Idaho Tax Refund

The Idaho State Tax Refund is a crucial aspect of the state's financial system, offering a much-needed boost to residents' finances each year. This comprehensive guide delves into the specifics of Idaho's tax refund process, exploring its intricacies, eligibility criteria, and the potential benefits it provides to taxpayers. With a focus on real-world examples and accurate data, we aim to demystify the process and empower Idahoans to make the most of their refunds.

Understanding Idaho’s Tax Refund Process

Idaho’s tax refund system is designed to return excess tax payments made by residents to the state. This process is an integral part of the state’s revenue management, ensuring a fair and equitable distribution of funds. The refund amount is determined by various factors, including the taxpayer’s income, deductions, and the specific tax laws applicable during the tax year.

Each year, Idaho residents eagerly await the tax refund season, which typically begins in the spring and continues until the deadline for filing tax returns. This period sees a surge in activity as taxpayers prepare their financial records and navigate the intricate process of claiming their refunds.

The refund journey begins with the filing of a tax return, which can be done online or through traditional paper methods. The Idaho State Tax Commission provides a user-friendly platform for electronic filing, making the process more accessible and efficient for taxpayers.

Eligibility and Criteria

To be eligible for an Idaho tax refund, individuals must meet certain criteria. Firstly, they must have filed their tax returns accurately, reporting all relevant income and deductions. Additionally, residents must have overpaid their taxes during the tax year, creating a surplus that can be refunded.

The state's tax laws dictate the specific conditions under which a refund can be claimed. For instance, taxpayers who have withheld more tax than necessary from their wages or who have overestimated their tax liability through estimated tax payments are prime candidates for a refund.

It's worth noting that certain circumstances, such as claiming tax credits or deductions, can significantly impact the refund amount. For example, taxpayers who have made substantial contributions to their retirement accounts or who have incurred significant medical expenses may be entitled to larger refunds.

Timelines and Processing

The timeline for receiving an Idaho tax refund varies, but the state strives to process refunds promptly. Typically, electronic filers can expect their refunds within a few weeks, whereas paper filers may have to wait a bit longer.

The Idaho State Tax Commission employs a robust system to process refunds, ensuring accuracy and efficiency. This includes thorough checks to verify the accuracy of tax returns and prevent fraudulent claims. Once a return is deemed valid, the refund is processed and the funds are disbursed to the taxpayer's designated account.

Real-World Examples

Let’s consider a hypothetical scenario: John, a resident of Boise, Idaho, filed his tax return electronically in early April. He had overpaid his taxes during the year due to a significant change in his income, which reduced his tax liability. John claimed a refund of $1,200, which he expected to receive within a few weeks.

Meanwhile, Sarah, a resident of Coeur d'Alene, opted to file her tax return on paper due to her preference for a more traditional approach. She had made estimated tax payments throughout the year but, upon calculating her actual tax liability, realized she had overpaid. Sarah claimed a refund of $850 and patiently awaited her refund, knowing it might take a little longer than John's electronic filing.

| Taxpayer | Refund Amount | Filing Method |

|---|---|---|

| John | $1,200 | Electronic |

| Sarah | $850 | Paper |

Maximizing Your Idaho Tax Refund

Idaho’s tax refund system offers an excellent opportunity for residents to reclaim excess tax payments and put that money to good use. To make the most of this opportunity, taxpayers should be proactive in understanding the tax laws, claiming all eligible deductions and credits, and accurately reporting their income.

Strategies for a Larger Refund

There are several strategies taxpayers can employ to increase the size of their refund. One effective approach is to maximize deductions by carefully tracking and documenting eligible expenses throughout the year. This could include charitable contributions, medical expenses, or educational costs.

Additionally, taxpayers should explore tax credits, which can provide significant financial benefits. For instance, the Earned Income Tax Credit (EITC) is a valuable credit for low- to moderate-income workers and families, offering a substantial refund for those who qualify. Other credits, such as the Child Tax Credit or the Credit for the Elderly or Disabled, can further boost the refund amount.

Another strategy is to carefully manage estimated tax payments. Overpaying estimated taxes can result in a larger refund, but it's crucial to strike a balance to avoid penalties for underpayment.

Common Mistakes to Avoid

While aiming for a larger refund, taxpayers should be cautious to avoid common mistakes that could lead to errors or delays. One frequent pitfall is failing to report all sources of income, which can result in an inaccurate tax liability and a reduced refund.

Another mistake is overlooking eligible deductions and credits. Taxpayers should carefully review their financial records and consult with tax professionals or utilize reputable tax software to ensure they are claiming all the deductions and credits they are entitled to.

