Nj New Taxes

The state of New Jersey, often abbreviated as NJ, is known for its diverse tax landscape, which includes a range of taxes aimed at funding various public services and initiatives. Understanding the tax structure in NJ is crucial for individuals and businesses operating within its borders. This article aims to provide a comprehensive guide to the taxes imposed in the Garden State, exploring their types, rates, and implications.

Income Taxes in New Jersey

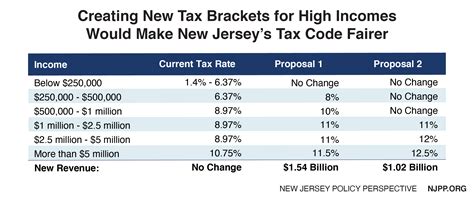

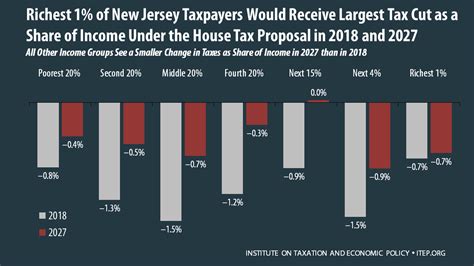

Income taxes form a significant portion of New Jersey’s tax revenue. The state operates a progressive income tax system, which means that higher income earners pay a higher percentage of their income in taxes. As of my last update in January 2023, New Jersey had the following income tax brackets:

| Tax Rate | Income Range |

|---|---|

| 1.4% | Up to $20,000 |

| 1.75% | $20,001 to $35,000 |

| 3.5% | $35,001 to $40,000 |

| 5.525% | $40,001 to $75,000 |

| 6.37% | $75,001 to $150,000 |

| 7.65% | $150,001 and above |

These rates are applicable for single, married filing separately, and head of household filers. For married filing jointly or qualifying widow(er) filers, the income ranges are doubled. It's important to note that these rates may be subject to changes and updates, so it's advisable to consult the latest tax guidelines issued by the New Jersey Division of Taxation for the most accurate information.

Tax Credits and Deductions

New Jersey offers various tax credits and deductions to reduce the tax burden on its residents. Some of these include the Homestead Rebate Program, which provides property tax relief to eligible homeowners, and the Property Tax Relief for Veterans and Surviving Spouses, which offers a credit for certain qualifying veterans and their surviving spouses.

Additionally, New Jersey allows for certain deductions, such as the Medical Expense Deduction and the Dependents Deduction, which can further reduce taxable income. It's crucial to consult a tax professional or refer to the official tax guidelines to determine eligibility and maximize potential deductions.

Sales and Use Taxes

New Jersey imposes a Sales and Use Tax on the retail sale, lease, or rental of most goods, as well as on certain services. The standard sales tax rate in New Jersey is 6.625%, which includes both the state and local sales tax rates. However, certain items like groceries, prescription drugs, and clothing under $100 are exempt from the sales tax.

Additionally, New Jersey has a Use Tax, which applies to purchases made outside the state but used or consumed within New Jersey. This tax ensures that residents pay taxes on items purchased remotely or out-of-state, preventing an unfair advantage over local businesses.

Local Sales Tax Variations

It’s important to note that sales tax rates can vary across different municipalities in New Jersey. For instance, certain counties and municipalities may impose additional local sales taxes, leading to higher overall sales tax rates in specific areas. It’s crucial for businesses operating in New Jersey to be aware of these variations to accurately calculate and collect sales taxes.

Property Taxes

Property taxes are a significant source of revenue for local governments in New Jersey. These taxes are imposed on both real estate and personal property. The tax rates and assessments are determined at the local level, which means that property tax rates can vary widely across the state.

New Jersey is known for having some of the highest property taxes in the nation. The average effective property tax rate in New Jersey is approximately 2.18%, which is significantly higher than the national average. However, it's important to note that these rates can vary greatly depending on the specific municipality and the assessed value of the property.

Tax Appeals and Assessments

Homeowners and property owners in New Jersey have the right to appeal their property tax assessments if they believe the assessed value is inaccurate or unfair. This process involves submitting an appeal to the local tax assessor’s office, which will review the assessment and make a determination. If the appeal is successful, it can result in a reduced tax burden for the property owner.

Corporate and Business Taxes

New Jersey imposes various taxes on businesses operating within its borders. The Corporation Business Tax (CBT) is a franchise tax levied on corporations doing business in the state. The CBT is calculated based on a corporation’s entire net worth, including assets, liabilities, and net income.

