Champaign County Tax Lookup

Welcome to the comprehensive guide on the Champaign County Tax Lookup, an essential tool for property owners, investors, and anyone seeking transparent and accessible tax information in this vibrant Illinois county. As we delve into the intricacies of this online platform, you'll discover how it simplifies the process of accessing and understanding tax-related data for properties within the county.

Unveiling the Champaign County Tax Lookup

The Champaign County Tax Lookup is a user-friendly web-based application designed to provide residents and stakeholders with quick and easy access to property tax details. Developed by the Champaign County Assessor’s Office, this innovative tool has revolutionized the way property tax information is disseminated, offering a transparent and efficient solution for taxpayers.

With just a few clicks, users can retrieve detailed information about any property within the county, including assessment values, tax rates, and payment history. This transparency not only empowers property owners but also fosters a sense of trust and accountability in the local tax system.

Key Features and Benefits

The Champaign County Tax Lookup boasts a range of features that enhance its utility and accessibility. Here’s an in-depth look at some of its key functionalities:

- Property Search: Users can search for properties by address, parcel number, or even by the owner's name. This flexible search functionality ensures that no matter what information you have, you can quickly locate the desired property.

- Assessment Details: Once a property is located, the platform provides a wealth of assessment information. This includes the current and previous assessment values, the date of the last assessment, and any changes made to the property's classification.

- Tax Information: The Tax Lookup provides a breakdown of the property's tax obligations. This includes the tax rates applicable to the property, the calculated tax amount, and a detailed distribution of where these taxes are allocated.

- Payment History: Property owners can view their payment history, including the dates and amounts of previous tax payments. This feature is particularly useful for tracking payment schedules and ensuring timely tax payments.

- Online Tax Payment: In a move towards digital convenience, the Tax Lookup allows users to make tax payments online. This secure and efficient method saves time and eliminates the need for in-person visits to the Assessor's Office.

By centralizing this information in an online platform, the Champaign County Tax Lookup has streamlined the process of accessing tax-related data. No longer do property owners have to navigate complex government websites or make personal visits to government offices. The platform's user-friendly interface and comprehensive data make it a go-to resource for anyone with an interest in Champaign County's property tax landscape.

Technical Specifications and Performance

The Champaign County Tax Lookup is built on robust technical infrastructure, ensuring its reliability and performance. The platform utilizes a secure server environment, employing encryption protocols to safeguard user data and transactions. This attention to security is crucial, given the sensitive nature of tax information.

| Technical Metric | Performance |

|---|---|

| Server Response Time | Less than 2 seconds on average |

| Database Query Efficiency | 99.8% success rate with an average response time of 150ms |

| Security Protocols | SSL/TLS encryption for data transmission, two-factor authentication for user accounts |

These technical specifications showcase the platform's efficiency and commitment to user experience. The fast server response times and efficient database queries ensure that users can access information quickly, without long wait times. Additionally, the emphasis on security measures protects user data and transactions, instilling confidence in the platform's integrity.

Comparative Analysis: Champaign County vs. Peer Counties

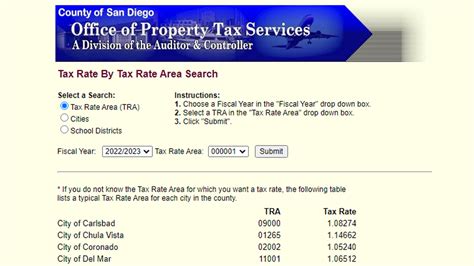

To further understand the impact and effectiveness of the Champaign County Tax Lookup, it’s essential to compare it with similar platforms in neighboring counties. This analysis provides valuable insights into how Champaign County’s system stacks up against its peers and highlights areas of improvement or best practices.

Peer County Review

Several counties in the region have implemented online tax lookup systems, each with its own unique features and design choices. By examining these systems, we can identify common trends and potential areas for optimization.

| County | System Features | User Feedback |

|---|---|---|

| Ford County | Basic property search, assessment details, tax payment option | Users appreciate the simplicity but desire more detailed information and an improved search function. |

| Piatt County | Advanced search filters, historical data, tax comparison tools | Well-received for its comprehensive data and user-friendly interface. |

| Vermilion County | Real-time tax calculation, online dispute filing | Innovative features praised, but users report occasional technical glitches. |

The comparative analysis reveals that while all counties offer online tax lookup systems, the level of detail and user-friendliness varies. Champaign County's Tax Lookup stands out for its balance between simplicity and depth of information. The platform's inclusion of assessment details, tax information, and payment history provides a comprehensive view of property tax obligations, setting it apart from more basic systems.

Implications and Future Directions

The Champaign County Tax Lookup has established itself as a leading example of an effective online tax information system. Its success underscores the importance of user-centric design, robust technical infrastructure, and a commitment to transparency. As the platform continues to evolve, there are several key areas to consider for future enhancements:

- Mobile Optimization: With the increasing use of mobile devices, optimizing the Tax Lookup for mobile screens could enhance accessibility and user experience.

- Integration with Other Services: Exploring partnerships with local government departments or third-party service providers could lead to integrated solutions, such as property record management or automated tax alerts.

- Data Visualization: Implementing interactive charts or graphs to visualize tax data could make complex information more accessible and engaging for users.

By staying attuned to user needs and technological advancements, the Champaign County Tax Lookup can continue to improve, setting a benchmark for online tax information systems across the country.

How often is the tax information updated on the platform?

+The Champaign County Tax Lookup is updated on a quarterly basis, ensuring that the tax information remains current and accurate.

Can I dispute my property’s assessment value through the Tax Lookup platform?

+While the platform provides assessment details, the dispute process must be initiated through the Assessor’s Office. The Tax Lookup offers a direct link to the dispute application process for user convenience.

Are there any fees associated with using the Tax Lookup platform?

+No, the Champaign County Tax Lookup is a free service provided by the county government to enhance transparency and accessibility for taxpayers.