Kern County Tax

Understanding the intricacies of local taxation is crucial, especially when it comes to managing one's financial responsibilities effectively. This comprehensive guide will delve into the world of Kern County's tax system, providing an in-depth analysis of its workings, implications, and strategies for optimal tax management. By exploring the various aspects of Kern County Tax, we aim to equip readers with the knowledge needed to navigate this essential aspect of financial life.

The Kern County Tax Landscape

Kern County, situated in the heart of California, boasts a unique tax system that reflects its diverse economic landscape. With a rich agricultural heritage and a thriving industrial sector, the county’s tax structure plays a pivotal role in funding essential services and infrastructure development. This section provides an overview of the key elements that define the Kern County Tax system.

Property Taxes: A Pillar of County Revenue

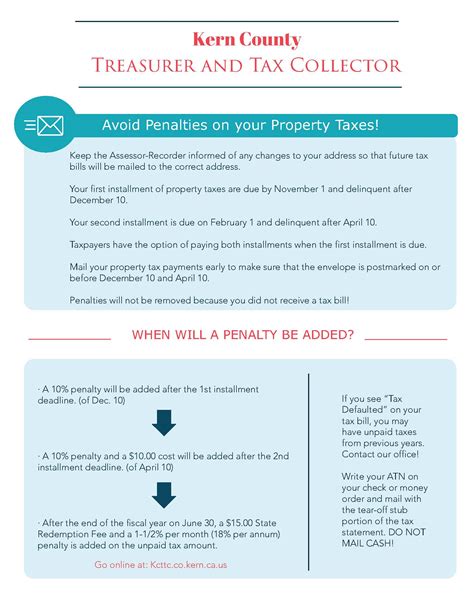

At the core of Kern County’s tax revenue lies the property tax system. This system assesses the value of real estate properties within the county, levying taxes based on their assessed value. The property tax rate is determined annually by the Kern County Assessor’s Office, considering factors such as market conditions, property improvements, and local budget needs.

Property owners in Kern County receive annual tax bills, detailing the assessed value of their properties and the corresponding tax amount. These taxes contribute significantly to the county's revenue stream, funding vital services like public schools, emergency response teams, and road maintenance.

| Tax Year | Average Assessed Value | Tax Rate |

|---|---|---|

| 2022 | $350,000 | 1.25% |

| 2023 | $365,000 | 1.3% |

| 2024 (Projected) | $380,000 | 1.35% |

Sales and Use Taxes: Capturing Economic Activity

In addition to property taxes, Kern County levies sales and use taxes on various goods and services sold within its boundaries. These taxes are collected from businesses and consumers, contributing to the county’s overall revenue. The sales tax rate in Kern County is comprised of a state base rate, a county rate, and any applicable city or district add-ons.

For instance, the current state sales tax rate in California is 7.25%, while Kern County adds an additional 0.25%, resulting in a combined rate of 7.5%. Cities within the county may further augment this rate to fund specific projects or services. It is essential for businesses and consumers to be aware of these rates to ensure compliance and accurate tax reporting.

| Entity | Sales Tax Rate |

|---|---|

| California (State) | 7.25% |

| Kern County | 0.25% |

| City of Bakersfield | 1.0% |

| Total (Combined) | 8.5% |

Business Taxes: Supporting Local Enterprises

Kern County recognizes the vital role played by local businesses in driving economic growth and development. As such, the county imposes various business taxes and fees to support the local business ecosystem. These taxes include:

- Business License Tax: A flat fee charged to businesses operating within Kern County, which contributes to funding local services and infrastructure.

- Transient Occupancy Tax (TOT): A tax levied on hotel and lodging establishments, aimed at supporting tourism-related initiatives and infrastructure.

- Utilities User Tax: A percentage-based tax on utility services provided to businesses, helping fund essential public services.

Business owners in Kern County are required to register for the appropriate business taxes and ensure timely payments. The revenue generated from these taxes is instrumental in fostering a supportive business environment and driving economic prosperity.

