Is There Sales Tax In Florida

In the realm of US taxation, understanding the nuances of sales tax is crucial, especially when considering specific states like Florida. While sales tax is a common levy across many states, Florida presents a unique landscape with its own set of rules and regulations. This article delves into the specifics of sales tax in Florida, providing an in-depth analysis for those interested in the economic landscape of the Sunshine State.

Understanding Sales Tax in Florida

Florida, much like many other states in the US, imposes a sales and use tax on the sale of tangible personal property, certain digitally supplied products, and some services. This tax is a crucial revenue generator for the state, contributing significantly to its overall budget. However, the implementation of sales tax in Florida is not a one-size-fits-all scenario, as it varies based on various factors, including the type of transaction and the location of the sale.

Taxable Transactions

Sales tax in Florida is applicable to a wide range of transactions. This includes the sale of goods like clothing, electronics, and groceries, as well as services such as auto repairs and haircuts. Additionally, Florida also levies sales tax on certain digitally supplied products, including software downloads and streaming services. However, there are some notable exceptions, such as groceries, which are tax-exempt in Florida, making it one of the few states to offer such a benefit to its residents.

| Category | Taxable |

|---|---|

| Tangible Personal Property | Yes |

| Digital Products | Yes |

| Services | Yes |

| Groceries | No |

Tax Rates

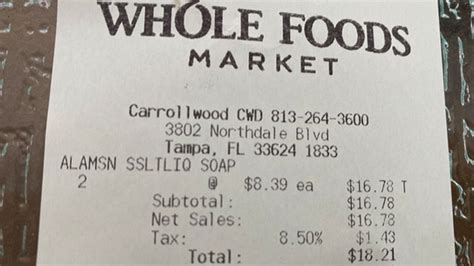

The sales tax rate in Florida is not a uniform figure across the state. Instead, it is composed of two parts: the state sales tax rate and the local option tax rate. The state sales tax rate is a fixed 6%, while the local option tax rate can vary based on the county. This local option tax is often used to fund specific projects or initiatives in a particular county, adding an additional layer of complexity to the sales tax landscape in Florida.

For instance, in Miami-Dade County, the local option tax rate is 1.5%, bringing the total sales tax rate to 7.5%. On the other hand, in counties like Monroe and Hillsborough, the local option tax rate is 1%, resulting in a total sales tax rate of 7%.

| County | Local Option Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Miami-Dade | 1.5% | 7.5% |

| Monroe | 1% | 7% |

| Hillsborough | 1% | 7% |

Sales Tax Holidays

Florida is known for its sales tax holidays, which are specific periods during the year when certain items are exempt from sales tax. These holidays are designed to provide relief to consumers and boost local economies. The state typically declares sales tax holidays for items like school supplies, hurricane preparedness items, and energy-efficient appliances. For instance, during the back-to-school season, Florida often waives sales tax on school supplies, clothing, and computers, making it an ideal time for parents to stock up on essentials.

Collection and Remittance

The responsibility of collecting and remitting sales tax falls on the seller. This means that businesses operating in Florida, whether online or brick-and-mortar, are required to register with the Florida Department of Revenue and obtain a sales tax permit. They must then collect the appropriate sales tax based on the transaction’s location and remit it to the state on a regular basis.

For online retailers, the rules are a bit more complex. If an online retailer has a physical presence in Florida, such as a warehouse or distribution center, they are required to collect sales tax on all transactions delivered to Florida residents. However, if they do not have a physical presence, they may only be required to collect sales tax if they meet certain economic thresholds, known as the economic nexus rules.

Impact on Consumers and Businesses

The implementation of sales tax in Florida has a significant impact on both consumers and businesses. For consumers, it means that a portion of their spending goes towards funding state and local projects. While this can be seen as an additional cost, it also ensures that the state has the resources to maintain infrastructure, provide public services, and invest in local communities.

For businesses, especially those operating online, the sales tax landscape in Florida can be a complex and ever-changing environment. With the introduction of economic nexus rules, online retailers must stay updated with the latest regulations to ensure compliance. Failure to do so can result in penalties and legal consequences.

Economic Benefits

Despite the complexities, sales tax in Florida brings several economic benefits. It provides a steady stream of revenue for the state, allowing for the development and maintenance of vital infrastructure, such as roads and schools. Additionally, sales tax holidays can stimulate local economies, encouraging consumer spending and supporting local businesses.

Challenges and Considerations

However, there are also challenges associated with sales tax in Florida. The varying tax rates across counties can create confusion for both consumers and businesses, especially those operating in multiple locations. Additionally, the constant evolution of online retail and the introduction of new technologies present unique challenges in terms of tax collection and compliance.

Conclusion

Sales tax in Florida is a crucial component of the state’s economy, providing revenue for essential services and infrastructure. While it presents a unique landscape with varying tax rates and complex rules, it is an essential aspect of doing business and living in the Sunshine State. Understanding these nuances is key to navigating the economic landscape of Florida successfully.

What is the current state sales tax rate in Florida?

+

The current state sales tax rate in Florida is 6%.

Are there any counties in Florida with a higher sales tax rate than the state average?

+

Yes, counties like Miami-Dade have a local option tax rate of 1.5%, resulting in a total sales tax rate of 7.5%.

When are sales tax holidays typically held in Florida?

+

Sales tax holidays in Florida are usually held during specific periods, such as back-to-school season and hurricane preparedness months.

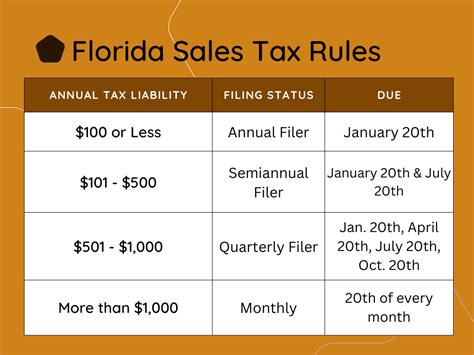

How often do businesses need to remit sales tax to the state of Florida?

+

Businesses are required to remit sales tax on a regular basis, typically monthly or quarterly, depending on their sales volume.

Are there any exceptions or exemptions to the sales tax in Florida?

+

Yes, there are certain exceptions, such as groceries, which are exempt from sales tax in Florida.