Oswego Tax

Welcome to the comprehensive guide on Oswego Tax, a critical aspect of financial management for individuals and businesses in the vibrant community of Oswego, New York. In this article, we will delve into the intricacies of Oswego Tax, providing you with a detailed understanding of its significance, components, and impact on the local economy. With a focus on clarity and depth, we aim to empower our readers with the knowledge they need to navigate the complex world of taxation effectively.

Understanding Oswego Tax: A Comprehensive Overview

Oswego Tax, often referred to as the Oswego County Tax or simply Oswego Levy, is a multifaceted system of taxation implemented by the local government to generate revenue for the community’s development and maintenance. It encompasses a range of taxes, each designed to contribute to the overall financial stability and growth of Oswego County. From property taxes to sales taxes, and even specialized levies, Oswego Tax plays a crucial role in funding essential services, infrastructure projects, and community initiatives.

For residents and business owners in Oswego, understanding the intricacies of local taxation is not just beneficial but essential. It empowers individuals to make informed decisions about their financial obligations, plan for the future, and contribute actively to the community's prosperity. In this section, we will break down the key components of Oswego Tax, shedding light on its structure, calculation methods, and the impact it has on the lives of Oswego's residents.

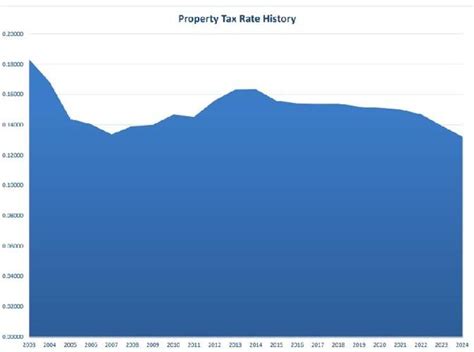

Property Taxes: The Backbone of Oswego’s Revenue

Property taxes form the backbone of Oswego County’s revenue stream. These taxes are levied on real estate properties within the county, including residential homes, commercial establishments, and even vacant land. The property tax system is designed to ensure that property owners contribute fairly to the community’s development based on the value of their assets.

The assessment process for property taxes involves a meticulous evaluation of each property's worth. Assessors take into account various factors such as the property's size, location, improvements, and recent sales data. This assessment determines the taxable value of the property, which then serves as the basis for calculating the property tax liability.

| Property Type | Average Tax Rate |

|---|---|

| Residential | 2.5% - 3.0% |

| Commercial | 3.2% - 3.8% |

| Vacant Land | 1.8% - 2.2% |

Oswego County employs a graduated tax rate system, meaning that the tax rate may vary based on the property's assessed value. This ensures that larger properties, which often benefit more from the community's infrastructure and services, contribute a higher proportion of their value in taxes.

Property taxes in Oswego County are typically due annually, with payment options and due dates outlined in the county's tax calendar. Failure to pay property taxes on time can result in penalties, interest, and even legal consequences. It is essential for property owners to stay informed about their tax obligations and take advantage of any available tax relief programs or exemptions.

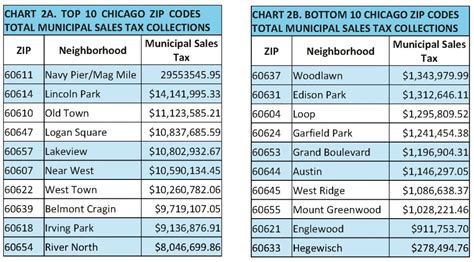

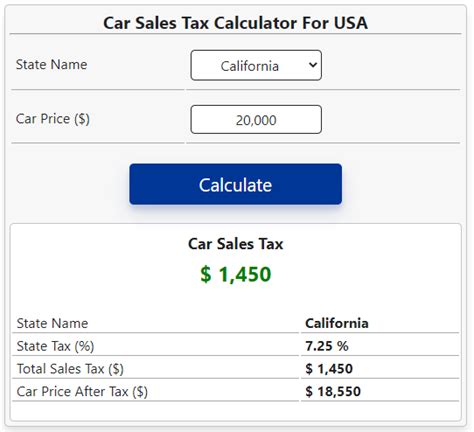

Sales and Use Taxes: Capturing Economic Activity

In addition to property taxes, Oswego County also collects sales and use taxes to generate revenue. Sales tax is applied to the sale of goods and certain services within the county, while use tax is levied on goods purchased outside the county but used or consumed within Oswego’s borders.

