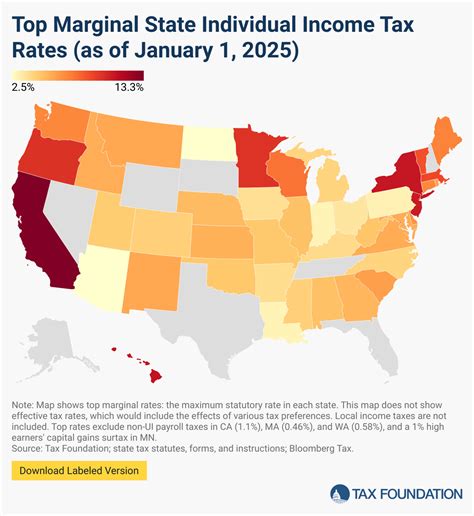

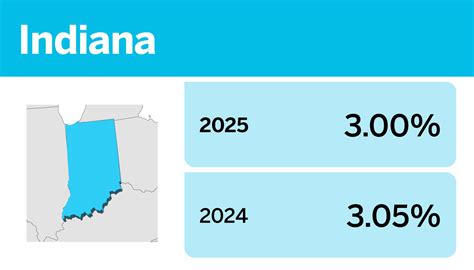

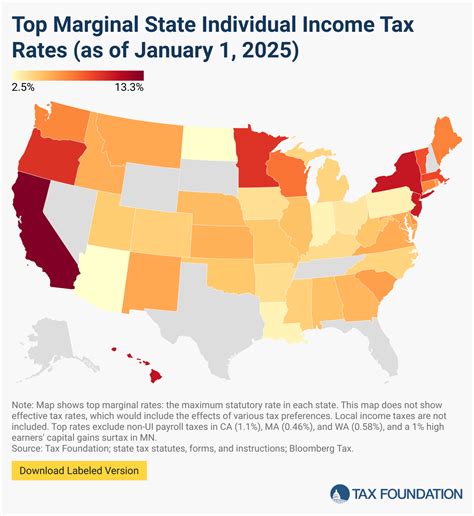

Indiana State Income Tax Rate 2025

Planning your financial future often involves considering the impact of income taxes, and one crucial factor is understanding the tax rates in the state you reside in. For those living in Indiana, this becomes especially pertinent as we navigate the complexities of tax planning. As we look ahead to 2025, it's essential to have a clear understanding of the state's income tax rate to make informed financial decisions. This article aims to provide a comprehensive analysis of the Indiana State Income Tax Rate for the year 2025, offering insights and clarity to taxpayers and financial planners alike.

Understanding Indiana’s Progressive Income Tax System

Indiana employs a progressive income tax system, which means that the state income tax rate you pay depends on your taxable income level. This system is designed to ensure fairness, as those with higher incomes contribute a larger proportion of their earnings to the state’s revenue. By understanding this progressive structure, taxpayers can effectively plan their finances and maximize their tax savings.

Income Tax Brackets for Indiana Residents in 2025

The Indiana Department of Revenue sets specific income tax brackets, each with its own tax rate, which are subject to adjustments annually. For the year 2025, these brackets and their corresponding tax rates are expected to be as follows:

| Taxable Income Range | Tax Rate |

|---|---|

| $0 - $2,650 | 3.23% |

| $2,651 - $7,500 | 3.38% |

| $7,501 - $10,000 | 3.50% |

| $10,001 - $25,000 | 3.23% |

| $25,001 - $40,000 | 3.33% |

| $40,001 - $60,000 | 3.40% |

| $60,001 and above | 3.46% |

Impact of Income Tax Rates on Financial Planning

The income tax rates have a significant impact on an individual’s financial planning strategies. For instance, those with incomes falling within the highest tax bracket ($60,001 and above) may consider tax-efficient investment strategies to optimize their financial returns. On the other hand, individuals with lower incomes might focus more on tax-exempt savings options to maximize their disposable income.

Strategies for Maximizing Tax Savings

To effectively manage your tax obligations, here are some strategies to consider:

- Tax-Advantaged Retirement Accounts: Contribute to retirement accounts like 401(k)s or IRAs, which offer tax benefits and can significantly reduce your taxable income.

- HSA and FSA Accounts: Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) allow you to set aside pre-tax dollars for qualified medical expenses, providing an effective way to reduce your taxable income.

- Tax Credits and Deductions: Explore tax credits and deductions that you may be eligible for, such as the Child Tax Credit or deductions for student loan interest, to further reduce your tax liability.

The Role of Tax Professionals

Navigating the complexities of state income taxes can be challenging, and this is where tax professionals come into play. Certified Public Accountants (CPAs) and Enrolled Agents (EAs) are licensed to represent taxpayers before the IRS and state tax authorities. They can provide personalized advice and ensure that your tax obligations are met accurately and efficiently.

Benefits of Engaging a Tax Professional

- Expertise: Tax professionals stay updated with the latest tax laws and regulations, ensuring that you take advantage of all eligible deductions and credits.

- Time Savings: Preparing tax returns can be time-consuming. By engaging a tax professional, you free up your time to focus on other aspects of your financial planning.

- Reduced Risk of Errors: Incorrectly filed tax returns can lead to penalties and interest charges. Tax professionals minimize these risks by ensuring accurate and complete tax filings.

Conclusion: Planning for a Secure Financial Future

Understanding the Indiana State Income Tax Rate for 2025 is a crucial step in effective financial planning. By being aware of the tax rates and employing strategic tax planning, individuals can optimize their financial strategies and work towards a secure future. Remember, while this article provides a comprehensive overview, it is always advisable to consult professional advice for personalized guidance.

Are these tax rates subject to change in 2025?

+Yes, tax rates can be adjusted annually based on legislative decisions and economic factors. It is advisable to stay updated with official sources for the most accurate information.

How can I minimize my tax liability in Indiana?

+You can explore various strategies such as contributing to tax-advantaged retirement accounts, utilizing HSA and FSA benefits, and claiming eligible tax credits and deductions.

What are the benefits of hiring a tax professional for my financial planning?

+Tax professionals provide expertise, save time, and reduce the risk of errors in tax filings. They ensure that you take advantage of all eligible deductions and credits, optimizing your financial strategies.