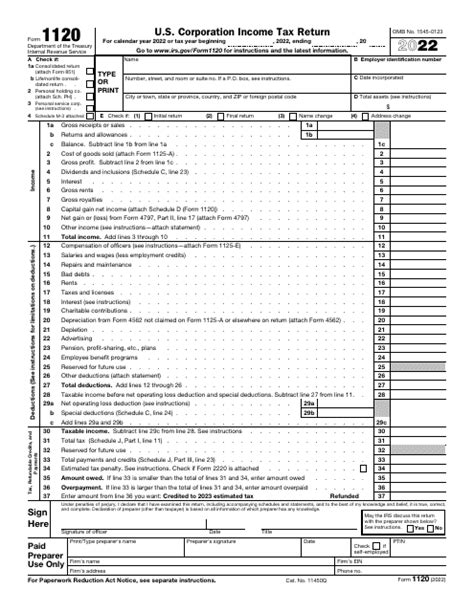

Sc Tax Return

Welcome to this comprehensive guide on understanding and managing your South Carolina (SC) Tax Returns. Filing taxes can be a daunting task, but with the right knowledge and tools, it can be a straightforward process. In this article, we will delve into the world of SC tax returns, covering everything from the basics to advanced strategies to ensure you are well-prepared and confident in navigating the tax landscape.

Understanding SC Tax Returns: A Comprehensive Overview

South Carolina’s tax system is designed to support the state’s economic growth and provide revenue for essential services. As a resident or business owner in SC, understanding the tax obligations and available deductions is crucial. Let’s break down the key components of SC tax returns.

Income Tax Structure in SC

South Carolina operates on a progressive income tax system, meaning that higher income brackets are taxed at higher rates. The state offers six tax brackets, ranging from 0% to 7% for individuals and married couples filing jointly. The tax rates are as follows:

| Tax Bracket | Tax Rate |

|---|---|

| 0% - 2,880</td><td>0%</td></tr> <tr><td>2,881 - 5,760</td><td>3%</td></tr> <tr><td>5,761 - 9,600</td><td>4%</td></tr> <tr><td>9,601 - 13,440</td><td>5%</td></tr> <tr><td>13,441 - 18,240</td><td>6%</td></tr> <tr><td>18,241 and above | 7% |

It’s important to note that SC has a standard deduction of 2,880 for individuals and 5,760 for married couples filing jointly. This means that a portion of your income is exempt from taxation, providing a tax benefit for many residents.

Filing Status and Deductions

SC tax returns recognize various filing statuses, including Single, Married Filing Jointly, Married Filing Separately, and Head of Household. The choice of filing status can impact your tax liability and eligibility for certain deductions. For instance, if you are the primary caregiver for a dependent, you may qualify for the Head of Household status, which offers a higher standard deduction.

SC offers a range of deductions and credits to help reduce your tax burden. These include deductions for medical expenses, charitable contributions, mortgage interest, and property taxes. Additionally, the state provides tax credits for various initiatives, such as the Low-Income Housing Tax Credit and the Historic Preservation Tax Credit.

Taxable Income and Exemptions

Not all income is taxable in SC. The state exempts certain types of income, such as Social Security benefits, military combat pay, and some types of retirement income. It’s essential to understand which income sources are taxable and which are exempt to ensure accurate reporting.

The Process of Filing SC Tax Returns

Filing your SC tax return is a systematic process that involves gathering necessary documents, calculating your taxable income, and claiming eligible deductions and credits. Let’s walk through the key steps.

Gathering Documents

To begin, collect all relevant documents, including W-2 forms, 1099 forms, bank statements, and receipts for deductible expenses. If you are self-employed, you’ll need to gather records of your business income and expenses. Organize these documents to make the filing process more efficient.

Calculating Taxable Income

Determine your total income for the tax year, including wages, salaries, tips, dividends, and other sources of income. Subtract any eligible deductions, such as the standard deduction or itemized deductions, to arrive at your taxable income. SC provides worksheets and online tools to assist with this calculation.

Filing Methods

SC offers several methods for filing tax returns, catering to different preferences and needs. You can file your return electronically using the SC Department of Revenue’s online filing system, eFile, which is secure and efficient. Alternatively, you can opt for paper filing by mailing your completed tax forms to the SC Department of Revenue.

Payment Options

If you owe taxes, you can pay online using a credit or debit card, electronic check, or by setting up a payment plan. SC also accepts payments by mail, including checks, money orders, and cashier’s checks. It’s crucial to pay your taxes on time to avoid penalties and interest.

Maximizing Your SC Tax Return: Strategies and Tips

Now that we’ve covered the fundamentals, let’s explore some advanced strategies and tips to optimize your SC tax return and potentially reduce your tax liability.