Tax Management Strategies for Kern County Residents

Navigating the complexities of Kern County’s tax system requires a strategic approach. Here are some essential strategies and insights to help residents effectively manage their tax obligations and maximize their financial well-being.

Property Tax Relief Programs

Kern County offers various property tax relief programs designed to assist eligible residents in managing their tax liabilities. These programs include:

- Homeowner's Exemption: A valuable program that reduces the assessed value of a primary residence, resulting in lower property taxes. To qualify, homeowners must occupy the property as their primary residence and meet specific income and residency requirements.

- Senior Citizen's Exemption: This program provides property tax relief to senior citizens aged 62 and above. Eligible seniors can apply for a reduction in their assessed property value, resulting in reduced tax obligations.

- Disabled Veteran's Exemption: Recognizing the service and sacrifice of veterans, Kern County offers a property tax exemption for disabled veterans. This program reduces the assessed value of a veteran's primary residence, providing financial relief.

It is essential for residents to explore these programs and understand their eligibility criteria. By taking advantage of these relief measures, Kern County residents can effectively manage their property tax liabilities and optimize their financial resources.

Sales Tax Savings Tips

While sales taxes are an inevitable part of consumer spending, there are strategies to minimize their impact on personal finances. Here are some tips for Kern County residents to save on sales taxes:

- Tax-Free Shopping Days: Keep an eye out for designated tax-free shopping days in Kern County. These days provide an opportunity to purchase goods without paying sales tax, offering significant savings on larger purchases.

- Online Shopping: Consider shopping online, especially for major purchases. Online retailers often offer competitive prices and may have different sales tax rates compared to brick-and-mortar stores. Be sure to check the final price, including any applicable taxes, before finalizing the purchase.

- Compare Prices: Shop around and compare prices across different retailers. By doing so, you can find the best deals and potentially save on sales taxes, especially for high-ticket items.

By being mindful of these strategies, Kern County residents can reduce their sales tax burden and optimize their spending power.

Business Tax Compliance and Optimization

For business owners in Kern County, effective tax management is crucial for long-term success and financial stability. Here are some key considerations for optimizing business tax compliance:

- Understand Tax Obligations: Stay informed about the various business taxes and fees applicable in Kern County. Ensure that you register for the appropriate taxes and maintain accurate records to facilitate timely payments.

- Seek Professional Advice: Consult with tax professionals or accountants who specialize in small business taxation. They can provide valuable insights and strategies to optimize your tax position, ensuring compliance and identifying potential deductions or credits.

- Stay Updated on Changes: The tax landscape is dynamic, with frequent updates and changes. Stay informed about any amendments to tax laws or regulations that may impact your business. This proactive approach ensures that you remain compliant and can take advantage of any new tax benefits or incentives.

By implementing these strategies, business owners in Kern County can effectively manage their tax obligations, minimize liabilities, and optimize their financial resources for sustainable growth.

Conclusion

Kern County’s tax system is a complex yet essential component of the local economy. By understanding the various taxes and implementing effective management strategies, residents and businesses can navigate this landscape with confidence. From property tax relief programs to sales tax savings tips, this guide has provided valuable insights to help individuals and enterprises thrive in Kern County’s tax environment. Stay informed, plan strategically, and make the most of the opportunities available to optimize your financial well-being.

What is the current sales tax rate in Kern County, including city add-ons?

+The current sales tax rate in Kern County, including city add-ons, is 8.5%. This rate is comprised of the state base rate of 7.25%, a county rate of 0.25%, and additional city rates, such as the 1.0% rate in Bakersfield.

Are there any property tax relief programs available for senior citizens in Kern County?

+Yes, Kern County offers a Senior Citizen’s Exemption program that provides property tax relief to senior citizens aged 62 and above. This program reduces the assessed value of a senior’s primary residence, resulting in lower property taxes. To qualify, seniors must meet specific income and residency requirements.

How often do property tax rates change in Kern County?

+Property tax rates in Kern County are subject to change annually. The Kern County Assessor’s Office assesses property values and determines the tax rate based on economic factors and budget requirements. It is important for property owners to stay informed about these changes to effectively manage their tax obligations.