Hillsborough County Sales Tax

In the heart of Florida, Hillsborough County stands as a bustling economic hub, boasting a diverse range of businesses and a thriving retail scene. Amidst this vibrant landscape, the topic of sales tax becomes an essential consideration for both consumers and businesses alike. This comprehensive guide delves into the intricacies of Hillsborough County's sales tax, shedding light on its rates, exemptions, and the impact it has on the local economy.

Understanding Hillsborough County’s Sales Tax Landscape

Hillsborough County, like many other counties in Florida, imposes a sales tax on various goods and services. This tax is a crucial revenue stream for the county, contributing significantly to its budget and funding essential services and infrastructure projects.

The sales tax in Hillsborough County is a combination of both state and local taxes. Florida, known for its relatively low tax rates, applies a base sales tax rate of 6%. However, local governments, including Hillsborough County, have the authority to levy additional taxes, creating a unique sales tax structure across the state.

The Breakdown of Sales Tax Rates in Hillsborough County

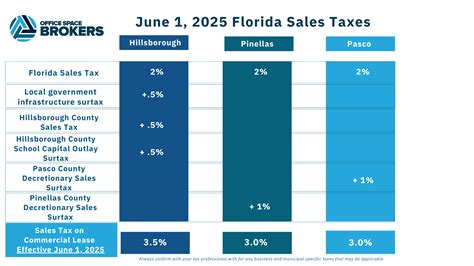

The sales tax rate in Hillsborough County currently stands at 7%, which includes the state’s base rate of 6% and an additional 1% levied by the county. This rate applies to most tangible personal property and certain services. However, it’s important to note that certain jurisdictions within the county may have slightly different tax rates due to special districts or municipalities.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6% |

| Hillsborough County Sales Tax | 1% |

| Total Sales Tax | 7% |

For instance, the city of Tampa, which is the county seat of Hillsborough County, applies an additional 0.5% sales tax, bringing the total sales tax rate within the city limits to 7.5%. This rate is applied to all qualifying purchases made within the city boundaries.

Exemptions and Special Considerations

While the sales tax in Hillsborough County applies to a wide range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. Understanding these exemptions can help navigate the sales tax landscape more effectively.

- Food and Groceries: In a welcome relief for consumers, Hillsborough County, along with the state of Florida, does not impose sales tax on unprepared food items and groceries. This exemption extends to a wide range of staple foods, including bread, milk, eggs, fruits, and vegetables. However, it's important to note that certain prepared foods and beverages may still be subject to sales tax.

- Prescription Drugs: Another significant exemption is the sales tax waiver on prescription drugs. This includes both prescription medications and certain medical devices. This exemption aims to alleviate the financial burden on individuals requiring essential healthcare items.

- Non-Profit Organizations: Registered non-profit organizations in Hillsborough County may be eligible for sales tax exemptions on certain purchases. These exemptions can significantly reduce the financial strain on charitable and community-based organizations, allowing them to allocate more resources towards their missions.

The Impact of Sales Tax on Hillsborough County’s Economy

Sales tax plays a pivotal role in shaping the economic landscape of Hillsborough County. It is a key revenue generator, funding critical services and infrastructure projects that contribute to the county’s overall prosperity.

Funding Essential Services

The revenue generated from sales tax is a primary source of funding for various essential services in Hillsborough County. This includes public safety initiatives, such as law enforcement and fire protection, as well as vital social services like healthcare and education.

For instance, a significant portion of the sales tax revenue is allocated towards maintaining and improving the county's infrastructure. This includes investments in roads, bridges, and public transportation systems, ensuring a smooth flow of commerce and enhancing the quality of life for residents.

Attracting Businesses and Tourism

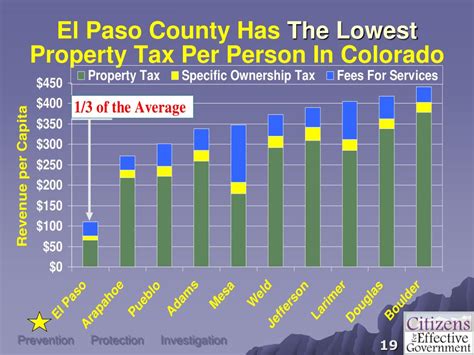

The relatively low sales tax rate in Hillsborough County, compared to other regions, can be an attractive feature for businesses considering relocation or expansion. A competitive tax rate can contribute to a more favorable business climate, encouraging economic growth and job creation.

