Hidalgo County Property Tax Search

Welcome to the comprehensive guide on the Hidalgo County Property Tax Search. This article aims to provide an in-depth analysis and expert insights into the process of conducting a property tax search in Hidalgo County, offering valuable information for homeowners, investors, and anyone interested in understanding the intricacies of property taxes in this region.

Understanding Property Taxes in Hidalgo County

Hidalgo County, located in the vibrant state of Texas, is renowned for its diverse communities and vibrant culture. As with any region, property taxes play a significant role in the local economy and are an essential consideration for property owners. The process of assessing and collecting property taxes is a complex yet well-regulated system, designed to ensure fairness and efficiency.

Property taxes in Hidalgo County are primarily governed by the Hidalgo County Appraisal District (HCAD), an independent entity responsible for appraising properties and determining their taxable value. This value, determined annually, forms the basis for the property taxes owed by homeowners and landowners.

The tax rate in Hidalgo County is composed of two main components: the maintenance and operations (M&O) tax rate and the debt service (DS) tax rate. The M&O rate funds the general operations of the county, including schools, roads, and public safety, while the DS rate is dedicated to repaying outstanding bonds and debts.

Key Factors Influencing Property Taxes

Several factors influence the property tax rates in Hidalgo County. These include:

- Property Type: Different types of properties, such as residential, commercial, or agricultural, are taxed differently.

- Location: Property taxes can vary based on the specific location within the county, with factors like school districts and municipal boundaries playing a role.

- Property Value: The appraised value of a property, determined by HCAD, is a significant determinant of the tax bill.

- Tax Exemptions and Discounts: Hidalgo County offers various exemptions and discounts to eligible homeowners, such as the Homestead Exemption and the Over-65 Exemption.

Conducting a Property Tax Search

Performing a property tax search in Hidalgo County is a straightforward process, thanks to the HCAD’s user-friendly online platform. Here’s a step-by-step guide to assist you in your search:

Step 1: Access the HCAD Website

Begin by visiting the Hidalgo County Appraisal District’s official website at https://www.hidalgoappraisal.org. This is your gateway to a wealth of property tax information and resources.

Step 2: Navigate to the Property Search Tool

Once on the HCAD website, locate and click on the “Property Search” or “Tax Records” option. This will direct you to the property search tool, where you can input specific details to retrieve property tax information.

Step 3: Input Property Details

On the property search page, you’ll be prompted to enter one or more of the following details to identify the property:

- Account Number: A unique identifier assigned to each property by HCAD. This is often the quickest way to access property tax records.

- Address: Enter the street address, city, and zip code of the property.

- Owner Name: If you know the name of the property owner, you can search by their name.

- Parcel ID: A unique identifier assigned to each parcel of land by the county.

After entering the necessary details, click on the "Search" button to initiate your query.

Step 4: Review Property Tax Information

Once your search is complete, you’ll be presented with a detailed overview of the property’s tax information. This typically includes:

- Property Details: Basic information such as the property address, type, and square footage.

- Appraised Value: The taxable value of the property as determined by HCAD.

- Taxable Value: The value used to calculate the property taxes, which may differ from the appraised value due to exemptions or limitations.

- Tax Rate: The combined M&O and DS tax rates applicable to the property.

- Tax Amount: The total amount of property taxes owed for the current year.

- Payment History: A record of previous tax payments, including due dates and amounts.

Step 5: Access Additional Resources

The HCAD website provides a wealth of additional resources to assist property owners and taxpayers. These include:

- Exemption Information: Detailed guidelines and application forms for various property tax exemptions.

- Appeal Process: Instructions and forms for appealing property tax values or tax rates.

- Payment Options: Information on how to pay property taxes, including online payment portals and payment plan options.

- Tax Calendar: A comprehensive calendar outlining important dates and deadlines related to property taxes.

Key Considerations and Expert Insights

When navigating the property tax landscape in Hidalgo County, it’s essential to keep a few key considerations in mind. Our experts offer the following insights:

Accurate Appraisals

Property owners should periodically review their property’s appraised value to ensure accuracy. Discrepancies in value can lead to over- or under-taxation. HCAD provides an online tool for property owners to compare their property values with similar properties in the area, helping to identify potential appraisal issues.

