Property Taxes Broward County

In Broward County, Florida, property taxes play a significant role in funding essential public services and infrastructure. This article aims to provide an in-depth exploration of the property tax system in Broward County, offering insights into how it works, its impact on residents and businesses, and its broader implications for the local economy and community. By understanding the intricacies of property taxes, we can appreciate the role they play in shaping the vibrant and dynamic landscape of this vibrant county.

Understanding Property Taxes in Broward County

Property taxes in Broward County are a vital revenue source for local government bodies, including the county itself, cities, and various special districts. These taxes are levied on both real property, such as land and buildings, and tangible personal property, encompassing assets like vehicles, boats, and aircraft. The primary purpose of property taxes is to finance crucial public services and infrastructure projects, ensuring the smooth functioning and development of the county.

The property tax system in Broward County operates under a uniform set of laws and regulations, governed by the Florida Constitution and the Florida Statutes. These laws outline the responsibilities of property owners, tax assessors, and tax collectors, providing a clear framework for the assessment, collection, and distribution of property taxes.

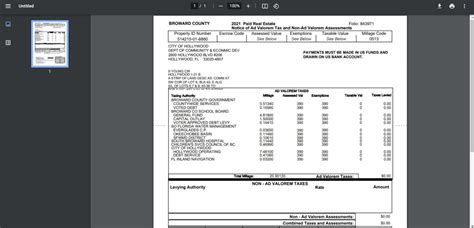

At the heart of the property tax system is the concept of ad valorem taxation, which means that taxes are based on the assessed value of the property. The process begins with the property appraisal, conducted by the Broward County Property Appraiser's Office. This office is responsible for assessing the fair market value of each property within the county, taking into account factors such as location, size, improvements, and recent sales data.

The Assessment Process

The property appraisal process in Broward County is a meticulous endeavor, aiming to ensure fairness and accuracy. The Property Appraiser’s Office employs a team of experienced appraisers who conduct on-site inspections, review sales data, and analyze market trends to determine the just value of each property. This just value serves as the basis for calculating property taxes.

During the appraisal process, property owners have the opportunity to review and challenge their assessed values. This ensures transparency and provides a mechanism for property owners to voice concerns or provide additional information that may impact the valuation of their property.

| Assessment Year | Total Assessable Value |

|---|---|

| 2023 | $150.2 Billion |

| 2022 | $144.7 Billion |

| 2021 | $139.2 Billion |

Tax Rates and Calculations

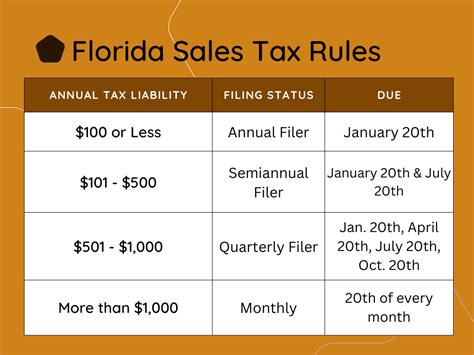

Once the assessed values are finalized, the property tax rates come into play. These rates are established by various taxing authorities, including the county, cities, and special districts. Each taxing authority determines its own millage rate, which is a measure of tax per $1,000 of assessed value. The millage rate is then applied to the assessed value of the property to calculate the tax liability.

For instance, if a property has an assessed value of $300,000 and the combined millage rate for all taxing authorities is 10 mills, the property tax liability would be calculated as follows: $300,000 x 0.010 = $3,000. This means the property owner would owe $3,000 in property taxes for that year.

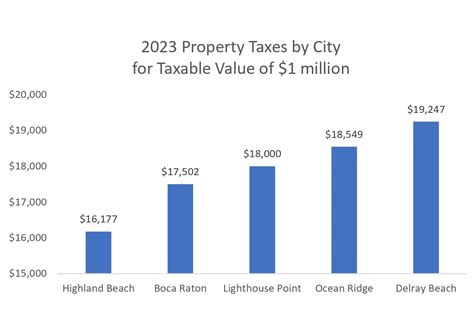

It's important to note that property tax rates can vary significantly depending on the location within Broward County. Different cities and special districts may have distinct tax rates to fund specific services or infrastructure projects unique to their areas.

Impact on Residents and Businesses

Property taxes in Broward County have a profound impact on both residents and businesses, influencing their financial planning and decisions. For homeowners, property taxes are often one of the largest annual expenses, impacting their overall cost of living and financial stability.

Homeowners’ Perspective

Homeowners in Broward County bear the responsibility of paying property taxes annually. These taxes are typically included as part of their mortgage payments, with the funds being escrowed and disbursed to the appropriate taxing authorities by the mortgage lender. However, for those who own their homes outright or have paid off their mortgages, property taxes become a direct and significant financial obligation.

The impact of property taxes on homeowners is twofold. Firstly, it influences their monthly cash flow, as property taxes are due annually, often requiring a lump-sum payment. Secondly, property taxes can affect a homeowner's financial planning and retirement strategies. As property values appreciate over time, so do property taxes, which can lead to increasing financial burdens for retirees or those on fixed incomes.