Utilizing Tax Credits

SC offers a range of tax credits that can significantly reduce your tax burden. These credits are designed to support specific initiatives or provide relief to certain groups. For example, the Low-Income Tax Credit is available to individuals and families with low to moderate incomes, helping them offset their tax liability.

Maximizing Deductions

SC allows itemized deductions for various expenses, including medical costs, charitable contributions, and state and local taxes. By keeping detailed records and maximizing these deductions, you can potentially lower your taxable income and save on taxes.

Retirement Savings and Investments

SC encourages retirement savings by offering tax benefits for contributions to certain retirement plans. Contributions to 401(k) plans, IRAs, and other qualified retirement accounts may be deductible, depending on your income level and eligibility. Additionally, capital gains from investments may be taxed at a lower rate, providing an opportunity for tax-efficient growth.

Business Tax Strategies

If you own a business in SC, there are several strategies to consider. Maximizing deductions for business expenses, such as advertising, travel, and office supplies, can help reduce your taxable income. Additionally, taking advantage of SC’s business tax credits, such as the Jobs Tax Credit, can provide significant savings.

Common Mistakes and How to Avoid Them

Filing taxes can be complex, and mistakes are common. Here are some of the most frequent errors made on SC tax returns and tips on how to avoid them.

Incorrect Income Reporting

Failing to report all sources of income is a common mistake. Remember to include all wages, self-employment income, investment income, and other taxable sources. Double-check your forms and verify the accuracy of the income amounts.

Overlooking Deductions and Credits

Many taxpayers miss out on valuable deductions and credits simply because they are unaware of their eligibility. Stay informed about the available deductions and credits in SC, and make sure to claim those that apply to your situation. Consult with a tax professional if needed.

Calculation Errors

Tax calculations can be complex, and even small errors can lead to significant discrepancies. Double-check your calculations and consider using tax software or engaging a tax professional to ensure accuracy.

Missing Deadlines

Tax deadlines are critical, and missing them can result in penalties and interest charges. Mark your calendar with important dates, such as the tax filing deadline and payment due dates. Consider setting reminders to ensure you meet these deadlines.

The Future of SC Tax Returns: Trends and Changes

As technology advances and tax laws evolve, the landscape of SC tax returns is likely to change. Here are some insights into the future of SC taxes and what taxpayers can expect.

Digital Transformation

The SC Department of Revenue is continuously improving its digital services, making tax filing more efficient and secure. Expect to see further enhancements to the eFile system, including additional features and improved user experience.

Tax Law Updates

Tax laws are subject to change, and SC is no exception. Stay informed about any updates to the tax code, including changes to tax rates, deductions, and credits. The SC Department of Revenue provides resources and updates on its website to help taxpayers stay current.

Taxpayer Support and Education

The SC Department of Revenue is committed to supporting taxpayers and providing educational resources. Expect to see continued efforts to simplify the tax filing process and enhance taxpayer understanding through workshops, webinars, and online resources.

Conclusion: Empowering SC Taxpayers

Filing your SC tax return may seem daunting, but with the right knowledge and tools, it can be a manageable and even rewarding process. By understanding the tax system, utilizing available deductions and credits, and staying informed about changes, you can take control of your financial future and ensure compliance with SC tax laws.

Remember, accurate and timely tax filing is crucial to avoid penalties and ensure a smooth financial journey. Stay informed, seek professional guidance when needed, and embrace the opportunities that SC's tax system offers.

What is the deadline for filing SC tax returns?

+The deadline for filing SC tax returns is typically April 15th each year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. It’s important to note that payment deadlines may differ, so it’s best to check the official SC Department of Revenue website for the most up-to-date information.

Can I file my SC tax return online?

+Yes, SC offers online filing through its eFile system. This secure and efficient method allows you to file your tax return electronically, saving time and effort. The eFile system provides step-by-step guidance and ensures a seamless filing experience.

What if I can’t pay my SC taxes on time?

+If you are unable to pay your SC taxes in full by the due date, it’s important to take action. The SC Department of Revenue offers payment plans to help taxpayers manage their tax liabilities. You can apply for a payment plan online or by contacting the department directly. It’s crucial to address any tax liabilities promptly to avoid penalties and interest charges.

How can I stay updated on SC tax law changes?

+To stay informed about SC tax law changes, it’s recommended to subscribe to the SC Department of Revenue’s email updates and follow their social media accounts. They provide regular updates and notifications about any changes to tax laws, deadlines, and important announcements. Additionally, consider signing up for tax-related newsletters or following reputable tax websites and blogs.