Illinois Death Tax

Understanding the Illinois Death Tax, also known as the Illinois Estate Tax, is crucial for residents of the state planning their estates and ensuring their loved ones are taken care of after their passing. This article aims to provide a comprehensive guide to the Illinois Death Tax, covering its history, current status, how it works, and its implications for residents and their families.

The History and Evolution of the Illinois Death Tax

The Illinois Death Tax has a long history dating back to the early 20th century. It was first introduced in 1909 as a way to generate revenue for the state and to ensure a more equitable distribution of wealth among its residents. The tax has undergone several changes over the years, with major revisions in the 1970s and 1990s, and most recently, a significant overhaul in 2007.

The 2007 reform was a pivotal moment in the history of the Illinois Death Tax. It brought about a fundamental shift in the tax's structure, moving away from a tax on the transfer of assets at death to a tax on the lifetime appreciation of assets. This change aimed to encourage estate planning and reduce the tax burden on Illinois residents.

Before 2007, the Illinois Death Tax was a "pick-up" tax, meaning it was levied on estates that exceeded the federal estate tax exemption amount. The state essentially "picked up" the tax from the federal government, ensuring a seamless transition between the two tax systems. However, the 2007 reform decoupled the state tax from the federal one, giving Illinois the flexibility to set its own tax rates and exemptions.

How the Current Illinois Death Tax Works

The Illinois Death Tax, as it stands today, is a progressive tax system. This means that the tax rate increases as the value of the estate increases. The tax is calculated based on the value of the taxable estate, which is the total value of the decedent’s assets minus any applicable deductions and exemptions.

One of the key features of the current Illinois Death Tax is its exclusion for family-owned farms and small businesses. This exclusion, known as the Family-Farm and Small Business Exclusion, allows up to $2.4 million of the value of these entities to be excluded from the taxable estate. This provision aims to protect family farms and small businesses from being forced to sell their assets to pay the death tax.

Another notable aspect of the Illinois Death Tax is its exemption for certain types of transfers. Spousal transfers, for instance, are exempt from the tax, meaning that assets transferred from a deceased spouse to a surviving spouse are not subject to the tax. This encourages married couples to plan their estates together and ensures that the surviving spouse is not burdened with a large tax liability.

The tax rate for the Illinois Death Tax varies depending on the value of the taxable estate. For estates valued at less than $100,000, there is no tax liability. For estates valued between $100,000 and $250,000, the tax rate is 1.25%. As the estate value increases, the tax rate climbs to a maximum of 16% for estates valued at $3,000,000 or more.

| Taxable Estate Value | Tax Rate |

|---|---|

| $100,000 - $250,000 | 1.25% |

| $250,001 - $500,000 | 2.5% |

| $500,001 - $750,000 | 3.75% |

| $750,001 - $1,000,000 | 5.0% |

| $1,000,001 - $1,500,000 | 6.25% |

| $1,500,001 - $2,000,000 | 8.5% |

| $2,000,001 - $3,000,000 | 12.0% |

| $3,000,000 and above | 16.0% |

Calculating the Taxable Estate

Determining the taxable estate is a crucial step in understanding one’s potential Illinois Death Tax liability. The taxable estate is calculated by subtracting any applicable deductions and exemptions from the total value of the decedent’s assets. These deductions and exemptions can significantly reduce the value of the taxable estate, thereby lowering the tax liability.

One of the most common deductions is the funeral and administration expenses. These expenses, which include the cost of the funeral, burial, and probate fees, can be deducted from the total value of the estate. Other deductions may include mortgages, debts, and certain charitable contributions.

The Illinois Death Tax also provides for a variety of exemptions. In addition to the aforementioned Family-Farm and Small Business Exclusion, there is also an unlimited marital deduction, meaning that any assets transferred to a surviving spouse are exempt from the tax. There is also an exemption for charitable contributions made during the decedent's lifetime.

Planning Strategies to Mitigate Illinois Death Tax

For Illinois residents concerned about the potential impact of the Death Tax on their estates, there are several planning strategies that can be employed to mitigate the tax burden. These strategies aim to reduce the taxable estate and, consequently, the tax liability.

Gifts and Trusts

One effective strategy is to make gifts during one’s lifetime. By giving away assets to loved ones, one can reduce the value of their taxable estate. This strategy is particularly effective when combined with the annual gift tax exclusion, which allows individuals to gift up to a certain amount ($16,000 in 2023) to each recipient without incurring a gift tax liability.

Another popular strategy is to establish a trust. Trusts can be used to transfer assets out of the decedent's estate, thereby reducing the taxable estate. There are various types of trusts, each with its own benefits and limitations. For instance, a bypass trust, also known as a credit shelter trust, can be used to take advantage of the estate tax exemption while also providing for a surviving spouse.

Life Insurance and Annuities

Life insurance and annuities can also be powerful tools in estate planning. By purchasing a life insurance policy, one can ensure that their loved ones receive a tax-free death benefit upon their passing. This can be particularly beneficial for those with large estates, as it provides a way to transfer wealth without incurring a tax liability.

Annuities, on the other hand, can be used to generate a steady stream of income for the decedent's beneficiaries. By purchasing an annuity, one can ensure that their beneficiaries receive regular payments for a specified period or for the rest of their lives. This can be a valuable source of income for those who rely on the decedent's financial support.

