Mississippi Income Taxes

Welcome to our comprehensive guide on Mississippi income taxes. In this article, we will delve into the intricacies of the tax system in the Magnolia State, providing you with valuable insights and information to navigate the world of personal finance and taxation effectively. Whether you're a resident, a business owner, or simply curious about Mississippi's tax landscape, this guide will equip you with the knowledge you need.

Understanding Mississippi’s Income Tax Structure

Mississippi, like many other states, imposes an income tax on its residents and businesses. The state’s tax system is designed to generate revenue to support various public services, infrastructure, and social programs. Let’s explore the key aspects of Mississippi’s income tax structure and how it impacts individuals and entities within its borders.

Tax Rates and Brackets

Mississippi operates on a graduated income tax system, which means that the tax rate you pay depends on your taxable income. The state has six income tax brackets, ranging from 3% to 5%, with higher incomes being taxed at a higher rate. This progressive tax structure aims to ensure that those with higher earnings contribute a larger proportion of their income towards state revenues.

| Tax Bracket | Tax Rate | Applicable Income Range |

|---|---|---|

| 1 | 3% | $0 - $5,000 |

| 2 | 4% | $5,001 - $10,000 |

| 3 | 4.25% | $10,001 - $25,000 |

| 4 | 4.5% | $25,001 - $50,000 |

| 5 | 4.75% | $50,001 - $100,000 |

| 6 | 5% | $100,001 and above |

These tax rates are applicable to both single filers and married couples filing jointly. It's important to note that Mississippi's tax brackets are relatively narrow, which means that even modest increases in income can push you into a higher tax bracket.

Taxable Income and Deductions

When calculating your taxable income in Mississippi, you can take advantage of certain deductions and exemptions. The state offers a standard deduction, which is a set amount that reduces your taxable income. Additionally, Mississippi allows you to claim deductions for various expenses, such as medical costs, charitable contributions, and certain business-related expenses.

Furthermore, Mississippi residents can benefit from federal income tax deductions when filing their state tax returns. This means that certain expenses that reduce your federal taxable income can also be applied to your Mississippi tax liability, potentially lowering your overall tax burden.

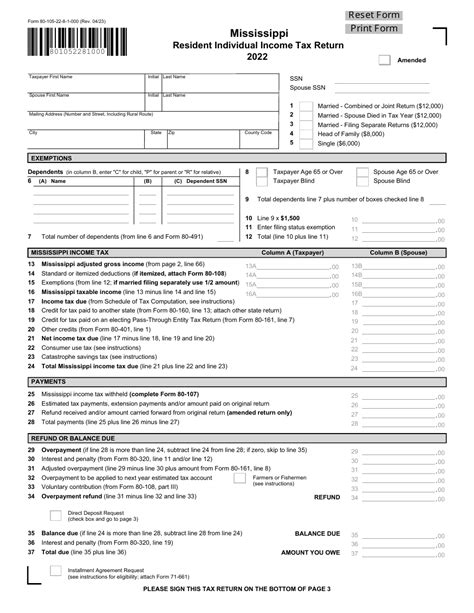

Tax Filing and Payment Options

Mississippi provides several convenient methods for taxpayers to file their income tax returns and make payments. The Mississippi Department of Revenue offers an online filing system, Mytax.Mississippi.gov, which allows individuals and businesses to complete and submit their tax returns electronically. This platform is user-friendly and secure, making the filing process efficient and accessible.

For those who prefer traditional methods, paper tax forms are also available. You can download the appropriate forms from the Department of Revenue's website or request them by mail. It's important to ensure that you use the correct form based on your filing status and income level.

When it comes to payment options, Mississippi offers flexibility. Taxpayers can pay their taxes online through the Mytax platform, by mail using a check or money order, or even through electronic funds transfer (EFT) directly from their bank account. Additionally, payment plans and installment agreements are available for those who may struggle to pay their taxes in full by the due date.

Tax Incentives and Credits

Mississippi recognizes the importance of encouraging economic growth and supporting its residents and businesses. As such, the state offers various tax incentives and credits to promote investment, job creation, and community development.

Business Tax Incentives

Mississippi has implemented several programs to attract and support businesses within the state. These incentives aim to stimulate economic activity, create job opportunities, and foster innovation. Here are a few notable business tax incentives:

- Enterprise Zone Program: Mississippi's Enterprise Zones are designated areas where businesses can benefit from reduced tax burdens and access various incentives. These zones encourage investment and development in targeted communities.

- Capital Investment Tax Credit: Businesses that make substantial capital investments in Mississippi may be eligible for a tax credit. This incentive aims to promote job creation and economic development by attracting new businesses and expanding existing ones.

- Research and Development Tax Credit: Mississippi offers a tax credit for businesses engaged in research and development activities. This credit encourages innovation and technological advancements, making the state an attractive hub for R&D-focused companies.

