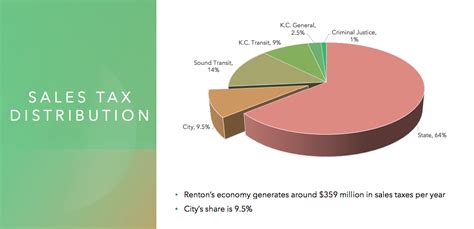

Renton Sales Tax

Welcome to our comprehensive guide on the Renton Sales Tax! In this article, we will delve into the intricacies of sales tax regulations in the city of Renton, providing you with a detailed understanding of the tax rates, exemptions, and procedures that businesses and consumers should be aware of. Whether you're a local business owner or a resident curious about the tax landscape, this guide will offer valuable insights and practical information.

Understanding Renton Sales Tax

Renton, located in King County, Washington, has a vibrant business community and a thriving economy. As a business owner or operator in Renton, it’s crucial to have a thorough understanding of the sales tax regulations to ensure compliance and avoid any legal complications. Let’s explore the key aspects of Renton sales tax.

Sales Tax Rates

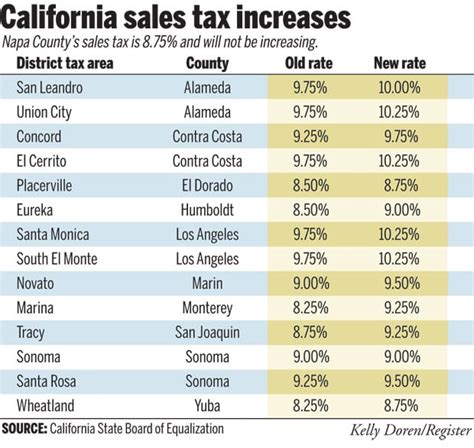

The sales tax rate in Renton consists of both state and local components. As of [most recent data available], the combined sales tax rate in Renton is 10.1%, which includes:

- The state sales tax rate of 6.5%, applicable across Washington.

- The King County sales tax rate of 0.4%, imposed by the county.

- The Renton City sales tax rate of 3.2%, specific to the city.

It’s important to note that these rates may be subject to change, so it’s advisable to check for any updates before finalizing your sales tax calculations.

Taxable Goods and Services

In Renton, a wide range of goods and services are subject to sales tax. Here’s an overview of the taxable items:

- Tangible Personal Property: This includes items like clothing, electronics, furniture, and appliances.

- Prepared Food and Beverages: Sales of food and drinks at restaurants, cafes, and food trucks are generally taxable.

- Admission Fees: Charges for entry to entertainment venues, such as cinemas, theaters, and sporting events, are subject to sales tax.

- Services: Certain services, like auto repairs, haircuts, and legal services, may also be taxable depending on the specific circumstances.

Exemptions and Special Considerations

While most goods and services are taxable in Renton, there are certain exemptions and special considerations to be aware of. Here are some key points:

- Food Exemptions: Some food items, such as unprepared groceries, are exempt from sales tax. However, it’s important to consult the specific guidelines provided by the Washington State Department of Revenue for a comprehensive understanding of food-related exemptions.

- Manufacturing Exemption: Sales of manufacturing equipment and supplies are exempt from sales tax under certain conditions. This exemption aims to support the manufacturing industry and encourage economic growth.

- Resale Certificates: Businesses that purchase goods for resale purposes can provide a resale certificate to their suppliers to avoid paying sales tax on the purchase. This ensures that the tax is collected from the end consumer rather than the business.

Registration and Remittance

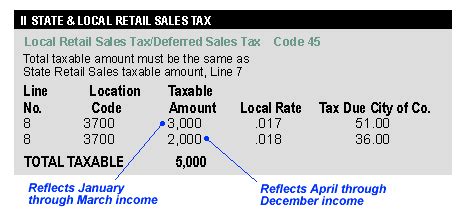

If you’re a business owner in Renton, it’s essential to register for a sales tax permit with the Washington State Department of Revenue. This permit allows you to collect and remit sales tax on behalf of the state and local government. The registration process involves providing business information, tax identification numbers, and agreeing to comply with sales tax regulations.

