’s primary residence, gifts, and inheritances under specific circumstances. It’s important to consult the relevant tax guidelines to understand the exemptions in detail.

How can I calculate my capital gains tax liability?

+To calculate your capital gains tax liability, you need to determine the acquisition cost of the asset, subtract any allowable expenses, and then apply the appropriate CGT rate based on your income tax bracket. It’s recommended to use the HMRC’s online calculators or seek professional tax advice for accurate calculations.