Michigan State Tax Status

Welcome to this comprehensive guide on the Michigan State Tax Status. Michigan, the Great Lakes State, boasts a unique tax landscape that influences the financial strategies of its residents and businesses. Understanding this tax system is crucial for anyone navigating their financial obligations within the state. In this expert-driven article, we'll delve deep into Michigan's tax structure, exploring its intricacies and implications.

Unraveling Michigan’s Tax Structure

Michigan’s tax system, like that of many states, comprises a mix of income, sales, and property taxes. What sets Michigan apart is its approach to these taxes, which has evolved over the years to meet the state’s economic and social needs. This section provides an in-depth analysis of each tax type and its significance.

Income Tax: A Personal Perspective

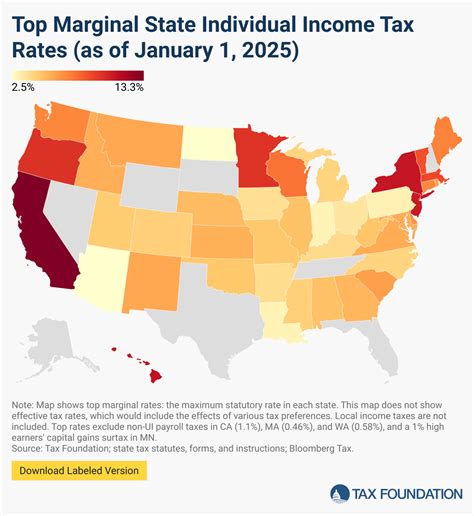

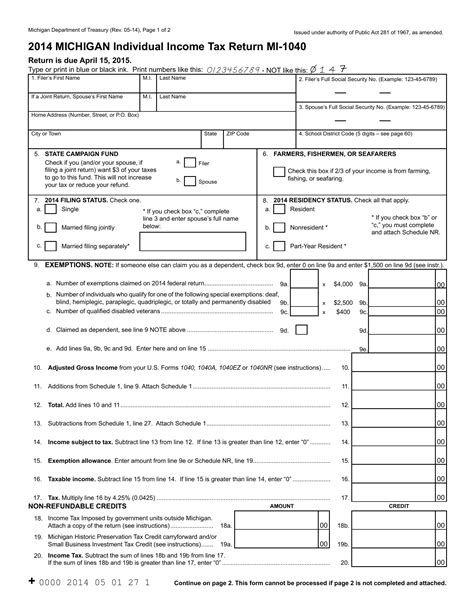

For individuals residing in Michigan, income tax is a key consideration. Michigan operates a graduated income tax system, meaning the tax rate increases as income levels rise. As of 2023, Michigan has four tax brackets with rates ranging from 4.25% to 4.6%. This system ensures that higher-income earners contribute a greater share to the state’s revenue.

One notable aspect of Michigan’s income tax is its “Homestead Principle.” This principle exempts a portion of a taxpayer’s primary residence from the property tax. This exemption, which varies based on income and property value, provides relief to homeowners and encourages homeownership.

| Tax Bracket | Income Range | Tax Rate |

|---|---|---|

| 1 | Up to 37,350</td> <td>4.25%</td> </tr> <tr> <td>2</td> <td>37,351 - 95,000</td> <td>4.275%</td> </tr> <tr> <td>3</td> <td>95,001 - 215,000</td> <td>4.35%</td> </tr> <tr> <td>4</td> <td>Over 215,000 | 4.6% |

Sales Tax: A State-Wide Perspective

Michigan’s sales tax is a consumption tax, applied to the sale of tangible personal property and certain services. As of 2023, the state’s general sales tax rate is 6%, which is relatively moderate compared to other states. However, local governments can also impose additional sales taxes, resulting in varying effective sales tax rates across the state.

