Sales Taxes In New York

The implementation of sales taxes is a crucial aspect of any state's economy, and New York, with its diverse population and thriving businesses, has a unique and comprehensive sales tax system. Understanding the intricacies of sales taxes in New York is essential for businesses, consumers, and anyone interested in the state's economic landscape.

The Basics of Sales Taxes in New York

Sales taxes in New York are a fundamental source of revenue for the state, helping to fund various public services and infrastructure projects. These taxes are levied on the sale of goods and certain services, and the collected revenue contributes to the overall fiscal health of the state. New York’s sales tax structure is designed to promote fairness and efficiency, ensuring that businesses and consumers alike understand their obligations and rights.

The state of New York imposes a 4% general sales tax, which is applicable to most retail sales. However, it's important to note that this is just the base rate, and local governments, counties, and municipalities can add their own sales taxes on top of this, resulting in a combined sales tax rate that varies across the state.

Combined Sales Tax Rates Across New York

The variation in sales tax rates across New York can be attributed to the local option sales tax that many counties and cities impose. These local taxes are added to the state’s base rate, creating a unique tax environment for each region. For instance, New York City has a 4.5% local tax, making the combined sales tax rate in the city a total of 8.875%. On the other hand, some regions, like Sullivan County, have a lower combined rate of 7.375%, which includes a 3.375% local tax on top of the state’s base rate.

| County/City | Local Sales Tax | Combined Sales Tax Rate |

|---|---|---|

| New York City | 4.5% | 8.875% |

| Sullivan County | 3.375% | 7.375% |

| Nassau County | 4.375% | 8.375% |

| Albany County | 3% | 7% |

| Monroe County | 2% | 6% |

Exemptions and Special Considerations

While the majority of goods and services are subject to sales tax in New York, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the overall tax burden for specific industries and individuals.

Exempt Sales

Certain types of sales are exempt from sales tax in New York. These include:

- Prescription medications: All prescription drugs are exempt from sales tax.

- Certain food items: Unprepared food products, such as raw fruits, vegetables, and grains, are exempt.

- Clothing and footwear: Sales of clothing and footwear under $110 per item are tax-free.

- Books: All books, regardless of format (print or digital), are exempt from sales tax.

- Newspapers and magazines: Sales of these printed materials are tax-exempt.

Special Considerations

New York also offers some special considerations for specific situations:

- Sales to Native Americans: Sales to Native Americans living on a reservation are generally exempt, provided certain criteria are met.

- Sales to tourists: Foreign tourists who are not US residents can claim a refund on the sales tax they paid for certain purchases. This is known as the Tourist Refund Program.

- Resale exemption: Businesses that purchase goods for resale are exempt from paying sales tax on those purchases.

Compliance and Reporting

Ensuring compliance with New York’s sales tax laws is crucial for businesses. The state has a comprehensive set of guidelines and resources to help businesses understand their obligations. Failure to comply can result in penalties and interest charges.

Registration and Collection

Businesses operating in New York, whether physical or online, must register with the New York State Department of Taxation and Finance to obtain a Certificate of Authority. This certificate allows businesses to collect and remit sales tax on behalf of the state. The registration process is straightforward and can be completed online.

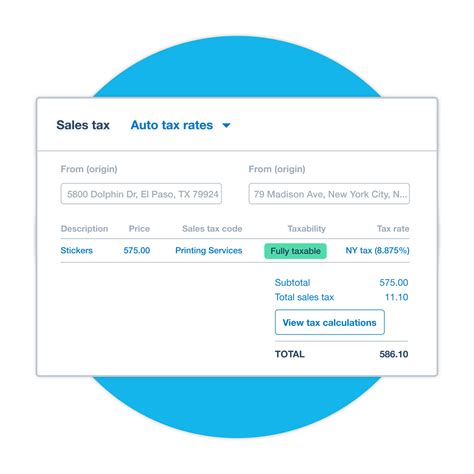

Once registered, businesses are responsible for collecting the correct sales tax from customers based on the location of the sale. This means that for online retailers, the tax rate applied depends on the shipping address of the customer, not the location of the business.

Filing and Remittance

Sales tax returns must be filed electronically through the Department’s website. The frequency of filing depends on the business’s sales volume: monthly, quarterly, or annually. Along with the return, businesses must remit the collected sales tax to the state.

It's important to note that late filing or late payment of sales tax can result in penalties and interest charges. The Department offers a Sales Tax Assistance Center to provide guidance and support to businesses, helping them stay compliant with the state's tax laws.

Impact on Businesses and Consumers

The sales tax system in New York has a significant impact on both businesses and consumers. For businesses, especially those with a physical presence in the state, understanding and complying with sales tax laws is essential to avoid penalties and maintain a positive relationship with customers.

Challenges for Businesses

One of the primary challenges for businesses is keeping up with the varying tax rates across the state. With local option sales taxes, businesses must ensure they are applying the correct rate based on the customer’s location. This can be especially complex for online retailers, who may have customers from various regions.

Additionally, the need to register, collect, and remit sales tax adds an administrative burden to businesses. However, with the right tools and guidance, this process can be streamlined, ensuring businesses remain compliant while focusing on their core operations.

Benefits for Consumers

For consumers, the sales tax system in New York offers some advantages. The state’s tax structure ensures that the burden is spread across various goods and services, preventing any one sector from being overly taxed. The variations in tax rates also provide an incentive for consumers to shop in certain regions, potentially saving them money.

Furthermore, the exemptions for essential items like food and clothing can significantly reduce the tax burden for lower-income individuals and families. This helps promote economic fairness and ensures that necessary goods are more affordable for all New Yorkers.

The Future of Sales Taxes in New York

As technology advances and the economy evolves, the sales tax landscape in New York is also likely to change. The state has already begun exploring digital sales tax options, especially with the rise of e-commerce. This could mean that online retailers, regardless of their physical location, may be required to collect sales tax on sales to New York residents.

Additionally, with the ongoing discussion around state and local tax (SALT) deductions at the federal level, there may be changes to how sales taxes are treated for individuals. Currently, New Yorkers can deduct their state and local taxes, including sales tax, from their federal taxable income. Any changes to this deduction could significantly impact the tax burden for New York residents.

The future of sales taxes in New York is uncertain but promising. The state's commitment to a fair and efficient tax system ensures that businesses and consumers will continue to benefit from a well-managed and transparent sales tax environment.

What is the average sales tax rate in New York State?

+The average sales tax rate in New York State, including local taxes, is approximately 8.35%, making it one of the higher sales tax rates in the country.

Are there any online resources for businesses to stay updated on sales tax laws in New York?

+Yes, the New York State Department of Taxation and Finance provides an extensive Sales Tax Basics guide, along with regular updates and resources on their website.

How often do sales tax rates change in New York?

+Sales tax rates in New York can change annually, especially when it comes to local option sales taxes. It’s important for businesses and consumers to stay informed about these changes to ensure compliance.

Can individuals claim a refund on sales tax paid in New York?

+Yes, individuals who have paid sales tax on certain items, like clothing or footwear under $110, can claim a refund on their New York State income tax return. However, this only applies to New York residents.

Are there any efforts to simplify the sales tax system in New York?

+The state has been exploring ways to streamline the sales tax system, including the potential implementation of a Marketplace Fairness Act, which would require out-of-state sellers to collect and remit sales tax on sales to New York residents.