Taxes On $5000 Lottery Winnings

Lottery winnings can be a significant source of excitement and financial windfall for many people. However, it's essential to understand the tax implications of these winnings, as they can significantly impact your overall earnings. In this article, we will delve into the world of lottery taxes and explore the specific case of a $5000 lottery win, providing a comprehensive guide to help you navigate the tax landscape.

Understanding Lottery Winnings and Taxes

When you win the lottery, your excitement might lead you to overlook the fact that your winnings are subject to taxation. Lottery winnings are considered taxable income in most jurisdictions, meaning you will need to report and pay taxes on them. The tax treatment of lottery winnings can vary depending on the country, state, or region, so it’s crucial to familiarize yourself with the specific tax laws in your area.

The taxation of lottery winnings typically occurs at two levels: federal and state. In the United States, federal taxes are levied on all lottery winnings, while state taxes may vary depending on the state where the ticket was purchased and where the winner resides. It's important to note that even if you are not a citizen or resident of the country where the lottery is operated, you may still be subject to tax obligations.

The tax rates and rules for lottery winnings can be complex and may involve various deductions, credits, and exemptions. Understanding these intricacies is crucial to ensure you fulfill your tax obligations accurately and avoid any potential penalties.

Tax Implications of a 5000 Lottery Win</h2> <p>Now, let's focus on the specific scenario of winning 5000 in the lottery. While this amount may not seem substantial compared to larger jackpots, it still carries significant tax implications that you should be aware of.

Federal Taxes

In the United States, lottery winnings are subject to federal income tax at various rates, depending on the total amount won. For a 5000 lottery win, you would typically fall into a lower tax bracket, resulting in a lower tax rate. However, it's important to note that federal taxes are applied to the gross winnings, meaning the entire 5000 is taxable.

The Internal Revenue Service (IRS) treats lottery winnings as ordinary income, which means they are taxed at your regular income tax rate. The specific tax rate can vary based on your overall income, filing status, and other factors. It's recommended to consult a tax professional or use tax calculators to estimate your federal tax liability accurately.

State Taxes

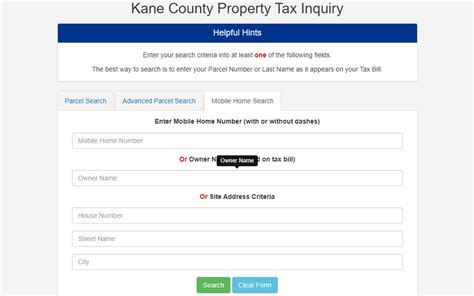

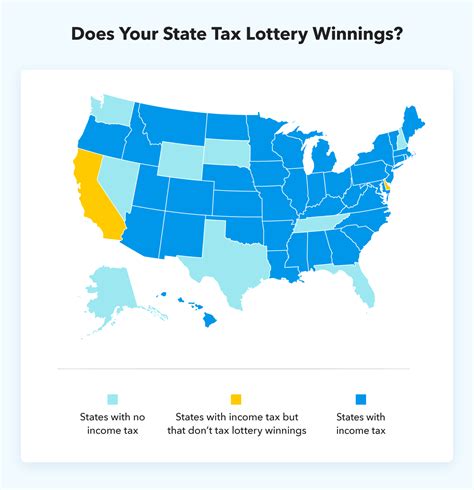

In addition to federal taxes, you may also be required to pay state taxes on your lottery winnings. State tax rates and regulations can vary significantly, so it’s crucial to understand the specific rules in your state.

Some states have no income tax, while others may have progressive tax systems with varying rates. Certain states may also have specific rules for lottery winnings, such as withholding taxes or different tax brackets. For example, in California, lottery winnings are subject to a flat 8.84% state income tax, regardless of the amount won.

To determine your state tax obligations, you should refer to your state's tax guidelines or seek advice from a local tax expert. They can provide you with accurate information regarding the applicable tax rates and any potential deductions or exemptions you may qualify for.

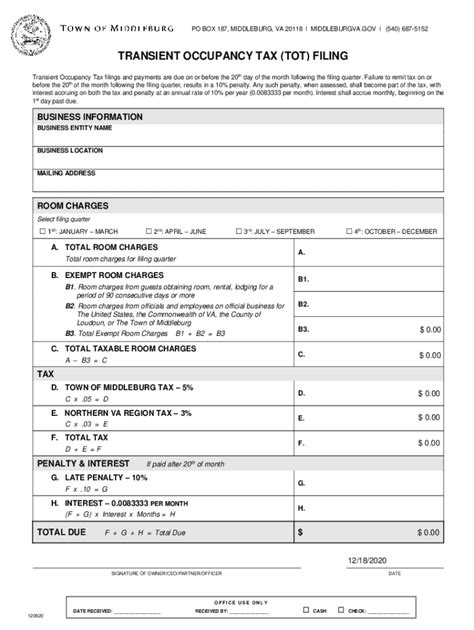

Withholding and Payment Options

When claiming your lottery winnings, the lottery operator or authority may withhold a certain percentage for tax purposes. This withholding amount varies depending on the jurisdiction and the size of your winnings. For a $5000 win, the withholding amount is typically lower compared to larger prizes.