Michigan’s sales tax is notable for its exemptions. Certain items, such as groceries, prescription drugs, and residential rents, are exempt from sales tax. This approach helps alleviate the tax burden on essential goods and services.

| Item Category | Sales Tax Status |

|---|---|

| Groceries | Exempt |

| Prescription Drugs | Exempt |

| Residential Rents | Exempt |

| Clothing | Taxable |

| Restaurant Meals | Taxable |

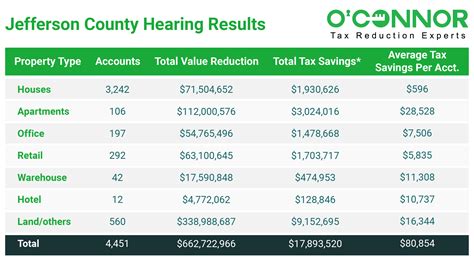

Property Tax: A Local Perspective

Property taxes in Michigan are primarily assessed and collected by local governments, with the state providing oversight. These taxes fund local services and infrastructure, including schools, roads, and public safety. The property tax system in Michigan is based on the assessed value of real estate, which can vary significantly across the state.

Michigan’s property tax system also offers various exemptions and credits. For instance, the “Homestead Principle” mentioned earlier, provides a significant property tax exemption for homeowners. Additionally, the state offers a tax credit for homeowners who meet certain income criteria.

The Impact of Michigan’s Tax System

Michigan’s tax structure has a profound impact on the state’s economy and its residents. It influences everything from individual spending habits to business investment decisions. This section explores some of these impacts and their broader implications.

Economic Development and Business Climate

Michigan’s tax system plays a crucial role in shaping the state’s business environment. The state’s relatively moderate sales and income tax rates can be attractive to businesses, especially when compared to states with higher tax burdens. This can encourage economic growth and job creation.

However, Michigan’s property tax system, with its varying rates and assessments, can be a double-edged sword. While it provides local funding for essential services, high property taxes can deter businesses from investing in certain areas. As a result, Michigan has implemented various incentives and programs to attract and retain businesses.

Social Welfare and Equity

The design of Michigan’s tax system also has implications for social welfare and equity. The state’s graduated income tax system ensures that higher-income earners contribute more, which can help fund social programs and services. Additionally, the exemptions and credits in the property tax system provide relief to homeowners, especially those with lower incomes.

However, there are ongoing debates about the fairness of Michigan’s tax system. Some argue that the state’s reliance on property taxes can disproportionately affect lower-income individuals and communities, as they may struggle to afford high property taxes.

Future Implications and Reforms

As Michigan’s economy and demographics evolve, so too must its tax system. The state is facing ongoing challenges, including an aging population and a changing job market. This has led to discussions about tax reform, with proposals ranging from simplifying the tax code to introducing new taxes, such as a state-wide value-added tax.

The state’s leadership and tax policymakers are continually evaluating these proposals, seeking to strike a balance between revenue needs and the tax burden on residents and businesses. The goal is to ensure Michigan remains competitive while also funding critical services and infrastructure.

Conclusion: Navigating Michigan’s Tax Landscape

Michigan’s tax system is a complex but vital component of the state’s economy and society. Understanding this system is crucial for residents and businesses to navigate their financial obligations effectively. From the graduated income tax to the varying property tax rates, each aspect of Michigan’s tax landscape has a unique impact on the state’s residents and businesses.

As we’ve explored in this article, Michigan’s tax system is designed to support the state’s economic growth, fund essential services, and promote social equity. However, it’s a delicate balance, and ongoing discussions about tax reform reflect the state’s commitment to continuous improvement.

For those navigating Michigan’s tax landscape, staying informed and seeking professional advice is essential. Whether you’re a homeowner, business owner, or individual taxpayer, understanding your obligations and available options can help you make the most of Michigan’s tax system.

What is Michigan’s state income tax rate for 2023?

+Michigan has a graduated income tax system with four tax brackets: 4.25%, 4.275%, 4.35%, and 4.6%.

Are there any notable sales tax exemptions in Michigan?

+Yes, Michigan exempts groceries, prescription drugs, and residential rents from sales tax.

How does Michigan’s property tax system work?

+Property taxes in Michigan are assessed and collected by local governments, with rates varying across the state. The state offers exemptions and credits, including the “Homestead Principle” for homeowners.

What are some proposed tax reforms in Michigan?

+Proposed reforms include simplifying the tax code and introducing a state-wide value-added tax to address revenue needs and the tax burden on residents and businesses.