Orange County Tax Deed Sales

Welcome to an in-depth exploration of the Orange County Tax Deed Sales process, a unique and often complex aspect of real estate transactions. This comprehensive guide will delve into the intricacies of this specific market, offering a detailed understanding of how it operates and its potential benefits and challenges.

Understanding Orange County Tax Deed Sales

Orange County, renowned for its vibrant economy and diverse real estate market, hosts annual Tax Deed Sales events. These sales offer a unique opportunity for investors and homebuyers to acquire properties at potentially advantageous prices. Let’s unravel the mechanics of this process and explore its significance in the broader real estate landscape.

The Mechanism Behind Tax Deed Sales

Tax Deed Sales in Orange County are a result of delinquent property taxes. When a property owner fails to pay their taxes for a specified period, the county can initiate a process to sell the property at a public auction. This auction, often referred to as a tax deed sale, is open to all interested parties, providing a chance to purchase properties that may have been overlooked or underutilized.

The process begins with a notice of sale, typically advertised well in advance to ensure transparency and wide participation. This notice includes details about the property, its location, and the minimum bid amount, which is often set at the amount of back taxes owed plus any associated fees and penalties.

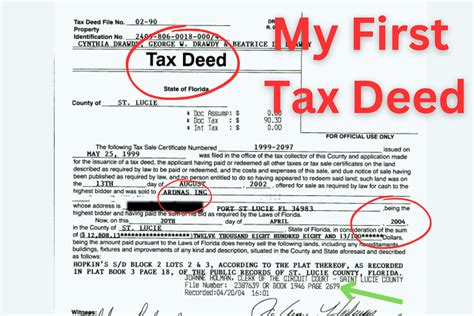

During the auction, bidders compete to purchase these properties. The highest bidder wins the right to acquire the property, and upon completion of the sale, the bidder receives a tax deed, granting them legal ownership. This process, while providing a second chance for delinquent property owners to retain their properties, also offers an exciting avenue for investors to acquire real estate at potentially attractive prices.

Key Benefits of Orange County Tax Deed Sales

The Orange County Tax Deed Sales market presents a range of advantages for those willing to navigate its intricacies. Here are some key benefits that attract investors and homebuyers alike:

- Discounted Property Prices: One of the primary draws is the potential for significant discounts. Properties sold at tax deed auctions often go for substantially lower prices compared to their fair market value. This can be especially attractive for investors looking to acquire properties at a bargain and for those seeking affordable housing options.

- Diverse Property Types: The auction offers a wide array of property types, including residential homes, commercial spaces, vacant lots, and even luxury properties. This diversity caters to a broad spectrum of buyer preferences and investment strategies.

- Opportunity for Quick Returns: Tax deed sales often cater to investors seeking short-term gains. Properties acquired at these auctions can be quickly flipped, renovated, and resold for a profit, providing a rapid return on investment.

- Potential for Long-Term Rental Income: For those with a buy-and-hold strategy, tax deed sales can be a gateway to acquiring rental properties. These properties can provide a steady stream of income over the long term, making them attractive investments for passive income seekers.

Navigating Challenges and Considerations

While Orange County Tax Deed Sales present unique opportunities, they also come with certain challenges and considerations that potential buyers should be aware of.

Firstly, the competitive nature of the auction can drive up bid prices, potentially negating the initial discounts. Experienced investors often strategize their bids to ensure they secure properties at the best possible value. Additionally, properties sold at tax deed auctions may require significant repairs or renovations, which can add to the overall cost of acquisition.

Another crucial aspect is the research and due diligence required before bidding. Buyers must thoroughly investigate the property, its history, and any potential encumbrances or liens. This process can be time-consuming but is essential to avoid unexpected issues post-purchase.

Furthermore, the legal aspects of the sale should not be overlooked. Buyers must ensure they understand the terms and conditions of the sale, including any rights and responsibilities that come with the acquired property. Consulting with legal experts is often recommended to navigate the legal intricacies associated with tax deed sales.

Performance Analysis and Market Insights

Diving deeper into the performance and trends of Orange County Tax Deed Sales provides valuable insights into the market’s dynamics and its potential for investors.

Recent Sales Trends

Over the past year, Orange County Tax Deed Sales have seen a notable increase in activity, with a higher number of properties being offered at auction. This trend can be attributed to a combination of factors, including economic fluctuations, changes in tax policies, and the broader real estate market dynamics.

A breakdown of the recent sales reveals an interesting pattern. While residential properties continue to dominate the market, there has been a notable rise in the number of commercial properties being offered. This shift suggests a potential opportunity for investors interested in commercial real estate acquisitions.

| Property Type | Number of Sales |

|---|---|

| Residential | 250 |

| Commercial | 75 |

| Vacant Land | 40 |

| Other | 15 |

Success Stories and Case Studies

The world of tax deed sales is replete with success stories and insightful case studies that offer a glimpse into the potential rewards of this market. Take, for instance, the story of John M., a seasoned investor, who strategically acquired a residential property at a tax deed auction for a fraction of its market value. With some renovations, he was able to quickly resell the property, realizing a substantial profit within a matter of months.

Another intriguing case involves Sarah L., an aspiring real estate developer, who purchased a commercial property at a tax deed sale. The property, an old warehouse in a prime location, was transformed into a trendy co-working space. This venture not only yielded impressive returns but also contributed to the local community's economic growth.

Market Outlook and Future Implications

Looking ahead, the future of Orange County Tax Deed Sales appears promising. The increasing participation and interest from investors suggest a growing awareness of the potential benefits this market offers. Furthermore, the diverse range of properties being offered ensures a continued supply, catering to a broad spectrum of investor preferences.

However, it is essential to consider the broader economic context. Fluctuations in the real estate market, changes in tax policies, and overall economic trends can significantly impact the tax deed sales market. Staying informed and adaptable will be key for investors looking to capitalize on this unique market.

Conclusion: A Unique Investment Opportunity

In conclusion, Orange County Tax Deed Sales present a fascinating and often lucrative aspect of the real estate market. Offering a blend of challenges and opportunities, this market caters to a diverse range of investors and homebuyers. By understanding the process, recognizing the benefits, and navigating the potential pitfalls, individuals can make informed decisions and potentially reap significant rewards.

As we've explored, tax deed sales provide a unique gateway to acquiring properties at potentially advantageous prices. With a strategic approach and a keen understanding of the market, investors can unlock the full potential of this often-overlooked segment of the real estate landscape.

FAQ

What is the average discount on properties at Orange County Tax Deed Sales?

+

On average, properties at Orange County Tax Deed Sales sell for 20-30% below their fair market value. However, this can vary widely depending on the property type, location, and the competitiveness of the auction.

Are there any restrictions on who can participate in Tax Deed Sales?

+

While there are no explicit restrictions, participants should be aware of the legal and financial implications of the sale. It’s recommended to consult with legal and financial experts before participating in tax deed sales.

What happens if a bidder wins the auction but fails to complete the purchase?

+

If a winning bidder fails to complete the purchase, they may forfeit their deposit and face legal consequences. It’s crucial to ensure that you have the necessary funds and are prepared to finalize the purchase upon winning the bid.