Additionally, the sales tax structure can also impact tourism. While sales tax is applicable to tourists, the relatively low rate can make Hillsborough County an appealing destination, particularly for shoppers seeking a tax-friendly environment.

Consumer Behavior and Pricing Strategies

The sales tax rate can influence consumer behavior and pricing strategies for businesses. Consumers often factor in the tax when making purchasing decisions, especially for big-ticket items. As such, businesses may need to consider the impact of sales tax when setting prices and creating promotional offers.

Moreover, the exemptions and special considerations in the sales tax landscape can also shape consumer behavior. For instance, the exemption on unprepared food items may encourage consumers to shop for groceries within the county, boosting local businesses.

Compliance and Enforcement

Ensuring compliance with sales tax regulations is a critical aspect for businesses operating in Hillsborough County. The Florida Department of Revenue oversees the collection and enforcement of sales tax, and non-compliance can lead to significant penalties.

Businesses are required to register for a sales tax permit, collect the appropriate tax on taxable sales, and remit the collected tax to the state on a regular basis. Failure to comply with these regulations can result in fines, interest charges, and even criminal penalties in severe cases.

Audits and Penalties

The Florida Department of Revenue conducts regular audits to ensure compliance with sales tax regulations. These audits can be random or targeted, and businesses should be prepared to provide accurate records and documentation to demonstrate compliance.

In the event of non-compliance, businesses may face penalties that can include fines, interest charges, and the potential revocation of their sales tax permit. Additionally, businesses may be required to repay any uncollected taxes, which can have a significant financial impact.

Online Sales and Remote Sellers

With the rise of e-commerce, the sales tax landscape has become increasingly complex. Remote sellers, including online retailers, are now required to collect and remit sales tax on transactions with customers in Hillsborough County, even if the business does not have a physical presence in the county.

This change in legislation aims to level the playing field between brick-and-mortar businesses and online retailers, ensuring that all businesses contribute fairly to the county's revenue stream.

The Future of Sales Tax in Hillsborough County

As the economic landscape continues to evolve, so too will the sales tax structure in Hillsborough County. While the current rates and exemptions provide a stable framework, there are several factors that could influence future changes.

Economic Growth and Development

Hillsborough County’s thriving economy and ongoing development projects may prompt discussions on the need for additional revenue sources. This could potentially lead to considerations for adjustments in the sales tax rate or the introduction of new taxes to fund specific initiatives or infrastructure projects.

Tax Reform and Simplification

There is an ongoing dialogue at both the state and local levels regarding tax reform and simplification. This includes discussions on streamlining the tax code, potentially consolidating various tax rates and exemptions into a more unified structure.

Simplifying the sales tax landscape could benefit both businesses and consumers by reducing administrative burdens and creating a more transparent tax system. However, such reforms would require careful planning and consideration of the impact on different sectors of the economy.

Community Engagement and Transparency

As with any tax-related decision, community engagement and transparency are crucial. Hillsborough County, known for its vibrant civic engagement, provides a platform for residents and businesses to voice their opinions and concerns. This dialogue ensures that any potential changes to the sales tax structure are well-informed and reflective of the community’s needs and aspirations.

What is the current sales tax rate in Hillsborough County, Florida?

+The current sales tax rate in Hillsborough County is 7%, which includes the state’s base rate of 6% and an additional 1% levied by the county. However, certain jurisdictions within the county may have slightly different tax rates due to special districts or municipalities.

Are there any sales tax exemptions in Hillsborough County?

+Yes, there are several sales tax exemptions in Hillsborough County. These include exemptions on unprepared food items and groceries, prescription drugs, and certain purchases made by registered non-profit organizations.

How does sales tax impact businesses in Hillsborough County?

+Sales tax can influence businesses by impacting pricing strategies and consumer behavior. Businesses must consider the tax when setting prices and may need to adjust their strategies to remain competitive. Additionally, businesses are required to collect and remit sales tax, ensuring compliance with state regulations.

What happens if a business fails to comply with sales tax regulations in Hillsborough County?

+Non-compliance with sales tax regulations can result in significant penalties. Businesses may face fines, interest charges, and even criminal penalties in severe cases. It is crucial for businesses to understand their sales tax obligations and maintain accurate records to ensure compliance.

How does Hillsborough County’s sales tax rate compare to other counties in Florida?

+Hillsborough County’s sales tax rate of 7% is relatively low compared to some other counties in Florida. While the state’s base rate is 6%, other counties may levy additional taxes, resulting in higher overall sales tax rates. This competitive tax rate can be an attractive feature for businesses and consumers.