Tax Rate Awareness

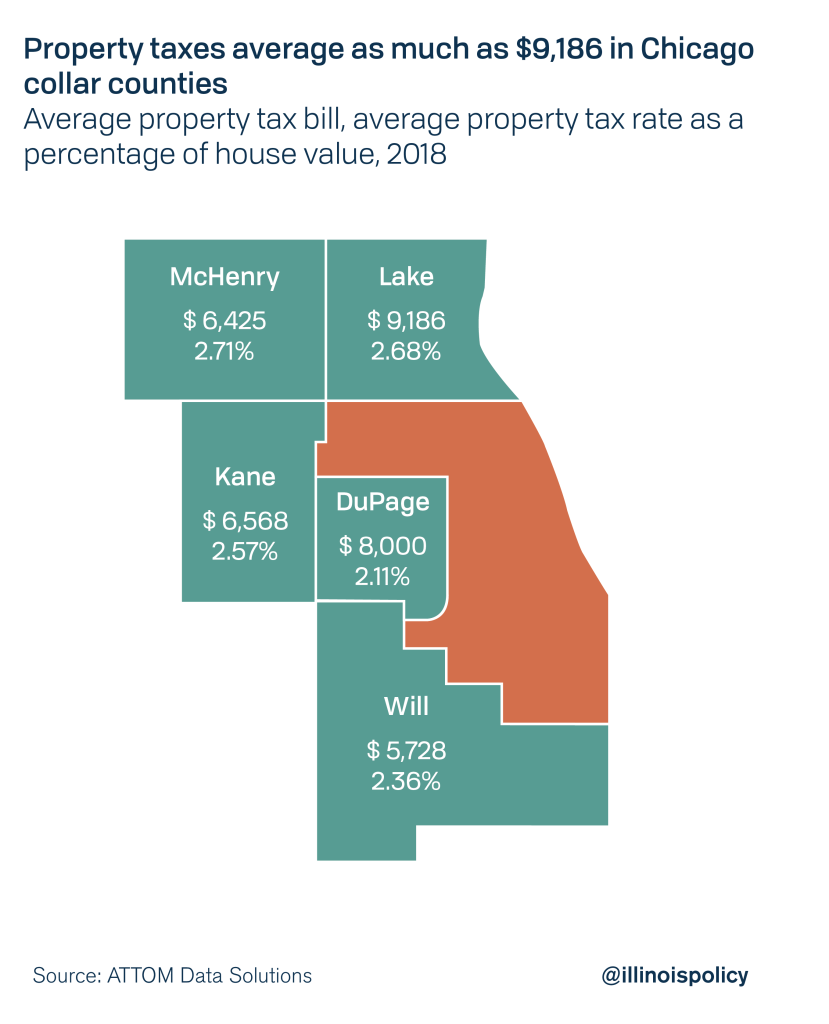

Understanding the tax rates in Hidalgo County is crucial for effective financial planning. The combined M&O and DS tax rates can vary significantly between different areas of the county. Property owners should be aware of these rates and their potential impact on their tax bills.

Exemptions and Discounts

Hidalgo County offers a range of exemptions and discounts to eligible homeowners. These can significantly reduce the taxable value of a property, resulting in lower tax bills. Our experts recommend that property owners explore these options to ensure they’re taking advantage of all available benefits.

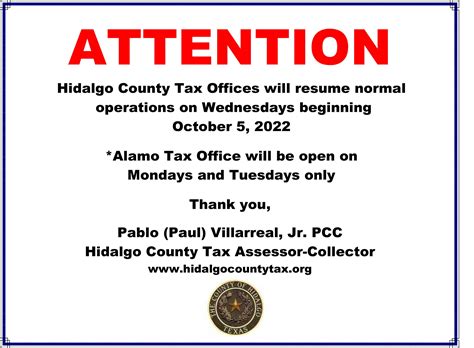

Payment Options and Deadlines

Property taxes in Hidalgo County are typically due in two installments, with payment deadlines falling in January and July. However, late payments may incur penalties and interest. Property owners should be aware of these deadlines and utilize the online payment options provided by HCAD to ensure timely payments.

Appeal Process

If a property owner disagrees with the appraised value or tax rate, they have the right to appeal. The HCAD website provides detailed instructions and forms for initiating an appeal. It’s important to note that appeals must be filed within a specific timeframe, so property owners should act promptly if they wish to dispute their tax assessment.

| Metric | Value |

|---|---|

| Total Assessed Property Value (2023) | $23.6 Billion |

| Average Property Tax Rate (2023) | 1.86% |

| Total Property Tax Revenue (2022) | $442.8 Million |

Future Implications and Outlook

As Hidalgo County continues to experience growth and development, the property tax landscape is likely to evolve. Here are some potential future implications:

Population Growth and Urbanization

Hidalgo County’s population is projected to increase significantly in the coming years, driven by economic opportunities and the region’s cultural appeal. This growth will likely lead to increased demand for housing and commercial properties, potentially impacting property values and tax rates.

Infrastructure Development

The county’s investment in infrastructure projects, such as road improvements and public transportation, may result in higher tax rates to fund these initiatives. On the other hand, improved infrastructure can attract businesses and residents, positively impacting property values.

Tax Policy Changes

While Hidalgo County’s property tax system is well-established, changes in state or local tax policies could impact the way property taxes are assessed and collected. Property owners should stay informed about any potential policy shifts that may affect their tax obligations.

Economic Factors

The local economy, influenced by factors such as job growth, industry trends, and real estate market conditions, plays a significant role in property values and, consequently, property taxes. Monitoring economic indicators can help property owners anticipate potential changes in their tax obligations.

Conclusion

Conducting a Hidalgo County Property Tax Search is a vital step for property owners and investors. By understanding the process, staying informed about tax rates and exemptions, and leveraging the resources provided by HCAD, individuals can ensure they’re fulfilling their tax obligations accurately and efficiently. As the county continues to thrive, staying abreast of the evolving property tax landscape will be crucial for financial planning and long-term success.

What is the Hidalgo County Appraisal District (HCAD)?

+

HCAD is an independent entity responsible for appraising properties and determining their taxable value in Hidalgo County. It plays a crucial role in the property tax system by ensuring fair and accurate assessments.

How often are property taxes assessed in Hidalgo County?

+

Property taxes in Hidalgo County are assessed annually. HCAD determines the taxable value of properties each year, and this value forms the basis for the property taxes owed by homeowners and landowners.

Are there any tax exemptions or discounts available in Hidalgo County?

+

Yes, Hidalgo County offers various exemptions and discounts to eligible homeowners. These include the Homestead Exemption, the Over-65 Exemption, and others. These exemptions can significantly reduce the taxable value of a property, resulting in lower tax bills.