Oklahoma Tax Calculator

The Oklahoma Tax Calculator is a valuable tool for individuals and businesses operating in the state of Oklahoma, providing a comprehensive and user-friendly platform to calculate and understand various taxes. With a diverse range of tax obligations, from income tax to sales tax, property tax, and more, this calculator simplifies the often complex world of taxation. In this article, we will delve into the specifics of the Oklahoma Tax Calculator, exploring its features, benefits, and how it can assist taxpayers in navigating the state's tax landscape.

Understanding the Oklahoma Tax Calculator

The Oklahoma Tax Calculator is an online platform developed by the Oklahoma Tax Commission, designed to assist taxpayers in calculating their tax liabilities accurately and efficiently. It serves as a one-stop solution for taxpayers, offering guidance and calculations for various tax types, ensuring compliance with the state’s tax regulations.

One of the key advantages of the Oklahoma Tax Calculator is its ability to cater to a wide range of taxpayers. Whether you're an individual filing personal income tax, a business calculating sales tax, or a property owner determining property tax obligations, the calculator provides tailored calculations and guidance for each scenario.

Income Tax Calculation

For individuals, the Oklahoma Tax Calculator offers a straightforward method to determine their income tax liability. Users can input their taxable income, filing status, and any applicable deductions and credits to obtain an accurate estimate of their tax due. The calculator takes into account the state’s progressive tax rates, ensuring that taxpayers are aware of their obligations based on their income level.

| Tax Rate | Taxable Income Range |

|---|---|

| 0.5% | $0 - $2,500 |

| 2.5% | $2,501 - $4,500 |

| 3.5% | $4,501 - $7,500 |

| 4.5% | $7,501 - $10,000 |

| 5.0% | $10,001 and above |

Additionally, the calculator provides information on tax credits, such as the Earned Income Tax Credit (EITC), which can reduce the tax burden for eligible individuals and families. It ensures that taxpayers are aware of all available credits and deductions, maximizing their potential tax savings.

Sales Tax Calculation

For businesses operating in Oklahoma, the sales tax calculation feature is a valuable asset. The calculator allows businesses to input the sale price of goods or services and the applicable sales tax rate to determine the tax amount due. With a base sales tax rate of 4.5% and varying rates across counties, the calculator simplifies the process of calculating and remitting sales tax accurately.

Moreover, the calculator provides information on tax exemptions and special rates for specific goods or services. This ensures that businesses are aware of their obligations and can accurately charge and remit sales tax, avoiding potential penalties.

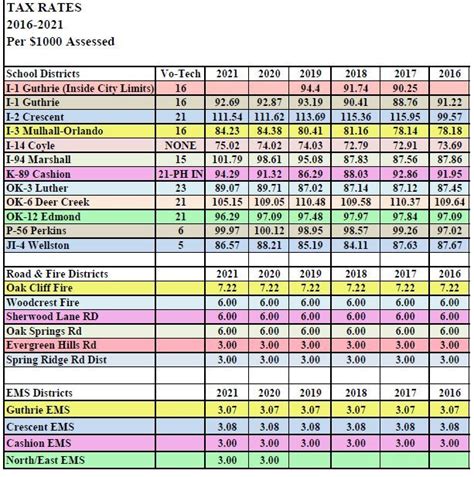

Property Tax Assessment

Property owners in Oklahoma can utilize the calculator to estimate their property tax obligations. By inputting the assessed value of their property and the applicable tax rate, they can obtain an estimate of their annual property tax liability. This feature is particularly useful for homeowners and commercial property owners, providing a quick and convenient way to understand their tax obligations.

The calculator also provides information on tax abatements and exemptions, allowing property owners to explore potential tax relief options. This ensures that property owners are aware of all available benefits and can make informed decisions regarding their tax strategies.

Benefits of Using the Oklahoma Tax Calculator

The Oklahoma Tax Calculator offers a multitude of benefits to taxpayers, enhancing their understanding of the state’s tax system and simplifying the tax calculation process.

Accuracy and Compliance

By utilizing the calculator, taxpayers can ensure accurate calculations and compliance with Oklahoma’s tax regulations. The calculator is regularly updated to reflect any changes in tax laws, ensuring that users have access to the most current and precise information. This reduces the risk of errors and potential penalties associated with incorrect tax filings.

Time and Cost Savings

The Oklahoma Tax Calculator saves taxpayers valuable time and resources. With its user-friendly interface, taxpayers can quickly input their information and obtain instant calculations. This efficiency eliminates the need for complex manual calculations or the engagement of tax professionals for simple tax scenarios, resulting in significant cost savings.

Enhanced Tax Planning

The calculator empowers taxpayers to engage in effective tax planning. By providing accurate estimates of tax liabilities, taxpayers can make informed decisions regarding their financial strategies. Whether it’s optimizing deductions, maximizing credits, or exploring tax-efficient investment options, the calculator serves as a valuable tool for proactive tax management.

Future Implications and Developments

As the tax landscape continues to evolve, the Oklahoma Tax Calculator is likely to undergo further enhancements to meet the changing needs of taxpayers. Here are some potential future developments and implications:

- Integration with Tax Software: The calculator may integrate with popular tax preparation software, allowing users to seamlessly transfer their data and calculations for more comprehensive tax filing.

- Enhanced User Experience: Ongoing improvements to the calculator's user interface and functionality will make it even more intuitive and accessible for taxpayers of all levels of technical expertise.

- Real-Time Tax Updates: The calculator could leverage real-time data and notifications to inform users of any changes in tax laws or rates, ensuring they remain up-to-date with the latest tax obligations.

- Expanded Tax Education: The platform may incorporate additional educational resources, providing taxpayers with a deeper understanding of tax concepts and strategies, empowering them to make more informed financial decisions.

Conclusion

The Oklahoma Tax Calculator is a powerful tool that simplifies the complex world of taxation for individuals and businesses in the state. By offering accurate calculations, tailored guidance, and valuable insights, it enhances taxpayer understanding and compliance. As the tax landscape evolves, the calculator is poised to adapt and continue serving as a reliable resource for Oklahomans navigating their tax obligations.

How often is the Oklahoma Tax Calculator updated to reflect changes in tax laws and rates?

+The Oklahoma Tax Calculator is updated regularly to align with any changes in tax laws and rates. The Oklahoma Tax Commission ensures that the calculator remains current, providing taxpayers with the most accurate information for their tax calculations.

Can the calculator assist with complex tax scenarios, such as business tax filings or estate tax calculations?

+While the Oklahoma Tax Calculator is a valuable resource for many tax scenarios, it is primarily designed for individuals and businesses with more straightforward tax obligations. For complex tax situations, it is recommended to consult with a tax professional who can provide specialized guidance and assistance.

Are there any limitations to the calculator’s accuracy, and how can users ensure their calculations are precise?

+The Oklahoma Tax Calculator is highly accurate, but it relies on the user’s input for precise calculations. Users should ensure they provide accurate and complete information, including all applicable deductions, credits, and tax rates. Additionally, for more complex tax scenarios, seeking professional advice can further enhance accuracy.