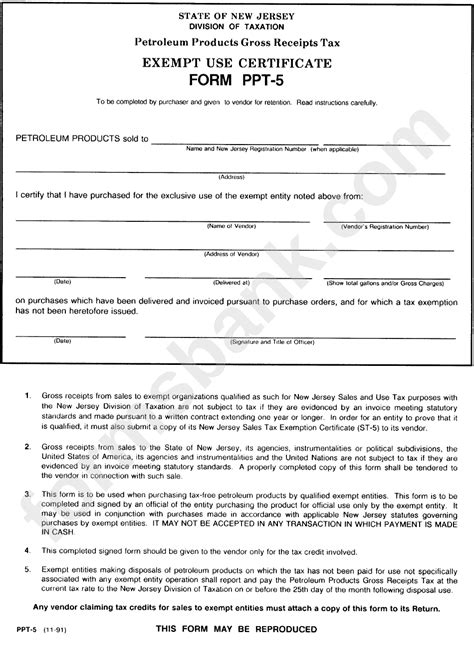

Additionally, New Jersey has a Gross Income Tax for businesses, which is imposed on certain types of business income, including gross receipts, sales, and services. The rate for the Gross Income Tax varies depending on the specific type of business and its income.

Business Incentives and Credits

To attract and support businesses, New Jersey offers a range of incentives and tax credits. For instance, the Grow New Jersey Assistance Program provides tax credits to businesses that create or retain jobs in targeted areas of the state. Additionally, there are credits available for research and development activities, as well as for businesses that invest in certain renewable energy projects.

Other Taxes and Fees

New Jersey imposes various other taxes and fees to generate revenue and fund specific initiatives. These include:

- Estate and Inheritance Taxes: These taxes are levied on the transfer of property upon an individual's death.

- Unemployment Insurance Taxes: Employers are required to pay these taxes to fund unemployment benefits for eligible workers.

- Fuel Taxes: Taxes are imposed on the sale of gasoline and diesel fuel to fund transportation infrastructure.

- Real Estate Transfer Taxes: These taxes are applied to the sale or transfer of real estate property.

It's important for individuals and businesses to understand the specific requirements and rates associated with these taxes to ensure compliance and minimize potential penalties.

Tax Compliance and Resources

To assist taxpayers in understanding and complying with New Jersey’s tax laws, the New Jersey Division of Taxation provides a wealth of resources and guidelines. These include tax forms, publication guides, and online tools for calculating taxes and filing returns. It’s crucial for taxpayers to stay informed and up-to-date with the latest tax regulations to avoid any non-compliance issues.

Tax Relief Programs

New Jersey offers various tax relief programs to support vulnerable populations and promote economic development. For instance, the Property Tax Relief Program provides assistance to senior citizens, disabled individuals, and veterans who meet certain income and residency requirements. Additionally, there are programs like the Senior Freeze and the Homestead Rebate Program that provide property tax relief to eligible homeowners.

Conclusion

Navigating the tax landscape in New Jersey can be complex due to the diverse range of taxes and varying rates. Whether you’re an individual taxpayer or a business owner, staying informed about the latest tax laws and regulations is essential. By understanding the types of taxes imposed, their rates, and potential deductions or credits, you can effectively manage your tax obligations and plan your financial strategies accordingly.

It's always advisable to consult with tax professionals or seek guidance from the official tax authorities to ensure compliance and take advantage of any available tax benefits. As tax laws can change over time, staying updated with the latest information is crucial for accurate tax planning and management.

What is the deadline for filing income taxes in New Jersey?

+The deadline for filing income taxes in New Jersey typically aligns with the federal deadline, which is usually April 15th. However, it’s important to note that this deadline may be subject to changes due to various factors, such as tax law changes or unforeseen circumstances. It’s always recommended to refer to the official tax guidelines or consult a tax professional for the most accurate and up-to-date information.

Are there any tax incentives for renewable energy projects in New Jersey?

+Yes, New Jersey offers several tax incentives for renewable energy projects. The state has programs like the Renewable Energy Certificate (REC) Program and the Corporate Business Tax (CBT) Credit for Renewable Energy. These programs provide tax credits and other benefits to businesses and individuals who invest in renewable energy projects or generate a certain percentage of their energy from renewable sources. It’s advisable to consult the official guidelines or seek professional advice to understand the specific requirements and benefits of these programs.

How can I appeal my property tax assessment in New Jersey?

+To appeal your property tax assessment in New Jersey, you’ll need to follow a specific process outlined by your local tax assessor’s office. Generally, the process involves submitting an appeal application, providing supporting documentation, and attending a hearing. It’s crucial to carefully review the guidelines provided by your local tax authority and consider seeking professional assistance to ensure a successful appeal.

Are there any tax benefits for seniors or veterans in New Jersey?

+Yes, New Jersey offers several tax benefits specifically for seniors and veterans. These include the Property Tax Relief for Senior Citizens and Disabled Individuals, which provides a property tax deduction for eligible seniors and disabled individuals. Additionally, veterans may be eligible for the Property Tax Relief for Veterans and Surviving Spouses, which offers a credit for certain qualifying veterans and their surviving spouses. It’s important to review the eligibility criteria and requirements to determine if you qualify for these benefits.

How can I stay updated with the latest tax laws and changes in New Jersey?

+To stay informed about the latest tax laws and changes in New Jersey, it’s recommended to regularly visit the official website of the New Jersey Division of Taxation. This website provides up-to-date information on tax rates, deadlines, and any significant changes to tax laws. Additionally, you can subscribe to their email updates or follow their social media accounts for timely notifications. It’s always a good practice to stay engaged with tax authorities and consult professionals to ensure compliance with the latest regulations.