The Impact of the Illinois Death Tax on Residents and Families

The Illinois Death Tax has significant implications for residents and their families. For those with large estates, the tax can be a substantial financial burden. It can force families to sell assets, including family homes and businesses, to pay the tax liability. This can disrupt family legacies and impact the financial security of future generations.

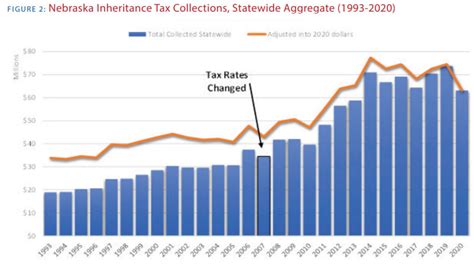

However, the tax also serves an important role in funding essential state services. The revenue generated from the Illinois Death Tax is used to support public education, healthcare, and other vital programs. It ensures that all Illinois residents benefit from the wealth created within the state.

Case Study: The Smith Family’s Estate Planning

Consider the Smith family, long-time residents of Illinois. The family owns a successful small business and has accumulated a substantial estate over the years. Upon the passing of the family patriarch, Mr. Smith, the family faces a potential Illinois Death Tax liability of over $1 million.

However, through careful estate planning, the Smith family was able to mitigate this tax burden. They utilized the Family-Farm and Small Business Exclusion to exclude the value of their small business from the taxable estate. Additionally, they made strategic gifts to their children and grandchildren, taking advantage of the annual gift tax exclusion. By combining these strategies, the Smith family reduced their taxable estate and significantly lowered their tax liability.

Future Implications and Potential Changes

The future of the Illinois Death Tax is uncertain. While the tax has remained relatively stable in recent years, there have been calls for reform, both from proponents and critics. Some argue that the tax is necessary to fund vital state services and promote economic equality, while others believe it is an unnecessary burden on Illinois residents.

In recent years, there have been discussions about the potential for a state-level income tax credit for estate tax payments. Such a credit would effectively reduce the estate tax burden for Illinois residents by allowing them to offset a portion of their estate tax liability against their income tax payments. This could provide some relief for those with substantial estates.

However, the future of such a proposal is uncertain. The political climate in Illinois is divided on the issue, with some advocating for tax relief and others arguing for maintaining the status quo. The outcome will depend on a variety of factors, including the state's financial health, political leadership, and the changing needs of Illinois residents.

Frequently Asked Questions

How often does the Illinois Death Tax change?

+

The Illinois Death Tax has undergone significant changes over the years, with major revisions in the 1970s, 1990s, and most recently in 2007. However, since the 2007 reform, the tax has remained relatively stable. Any future changes will depend on the political climate and the state’s financial needs.

Are there any exemptions or deductions I can take advantage of to reduce my Illinois Death Tax liability?

+

Yes, there are several exemptions and deductions available to reduce your Illinois Death Tax liability. These include the Family-Farm and Small Business Exclusion, the marital deduction, and the charitable contribution deduction. Additionally, you can utilize the annual gift tax exclusion to make strategic gifts during your lifetime.

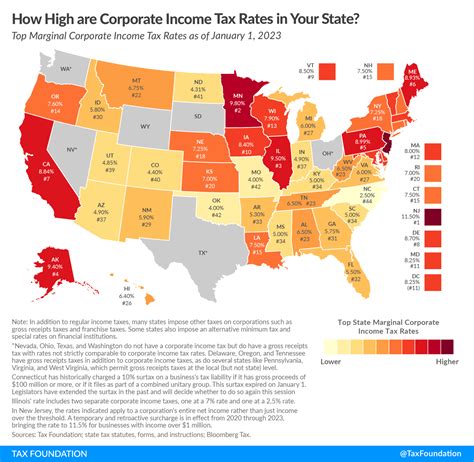

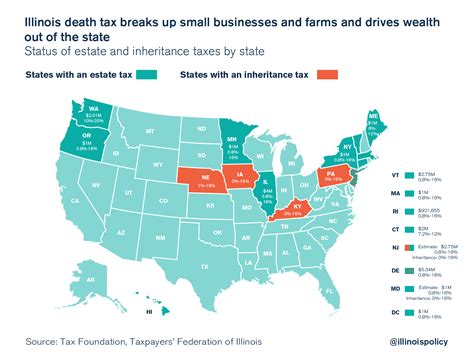

How does the Illinois Death Tax compare to other states’ estate taxes?

+

The Illinois Death Tax is one of the few remaining state-level estate taxes in the country. Many states have either eliminated their estate taxes or have significantly increased their exemption amounts to match the federal estate tax exemption. Illinois, however, maintains a progressive tax system with rates up to 16% for estates valued at $3 million or more.

Is there a way to challenge an Illinois Death Tax assessment?

+

Yes, if you believe your Illinois Death Tax assessment is incorrect, you have the right to challenge it. You can file an appeal with the Illinois Department of Revenue, providing evidence and arguments to support your case. It’s important to seek professional advice and guidance when considering an appeal.

What is the role of a tax professional in estate planning for the Illinois Death Tax?

+

A tax professional, such as a certified public accountant (CPA) or an estate planning attorney, plays a crucial role in navigating the complexities of the Illinois Death Tax. They can help you understand the tax’s implications, develop effective planning strategies, and ensure compliance with the law. Their expertise can be invaluable in maximizing the value of your estate and minimizing tax liability.