Discover the Unique Features of the New York Estate Tax Explained

The evolution of estate taxation in New York State has been marked by nuanced legislative shifts and strategic policy reforms that reflect broader fiscal priorities and societal values. Among recent developments, the introduction of the new estate tax framework stands out as a pivotal change, redefining how wealth transfer mechanisms operate within the state’s legal and fiscal landscape. This comprehensive analysis delves into the distinctive features of the New York estate tax, exploring its legislative origins, core components, and the implications for high-net-worth individuals, estate planners, and policymakers alike.

Understanding the Foundations of the New York Estate Tax

Estate taxation in New York is characterized by a confluence of historical statutes and modern amendments designed to balance revenue generation with estate planning flexibility. Historically, New York maintained a separate estate tax from the federal inheritance tax, with rates and exemption thresholds that have evolved significantly over the past few decades. The current iteration—often termed the “new estate tax”—reflects policy shifts aimed at addressing economic disparities and encouraging philanthropic contributions, while also safeguarding state revenue streams.

At its core, the New York estate tax applies to the transfer of assets from decedents residing in the state or owning property therein. Unlike federal estate tax thresholds, which stood at $12.92 million in 2023, New York has set its exemption threshold at varying levels, influenced by legislative amendments. The recent changes focus particularly on enhancing the tax’s reach and refining its calculation mechanisms, making it essential to understand the individual components and how they interact within the broader estate planning context.

The Key Features of the New York Estate Tax

Central to comprehending the new estate tax are its distinctive features that differentiate it from other state and federal counterparts. These features encompass exemption thresholds, progressive tax rates, valuation adjustments, and specific inclusion rules for certain assets. Each element has been thoughtfully calibrated to balance revenue objectives with fairness and administrative practicality.

Exemption Thresholds and Their Strategic Significance

As of 2023, New York’s exemption threshold for estate taxation stands at approximately $6.58 million, significantly lower than the federal exemption. This disparity ensures that a substantial portion of estates—particularly those of high-net-worth individuals—are subject to state estate tax. The threshold is subject to periodic adjustments based on inflation indexing, legislative initiatives, and fiscal policy considerations. Notably, recent reforms have streamlined the exemption’s application, minimizing ambiguities for estate planners and beneficiaries.

| Relevant Category | Substantive Data |

|---|---|

| Exemption Threshold | $6.58 million (2023), adjustable annually |

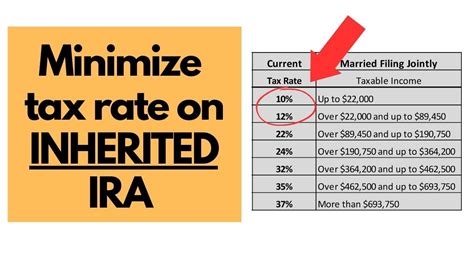

Progressive Tax Rates and Their Implementation

The tax rate structure applied to estates exceeding the exemption threshold is progressive, with rates ascending from 5% up to a maximum of 16%. The top tier applies to taxable estates above approximately $10 million, reflecting a graduated approach designed to capture higher wealth brackets more proportionally. This tiered system incentivizes proactive estate planning and diversification of assets to mitigate tax burdens.

| Relevant Category | Substantive Data |

|---|---|

| Maximum Tax Rate | 16% for estates above $10 million (2023) |

| Tax Brackets | Progressing from 5% to 16% based on estate value |

Valuation Adjustments and Asset Inclusion

Valuation is a critical aspect of estate tax calculation, with specific provisions for closely held businesses, real estate, and certain intangible assets. The valuation discounts permitted through minority interest considerations often reduce the taxable estate valuation, whereas recent reforms tighten some of these provisions, reducing opportunities for undervaluation. Additionally, the inclusion of certain retirement accounts and life insurance proceeds directly into the taxable estate underscores the need for meticulous asset management.

| Relevant Category | Substantive Data |

|---|---|

| Valuation Discounts | Up to 20-30% for minority interests, subject to legislative oversight |

| Asset Inclusion | Retirement accounts, life insurance, and real property included in estate calculation |

Legal and Policy Considerations in the New York Estate Tax

Administrator and estate planners must navigate a complex web of legal stipulations that influence tax liabilities. Legislative efforts have aimed to streamline compliance, reduce ambiguities, and enhance revenue collection through statutory clarifications and enforcement provisions. Moreover, policy debates around estate taxation often pivot on issues of fairness, economic inequality, and fiscal sustainability, making it a fertile ground for ongoing legislative innovation.

