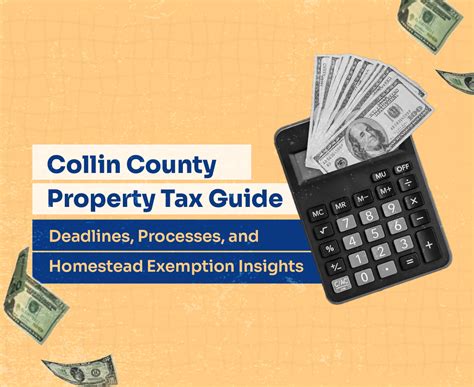

Collin County Property Tax Payment

Welcome to this comprehensive guide on Collin County property tax payments, where we will delve into the intricacies of this essential financial process. As a resident of Collin County, understanding the property tax landscape is crucial for managing your financial obligations effectively. In this article, we will explore the key aspects of property tax payments, from the assessment process to the various payment options available, empowering you to navigate this critical aspect of homeownership with confidence.

Understanding Property Tax Assessments in Collin County

Property taxes are an essential source of revenue for local governments, including Collin County. These taxes are used to fund vital services and infrastructure, ensuring the smooth functioning of our communities. The assessment process is a critical step in determining the property tax liability for each homeowner. Let’s unravel the details of this process and its implications.

The Assessment Process: A Step-by-Step Guide

In Collin County, the property tax assessment process is handled by the Collin Central Appraisal District (CCAD). This district is responsible for appraising all taxable property within the county, ensuring fair and accurate valuations.

- Appraisal Notices: Typically, appraisal notices are mailed out by April 15th each year. These notices provide homeowners with crucial information, including the appraised value of their property, the prior year’s value, and any applicable exemptions.

- Review and Protest: Homeowners have the right to review and protest their appraised value if they believe it is inaccurate. The protest period usually opens in late April and closes in mid-May. During this time, homeowners can schedule appointments with CCAD appraisers to discuss their property’s value.

- Appraisal Board Hearings: If a protest is not resolved through the initial review process, homeowners can request a hearing before the Appraisal Review Board. This board is an independent body that makes final decisions on property values.

- Tax Bills: Once the appraisal process is complete and any protests are resolved, the tax rolls are certified, and tax bills are generated. Tax bills include the appraised value, any applicable exemptions, and the calculated tax rate.

Factors Influencing Property Tax Assessments

Several factors come into play when determining the appraised value of a property in Collin County. These factors include:

- Market Value: The CCAD considers the current market value of similar properties in the area when appraising a specific property.

- Improvements: Any improvements made to the property, such as renovations or additions, can impact its value and, consequently, the property taxes.

- Location: The property’s location within the county, including its proximity to amenities and the overall desirability of the area, can affect its value.

- Property Type: Different types of properties, such as residential, commercial, or agricultural, may have varying assessment methodologies.

Navigating Property Tax Payments: A Comprehensive Overview

Now that we have a solid understanding of the assessment process, let’s explore the various methods and considerations for paying property taxes in Collin County.

Payment Options: Convenience and Flexibility

Collin County offers a range of convenient payment options to accommodate the diverse needs of its residents. Here’s an overview of the available methods:

- Online Payments: The most popular and convenient option, online payments can be made through the CCAD website. This method allows for secure transactions and provides real-time updates on payment status.

- By Mail: Taxpayers can mail their payments directly to the Collin Central Appraisal District. It’s important to include the remittance stub from the tax bill and ensure timely delivery to avoid late fees.

- In-Person Payments: For those who prefer a more traditional approach, in-person payments can be made at the CCAD offices. This option provides an opportunity for direct interaction with tax professionals.

- Electronic Funds Transfer (EFT): EFT payments can be set up through the CCAD website, offering a convenient and automated payment method. This option is ideal for those who prefer a hands-off approach.

Important Dates and Deadlines

Staying informed about key dates and deadlines is crucial to avoid late fees and penalties. Here’s a breakdown of the essential timelines:

| Event | Date |

|---|---|

| Appraisal Notices Mailed | April 15th |

| Protest Period Opens | Late April |

| Protest Period Closes | Mid-May |

| Tax Bills Mailed | July 1st |

| First Installment Due | February 1st |

| Second Installment Due | July 1st |

| Late Fees Apply | 30 days after each installment due date |

Payment Plans and Assistance Programs

Collin County understands that property tax payments can be a significant financial burden, especially for those facing economic challenges. To provide relief and support, the county offers various payment plans and assistance programs.