To alleviate the financial strain of property taxes, Broward County offers various exemptions and tax relief programs. These include homestead exemptions, which reduce the assessed value of a primary residence, and senior citizen discounts, which provide tax relief to homeowners aged 65 and older. These exemptions aim to make property ownership more affordable and sustainable for residents.

Business Owners’ Perspective

For business owners in Broward County, property taxes are a significant consideration when establishing and operating their enterprises. Commercial properties are subject to property taxes based on their assessed value, which can vary depending on the type of business, location, and improvements made to the property.

Property taxes impact business owners in several ways. Firstly, they influence the overall cost of doing business, as these taxes are often passed on to consumers through pricing strategies. Secondly, property taxes can affect a business's financial planning and investment decisions. Higher property taxes may discourage business expansion or relocation, impacting the county's economic growth and job creation.

To support business growth and attract new investments, Broward County offers various incentives and tax relief programs. These may include tax abatements, tax credits, or reduced tax rates for specific industries or development projects. These initiatives aim to foster a business-friendly environment, encouraging economic development and job creation within the county.

Broader Implications for the Community

Beyond their impact on individual residents and businesses, property taxes in Broward County have broader implications for the entire community. The revenue generated from property taxes funds a wide range of essential public services and infrastructure projects, shaping the county’s overall development and quality of life.

Funding Public Services

Property taxes are a primary source of funding for various public services in Broward County. These include education, public safety, transportation, environmental protection, and social services. The revenue generated from property taxes ensures that residents have access to quality schools, well-maintained roads and infrastructure, effective law enforcement, and a range of social services that support the community’s well-being.

For instance, property taxes fund the Broward County Public Schools, one of the largest school districts in the state. These funds support the district's operations, including teacher salaries, school maintenance, curriculum development, and extracurricular activities. By investing in education, property taxes play a crucial role in nurturing the county's future workforce and ensuring a skilled and knowledgeable community.

Infrastructure Development

Property taxes also play a significant role in funding infrastructure projects in Broward County. These projects encompass a wide range of initiatives, from road and bridge construction to water and sewer system upgrades, as well as public transportation improvements. By investing in infrastructure, property taxes contribute to the county’s economic growth, enhance mobility, and improve the overall quality of life for residents.

One notable infrastructure project funded by property taxes is the expansion and modernization of the Port Everglades. This project, which includes the construction of new cargo facilities and the deepening of the port's channels, aims to enhance the port's capacity and attract more shipping and cruise lines. As a result, the project is expected to create thousands of jobs and boost the county's economy.

Economic Impact and Community Development

The revenue generated from property taxes not only funds essential public services and infrastructure but also has a broader economic impact on the community. By investing in these areas, property taxes contribute to the county’s economic growth, job creation, and overall prosperity. Well-funded public services and infrastructure attract businesses and residents, fostering a vibrant and thriving community.

Additionally, property taxes support community development initiatives, such as affordable housing programs, neighborhood revitalization projects, and cultural and recreational facilities. These investments enhance the county's social fabric, promote inclusivity, and provide opportunities for all residents to thrive.

Conclusion

Property taxes in Broward County are a critical component of the local economy and community. They fund essential public services, infrastructure projects, and community development initiatives, shaping the county’s overall well-being and prosperity. Understanding the intricacies of the property tax system and its impact on residents and businesses is crucial for fostering a sustainable and thriving community.

As Broward County continues to grow and evolve, property taxes will remain a vital revenue source, influencing the county's development trajectory and the quality of life for its residents. By striking a balance between funding crucial public services and providing tax relief programs, Broward County aims to create a vibrant and resilient community, ensuring that property taxes serve as a catalyst for positive change and economic growth.

How are property taxes calculated in Broward County?

+Property taxes in Broward County are calculated based on the assessed value of the property and the millage rate set by the taxing authorities. The assessed value is determined by the Property Appraiser’s Office, while the millage rate is established by various taxing bodies. The tax liability is then calculated by multiplying the assessed value by the millage rate.

Are there any exemptions or tax relief programs available for property owners in Broward County?

+Yes, Broward County offers several exemptions and tax relief programs to make property ownership more affordable. These include homestead exemptions, which reduce the assessed value of a primary residence, and senior citizen discounts, providing tax relief to homeowners aged 65 and older. Additionally, there are special exemptions for disabled veterans and low-income homeowners.

How do property taxes impact business owners in Broward County?

+Property taxes impact business owners by influencing their overall cost of doing business and financial planning. Higher property taxes may lead to increased operational costs, which may be passed on to consumers. Additionally, property taxes can affect a business’s decision to expand or relocate, impacting the county’s economic growth and job creation.

What public services and infrastructure projects are funded by property taxes in Broward County?

+Property taxes in Broward County fund a wide range of public services, including education, public safety, transportation, environmental protection, and social services. They also support infrastructure projects such as road and bridge construction, water and sewer system upgrades, and public transportation improvements.

How do property taxes contribute to the overall economic development of Broward County?

+Property taxes play a crucial role in the economic development of Broward County by funding essential public services and infrastructure. Well-funded public services and infrastructure attract businesses and residents, fostering economic growth, job creation, and overall prosperity. Property taxes also support community development initiatives, further enhancing the county’s social and economic fabric.