It's important to understand that the withholding amount is not your final tax liability. It serves as an advance payment towards your overall tax obligation. You may still need to include the winnings on your tax return and calculate the remaining tax due or receive a refund if the withholding amount exceeds your actual tax liability.

You have the option to pay your taxes in full when claiming your winnings or make estimated tax payments throughout the year. Consult with a tax professional to determine the best approach based on your specific circumstances.

Maximizing Your Lottery Winnings

While taxes are an inevitable part of lottery winnings, there are strategies you can employ to maximize your earnings and minimize the tax impact.

Seek Professional Tax Advice

Navigating the tax landscape can be complex, especially when it comes to lottery winnings. Seeking guidance from a qualified tax professional or accountant can be invaluable. They can provide personalized advice based on your specific situation, helping you understand your tax obligations and potentially identify opportunities to reduce your tax burden.

Consider Tax-Efficient Payment Options

When claiming your lottery winnings, you often have the choice between receiving a lump-sum payment or annuity payments over several years. From a tax perspective, lump-sum payments may be more tax-efficient, as they allow you to pay taxes on the entire amount in one year. However, annuity payments can provide a more consistent income stream and potentially reduce the tax impact on your overall income.

Consulting with a financial advisor can help you weigh the pros and cons of each payment option and determine the most suitable choice for your financial goals and tax situation.

Explore Tax Credits and Deductions

Tax credits and deductions can help reduce your tax liability and maximize your lottery winnings. Depending on your circumstances, you may be eligible for various tax credits, such as the Child Tax Credit or the Earned Income Tax Credit. Additionally, certain expenses related to gambling, such as travel costs to purchase lottery tickets, may be deductible if you itemize your deductions.

Working with a tax professional can help you identify and claim all applicable tax credits and deductions, ensuring you minimize your tax obligations.

Reporting and Filing Taxes

Properly reporting and filing your lottery winnings is crucial to avoid any legal complications or penalties. Here are some key steps to ensure you fulfill your tax obligations:

- Report Winnings: When claiming your lottery winnings, ensure you provide accurate and complete information to the lottery authority. This includes your personal details, tax identification number, and any other required documentation.

- Receive Tax Forms: The lottery authority will typically provide you with tax forms, such as a W-2G form, which reports your winnings to the IRS. Keep these forms safe and use them when filing your tax return.

- File Your Tax Return: Include your lottery winnings on your tax return, along with any other income sources. Ensure you accurately calculate your tax liability and make the necessary payments by the deadline.

- Keep Records: Maintain good records of your winnings, tax forms, and any supporting documentation. This can be crucial in case of an audit or if you need to substantiate your income.

Frequently Asked Questions

Are lottery winnings taxed in all countries?

+No, the taxation of lottery winnings varies by country. While many countries tax lottery winnings as income, some do not. It’s essential to research the tax laws in your specific country or seek professional advice.

Can I avoid paying taxes on my lottery winnings by not claiming them?

+No, not claiming your lottery winnings does not exempt you from tax obligations. Failing to report and pay taxes on lottery winnings can result in significant penalties and legal consequences. It’s best to claim your winnings and fulfill your tax responsibilities.

How do I calculate my tax liability for lottery winnings?

+Calculating your tax liability for lottery winnings can be complex. It involves understanding your tax bracket, applicable tax rates, and any deductions or credits you may qualify for. Using tax calculators or consulting a tax professional can provide accurate estimates.

Are there any tax advantages to receiving lottery winnings as an annuity?

+Receiving lottery winnings as an annuity can have tax advantages, especially if you are in a higher tax bracket. It spreads out your taxable income over several years, potentially reducing your overall tax liability. However, it’s essential to weigh this option against lump-sum payments with a financial advisor.

Can I deduct any expenses related to purchasing lottery tickets from my taxes?

+Yes, certain expenses related to purchasing lottery tickets may be deductible if you itemize your deductions. These can include travel costs, subscription fees, or other eligible expenses. Consult a tax professional to determine which expenses you can deduct.

Understanding the tax implications of lottery winnings is crucial to making the most of your winnings and avoiding any unexpected tax surprises. By seeking professional advice, exploring tax-efficient options, and properly reporting your winnings, you can navigate the tax landscape with confidence and maximize your lottery earnings.