- Payment Plans: Taxpayers can request a payment plan to spread their tax payments over multiple installments. This option is particularly beneficial for those with limited financial resources.

- Senior Citizen and Disabled Persons Exemption: Collin County offers an exemption program for qualifying senior citizens and disabled individuals. This exemption reduces the taxable value of their property, resulting in lower tax bills.

- Other Exemptions: Various other exemptions are available, including the Homestead Exemption and the Over-65 Homestead Exemption. These exemptions can significantly reduce property tax liabilities for eligible homeowners.

Real-World Examples: Navigating Property Tax Scenarios

To illustrate the practical application of property tax payments, let’s explore two real-world scenarios and how they unfold in Collin County.

Scenario 1: A New Homeowner’s Journey

Imagine Sarah, a recent transplant to Collin County, who just purchased her first home. She receives her appraisal notice in April and notices that the appraised value is higher than she expected. After reviewing the notice, she decides to protest the value, scheduling an appointment with the CCAD appraiser.

During the protest, Sarah presents evidence of recent sales of similar properties in the area, which supports her claim of an overvaluation. The appraiser considers her evidence and agrees to adjust the value downward. This adjustment results in a significant reduction in Sarah’s property taxes, providing her with some much-needed financial relief.

Scenario 2: Exploring Payment Plan Options

John, a longtime resident of Collin County, has experienced a sudden loss of income due to unforeseen circumstances. As a result, he is concerned about his ability to pay his property taxes on time. After reviewing his options, he decides to apply for a payment plan.

John contacts the CCAD and explains his situation. The tax office understands his predicament and offers him a flexible payment plan, allowing him to make monthly payments over the course of a year. This plan provides John with the financial breathing room he needs while ensuring he remains in good standing with the county.

Future Implications and Considerations

As we look ahead, it’s essential to consider the evolving landscape of property taxes in Collin County. Here are some key factors to keep in mind:

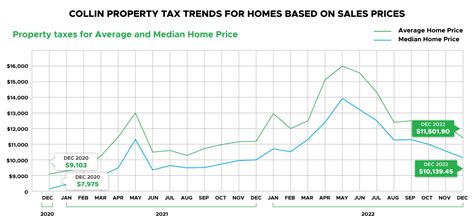

- Economic Trends: The local economy plays a significant role in property tax assessments. As Collin County continues to experience growth and development, it’s crucial to stay informed about market trends and their impact on property values.

- Policy Changes: Keep an eye on any proposed changes to tax policies or legislation that may affect property tax assessments and payment options. Staying informed ensures you can adapt to any new regulations.

- Community Engagement: Active participation in community events and discussions related to property taxes can provide valuable insights and opportunities to voice your concerns or suggestions.

How can I estimate my property tax bill before receiving the official notice?

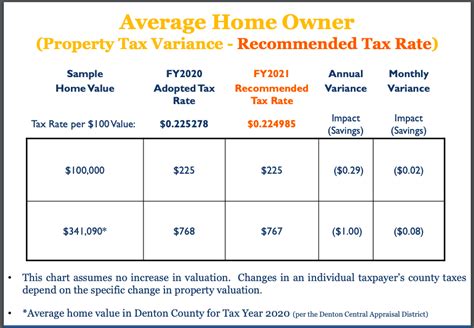

+You can estimate your property tax bill by multiplying your property's appraised value by the tax rate. The tax rate is set by the local taxing units, such as the county, city, and school district. You can find the current tax rates on the CCAD website or by contacting your local tax office.

What happens if I miss the deadline for protesting my property's appraised value?

+If you miss the protest deadline, you may still have options. Contact the CCAD to discuss your concerns and see if there are any alternative avenues for appealing your property's value. However, it's important to act promptly to avoid potential late fees or penalties.

Can I pay my property taxes early, before the due date?

+Yes, you can pay your property taxes early without any penalties. In fact, paying early can provide some peace of mind and ensure you avoid any potential late fees. However, keep in mind that early payments may not be eligible for certain exemptions or discounts, so it's essential to review your specific circumstances.

In conclusion, navigating property tax payments in Collin County requires a combination of understanding, planning, and timely action. By staying informed about the assessment process, exploring the available payment options, and taking advantage of assistance programs when needed, homeowners can effectively manage their financial obligations. Remember, proactive engagement and a solid grasp of the property tax landscape are key to ensuring a smooth and stress-free experience.