Recent Legislative Reforms and Future Outlook

Recent amendments introduced mechanisms to phase out certain exemptions for larger estates, increase transparency requirements for asset valuation, and close tax avoidance channels via gift and transfer planning. The prospect of future reforms remains high, with discussions about aligning New York’s estate tax more closely with federal standards or adjusting thresholds in response to economic trends.

| Relevant Category | Substantive Data |

|---|---|

| Legislative Amendments | Reforms enacted in 2022 and 2023 targeting exemption thresholds and valuation rules |

| Policy Predictions | Potential alignment with federal thresholds or tiered approaches based on economic growth |

Practical Implications for Estate Planning

Estate planning in light of the new estate tax features emphasizes strategic asset structuring, charitable planning, and timely transfers. High-net-worth individuals typically leverage irrevocable trusts, gifting programs, and charitable foundations to mitigate tax exposure, ensure wealth transfer alignment with family objectives, and support philanthropic endeavors. The nuanced understanding of valuation methods and tax thresholds enables tailored strategies that optimize estate liquidity and continuity.

Strategic Asset Management and Tax Efficiency

Implementing advanced tools such as family limited partnerships (FLPs) and leveraged gifting can significantly reduce taxable estate values. Moreover, coordinating estate and income tax considerations maximizes the benefits of applicable exemptions and deductions. These techniques require careful legal and tax counsel to navigate compliance and safeguard against unintended consequences.

| Relevant Category | Substantive Data |

|---|---|

| Asset Transfer Techniques | Use of irrevocable trusts, FLPs, and lifetime gifting |

| Tax Optimization Strategies | Valuation discounts, charitable deductions, and life insurance pooling |

Implications for High-Net-Worth Individuals and Families

The reformulated estate tax landscape compels wealthy families to revisit their legacy planning and wealth preservation strategies. The reduced exemption threshold, coupled with elevated tax rates at higher brackets, transforms estate management into a highly strategic endeavor, where timing, asset allocation, and inheritance structures directly influence the long-term financial health of dynasties.

Some families increasingly embrace philanthropy as a dual-purpose strategy—reducing taxable estate size while supporting philanthropic aims. Others rely heavily on advanced estate structures tailored to exploit legislative allowances while maintaining compliance. The ascendancy of digital assets and valuation challenges further complicates estate planning, demanding innovative approaches and continuous oversight.

Key Points

- Exemption thresholds significantly influence estate planning strategies; lower thresholds necessitate early asset transfers and gifting.

- Progressive tax rates incentivize diversification and valuation practices to minimize liabilities.

- Legislative reforms continually reshape the landscape, requiring vigilant legal and tax counsel.

- Asset valuation remains vital, with recent tightening measures closing loopholes.

- Advanced planning techniques can mitigate liabilities but require expert execution and compliance awareness.

How does the New York estate tax differ from federal estate tax?

+New York’s estate tax applies to estates exceeding approximately 6.58 million (2023), with a maximum rate of 16%, whereas the federal exemption is much higher at about 12.92 million, with a top rate of 40%. Additionally, New York includes certain assets like life insurance and retirement accounts directly into taxable estates, while federal rules differ in asset inclusion and valuation.

What estate planning techniques are recommended under the new law?

+Techniques such as irrevocable trusts, charitable giving, and family limited partnerships are effective. Employing valuation discounts, making lifetime gifts, and strategic use of life insurance can also optimize estate transfer and reduce tax liabilities—always tailored to individual circumstances and aligned with current legislative parameters.

Are digital assets affected by the new estate tax rules?

+Yes, digital assets like cryptocurrencies, online accounts, and digital holdings are increasingly recognized as part of the estate. Accurate valuation and secure transfer mechanisms are essential, especially as legislative clarity around these assets continues to develop.