Individual Tax Credits

Mississippi also provides tax credits to individuals, recognizing their contributions to the state’s economy and society. Some notable individual tax credits include:

- Low-Income Tax Credit: Mississippi offers a tax credit to low-income individuals and families to help alleviate the financial burden of taxation. This credit aims to ensure that those with limited means are not disproportionately affected by the state's income tax system.

- Estate Tax Credit: The state provides a credit for individuals who have paid estate taxes on the federal level. This credit helps reduce the overall tax liability for those who have inherited property or assets.

- Education Tax Credits: Mississippi supports education by offering tax credits for various educational expenses. These credits can be used to offset the cost of tuition, books, and other educational-related fees, making education more accessible to residents.

Mississippi’s Taxable Services and Sales

In addition to income taxes, Mississippi imposes taxes on various services and sales. These taxes contribute to the state’s revenue stream and support essential public services.

Sales and Use Tax

Mississippi applies a sales and use tax to most tangible personal property sold within the state. The sales tax rate is 7%, which includes a 3% state tax and varying local taxes. This tax is collected by retailers and remitted to the Mississippi Department of Revenue.

Mississippi also has a use tax, which applies to purchases made outside the state but used within Mississippi. This tax ensures that residents pay their fair share, regardless of where they make their purchases. The use tax rate is the same as the sales tax rate, ensuring uniformity.

Taxable Services

Mississippi taxes certain services provided within the state. These services include, but are not limited to, professional services, repairs, installations, and various personal services. The tax rate for services varies depending on the specific service provided and can range from 3% to 7%.

It's important for businesses providing taxable services to understand their tax obligations and register with the Mississippi Department of Revenue to ensure compliance. Failure to collect and remit taxes can result in penalties and legal consequences.

The Future of Mississippi’s Tax Landscape

Mississippi’s tax system, like that of any state, is subject to ongoing evaluation and potential reforms. As economic conditions, political priorities, and societal needs evolve, the state may consider adjustments to its tax policies.

One potential area of focus is tax simplification. Mississippi's tax code, like many others, can be complex and confusing for taxpayers. Simplifying the tax system by reducing the number of tax brackets, standardizing tax rates, and streamlining filing processes could make it more accessible and less burdensome for taxpayers.

Additionally, the state may explore ways to promote economic growth and competitiveness by offering tax incentives for specific industries or sectors. This could involve targeted tax credits or deductions to attract businesses and stimulate job creation in key areas such as technology, renewable energy, or manufacturing.

Furthermore, as the digital economy continues to grow, Mississippi may need to adapt its tax system to address the challenges posed by online sales and remote work. Ensuring fair taxation of e-commerce and remote workers while maintaining competitiveness with other states will be crucial in the coming years.

Conclusion

Mississippi’s income tax system, while progressive and designed to support public services, offers a range of benefits and incentives for both individuals and businesses. From graduated tax rates to tax credits and deductions, the state aims to strike a balance between generating revenue and supporting its residents and economy.

Understanding Mississippi's tax landscape is essential for individuals and businesses operating within the state. By staying informed about tax rates, filing requirements, and available incentives, taxpayers can ensure compliance and make the most of the opportunities provided by the state's tax structure. As Mississippi continues to evolve, its tax policies will play a vital role in shaping the state's economic future.

When is the Mississippi income tax filing deadline for the current tax year?

+

The income tax filing deadline for Mississippi residents is typically April 15th of the following year. However, it’s important to note that this date may be subject to change, so it’s advisable to check the official website of the Mississippi Department of Revenue for any updates or extensions.

Are there any special tax filing requirements for businesses in Mississippi?

+

Yes, businesses operating in Mississippi have specific tax filing requirements. They must obtain a tax registration number from the Mississippi Department of Revenue and file their taxes based on their business structure and revenue. It’s crucial for businesses to stay informed about their tax obligations to avoid penalties.

Can I file my Mississippi income taxes electronically?

+

Absolutely! Mississippi offers electronic filing options through its official website, Mytax.Mississippi.gov. This platform allows individuals and businesses to file their tax returns securely and efficiently. Electronic filing is a convenient and recommended method for most taxpayers.

Are there any tax breaks or incentives for renewable energy investments in Mississippi?

+

Yes, Mississippi provides tax incentives to promote renewable energy investments. The state offers a Renewable Energy Tax Credit, which can be claimed by individuals and businesses that install qualifying renewable energy systems, such as solar panels or wind turbines. This credit helps offset the cost of these investments.

How can I stay updated on Mississippi’s tax laws and changes?

+

The Mississippi Department of Revenue maintains a comprehensive website with up-to-date information on tax laws, regulations, and any changes or updates. It’s a good practice to bookmark their website and regularly check for news and announcements to ensure you’re compliant with the latest tax requirements.