Once registered, businesses are required to remit the collected sales tax to the Department of Revenue on a regular basis. The frequency of remittance can vary depending on the business's sales volume and turnover. It's crucial to accurately calculate and report the sales tax to avoid penalties and ensure compliance.

Sales Tax Compliance and Audits

The Washington State Department of Revenue conducts regular audits to ensure businesses are complying with sales tax regulations. These audits involve a thorough examination of sales records, tax returns, and other relevant documentation. It’s important for businesses to maintain accurate records and be prepared for potential audits.

During an audit, the Department of Revenue may request various documents, including sales receipts, invoices, and inventory records. It's advisable to have a well-organized system in place to efficiently retrieve the necessary information. Additionally, businesses should be familiar with the audit process and their rights and responsibilities during an audit.

Sales Tax Software and Tools

Managing sales tax compliance can be complex, especially for businesses with multiple locations or a diverse product range. Fortunately, there are several sales tax software and tools available that can simplify the process. These solutions automate sales tax calculations, ensure accurate rate determination, and facilitate timely remittance.

Some popular sales tax software options include Avalara, TaxJar, and Vertex Inc. These platforms offer features such as rate lookup, tax calculation, and filing assistance, making it easier for businesses to stay compliant and reduce the risk of errors.

Future Implications and Changes

Sales tax regulations are subject to change, and it’s important for businesses and consumers to stay updated on any upcoming modifications. In recent years, there have been discussions and proposals regarding potential changes to sales tax laws in Washington. These changes may impact the rates, exemptions, or administrative procedures.

Staying informed about any proposed or enacted changes is crucial for businesses to adapt their systems and processes accordingly. This ensures continued compliance and helps businesses avoid any unexpected consequences. Regularly reviewing official government websites and staying connected with industry associations can provide valuable insights into any upcoming sales tax updates.

Conclusion: Navigating Renton Sales Tax

Understanding and complying with Renton sales tax regulations is essential for both businesses and consumers. By familiarizing yourself with the tax rates, taxable items, exemptions, and compliance procedures, you can ensure a smooth and accurate sales tax experience. Whether you’re a business owner or a resident, this guide provides a comprehensive overview to help you navigate the Renton sales tax landscape.

Remember, staying informed and seeking professional advice when needed is crucial. For more detailed information or specific inquiries, we recommend reaching out to the Washington State Department of Revenue or consulting with a tax professional.

Are there any specific industries or products exempt from sales tax in Renton?

+Yes, there are certain industries and products that are exempt from sales tax in Renton. These exemptions are outlined by the Washington State Department of Revenue and can include items such as prescription medications, certain agricultural products, and some educational materials. It’s important to consult the specific guidelines to determine if your industry or product falls under any of these exemptions.

How often do sales tax rates change in Renton?

+Sales tax rates in Renton can change periodically, usually as a result of legislative actions or special local initiatives. While it’s not common for rates to change frequently, it’s important to stay updated on any proposed or enacted changes. The Washington State Department of Revenue typically provides notifications and updates regarding any changes to sales tax rates.

What happens if a business fails to remit sales tax on time?

+Failure to remit sales tax on time can result in penalties and interest charges. The Washington State Department of Revenue may impose fines and penalties based on the amount of tax owed and the duration of non-compliance. It’s crucial for businesses to maintain accurate records and remit sales tax in a timely manner to avoid these consequences.

Are there any resources available to assist businesses with sales tax compliance in Renton?

+Yes, the Washington State Department of Revenue provides a wealth of resources to assist businesses with sales tax compliance. Their website offers detailed guides, FAQs, and educational materials. Additionally, businesses can reach out to the Department’s customer service team for personalized assistance and guidance on specific sales tax matters.

How can consumers ensure they are not overcharged for sales tax in Renton?

+Consumers can take a proactive approach to ensure they are not overcharged for sales tax in Renton. It’s advisable to familiarize yourself with the current sales tax rates and applicable exemptions. When making purchases, review the sales receipts to verify the tax calculations. If you suspect an overcharge, you can reach out to the business or contact the Washington State Department of Revenue for assistance.