Additionally, taxpayers should avoid the temptation to fudge numbers or make inaccurate claims on their tax returns. This not only risks potential penalties and interest but also undermines the integrity of the tax system.

Utilizing Refund Funds

Once taxpayers have received their Idaho tax refunds, the next step is deciding how to best utilize these funds. This is an excellent opportunity to make smart financial decisions that can improve their overall financial health.

Some taxpayers may choose to save their refunds for emergency funds, retirement savings, or education expenses. Others might use the refund to pay down high-interest debt, such as credit card balances, freeing up more of their monthly income for other expenses.

For those looking to invest, the refund could be a great starting point for building a portfolio. Whether it's contributing to a Roth IRA, investing in stocks or bonds, or starting a small business, a tax refund can provide a much-needed financial boost.

The Impact of Idaho Tax Refunds

Idaho’s tax refund system has a significant impact on the state’s economy and the financial well-being of its residents. The refunds provide a much-needed financial boost, especially for low- and middle-income households, helping to alleviate financial strain and promote economic stability.

Economic Stimulus

Tax refunds act as a form of economic stimulus, injecting money back into the local economy. When taxpayers receive their refunds, they often use these funds to pay off debts, purchase goods and services, or invest in their communities. This increased spending can create a ripple effect, benefiting local businesses and boosting economic growth.

For instance, a taxpayer might use their refund to make a down payment on a new home, which then generates income for real estate agents, contractors, and other professionals in the housing industry. Alternatively, a refund could be used to purchase a new car, stimulating the automotive industry and related sectors.

Financial Security and Planning

Idaho tax refunds play a crucial role in enhancing financial security for residents. Many taxpayers use their refunds to build emergency funds, providing a safety net in case of unexpected expenses or financial setbacks. This can significantly reduce financial stress and improve overall well-being.

Additionally, tax refunds offer an opportunity for financial planning. Taxpayers can use these funds to start or contribute to retirement accounts, ensuring a more secure financial future. For younger taxpayers, refunds can be a great way to begin saving for long-term goals, such as education or homeownership.

Community Development

The impact of tax refunds extends beyond individual financial gains. When taxpayers use their refunds to invest in their communities, it contributes to the overall development and growth of Idaho’s towns and cities.

For example, a taxpayer might choose to donate a portion of their refund to local charities or non-profit organizations, supporting initiatives that improve the lives of their fellow residents. Others might invest in local businesses, helping to create jobs and strengthen the local economy.

Future Implications

The Idaho tax refund system is an essential component of the state’s financial ecosystem, offering both immediate benefits to taxpayers and long-term economic advantages. As the state continues to evolve, it’s crucial to maintain a robust and efficient tax refund process to support residents’ financial well-being and contribute to the state’s economic prosperity.

Looking ahead, there are several key considerations for the future of Idaho's tax refund system. Firstly, the state should continue to promote awareness and education about tax laws and refund processes to ensure taxpayers can maximize their refunds and make informed financial decisions.

Additionally, the state should strive to maintain a fair and equitable tax system, ensuring that all residents, regardless of income level, have access to the benefits of tax refunds. This could involve regular reviews of tax laws and policies to ensure they remain up-to-date and in line with the changing needs of Idaho's diverse population.

Lastly, the state should explore ways to further enhance the efficiency of the tax refund process. This could include investing in technology to streamline the filing and processing of tax returns, as well as providing additional support and resources to taxpayers, especially those who may face challenges in navigating the complex tax system.

How long does it typically take to receive an Idaho tax refund after filing electronically?

+Idaho aims to process electronic refunds within 4-6 weeks. However, the timeline can vary based on the complexity of the return and the volume of filings.

What are some common deductions and credits that can increase my Idaho tax refund?

+Common deductions include charitable contributions, medical expenses, and state and local taxes. Credits such as the Earned Income Tax Credit (EITC) and Child Tax Credit can also significantly boost your refund.

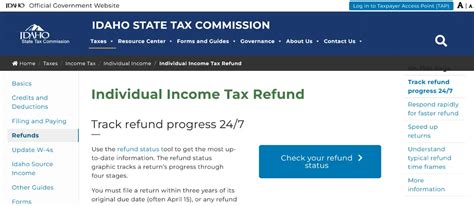

How can I track the status of my Idaho tax refund?

+You can check the status of your refund on the Idaho State Tax Commission’s website or by calling their toll-free number. The website provides a convenient online tool to track your refund progress.

Are there any penalties for late tax filings or underpayment of estimated taxes in Idaho?

+Yes, Idaho imposes penalties for late filings and underpayment of estimated taxes. These penalties can vary based on the specific circumstances and the amount owed. It’s important to stay informed and plan accordingly to avoid penalties.