The sales tax rate in Oswego County is composed of a base state tax rate, a county tax rate, and additional local tax rates, if applicable. As of the latest data, the combined sales tax rate in Oswego County stands at [insert current sales tax rate]%. This rate is subject to change, so it is advisable for businesses and consumers to stay updated with the latest tax rates to ensure compliance.

| Tax Type | Rate |

|---|---|

| State Sales Tax | [State Rate]% |

| County Sales Tax | [County Rate]% |

| Local Sales Tax (if applicable) | [Local Rate]% |

Sales and use taxes contribute significantly to Oswego County's revenue, particularly in areas with high economic activity. These taxes fund various public services, infrastructure improvements, and community development projects. For businesses operating in Oswego, understanding and complying with sales tax regulations is crucial to avoid penalties and maintain a positive relationship with the local tax authorities.

Special Levies and Assessments: Targeted Taxation

Oswego County sometimes implements special levies and assessments to fund specific projects or address unique community needs. These targeted taxes are designed to provide additional funding for initiatives that may not be covered by the general tax revenue.

Special levies can take various forms, such as bond issues, special purpose taxes, or assessments for infrastructure improvements. For instance, a community may approve a bond issue to finance the construction of a new school or a special tax to support local fire and emergency services. These levies are often approved through public votes, ensuring that the community has a say in how their tax dollars are allocated.

Assessments, on the other hand, are charges levied on property owners to fund specific improvements or services that benefit the property directly. This could include assessments for street lighting, sidewalk maintenance, or water and sewer system upgrades. These assessments are typically tied to the property and remain in effect until the improvement project is completed or the service is no longer required.

The Impact of Oswego Tax on the Local Economy

Oswego Tax plays a pivotal role in shaping the economic landscape of the county. The revenue generated through various taxes is a vital resource for the local government to invest in infrastructure, education, public safety, and other essential services. Let’s explore how Oswego Tax influences the local economy and the lives of its residents.

Funding Essential Services and Infrastructure

The revenue collected through Oswego Tax is primarily directed towards funding essential services that benefit the entire community. This includes maintaining and improving roads, bridges, and public transportation systems. Additionally, tax revenue supports the operation of local schools, fire departments, police services, and other critical public safety initiatives.

Infrastructure development is a key area of focus for Oswego County, as it directly impacts the quality of life for residents and the attractiveness of the region for businesses. Tax revenue enables the county to embark on projects such as road widening, bridge repairs, and the expansion of public transit systems, enhancing connectivity and accessibility throughout the county.

Promoting Economic Development and Business Growth

Oswego County recognizes the importance of a vibrant business community in driving economic growth. Tax revenue is strategically allocated to support initiatives that attract new businesses, foster entrepreneurship, and create job opportunities. This includes providing tax incentives for businesses to locate in the county, investing in business incubators and innovation hubs, and offering support for small businesses through training and resource programs.

The county also works closely with local business associations and chambers of commerce to understand the needs of the business community and develop targeted tax policies. By creating an environment conducive to business growth, Oswego County aims to boost its economic resilience and ensure a thriving local economy.

Enhancing Community Well-being and Quality of Life

Beyond its economic impact, Oswego Tax directly influences the well-being and quality of life for residents. The revenue generated through taxes is allocated to various community programs and initiatives that promote health, education, and social welfare.

For instance, tax revenue supports public health initiatives, such as the operation of local health clinics, immunization programs, and mental health services. It also funds recreational facilities, parks, and cultural centers, providing residents with opportunities for physical activity, social engagement, and cultural enrichment. Additionally, tax-funded social services programs assist vulnerable populations, ensuring that everyone in the community has access to the resources they need.

Conclusion: Navigating the Oswego Tax Landscape

Understanding the intricacies of Oswego Tax is a vital step towards financial literacy and community engagement. By comprehending the components of local taxation and their impact on the community, residents and business owners can make informed decisions, plan their finances effectively, and actively contribute to the prosperity of Oswego County.

As we have explored in this guide, Oswego Tax encompasses a range of taxes, including property taxes, sales taxes, and special levies. Each of these tax components plays a unique role in funding essential services, infrastructure projects, and community initiatives. By staying informed about tax rates, assessment processes, and payment deadlines, individuals can navigate the tax landscape with confidence and ensure compliance with local regulations.

For those seeking further insights into Oswego Tax or assistance with their tax obligations, various resources are available. The Oswego County Department of Finance provides comprehensive information on tax rates, assessment procedures, and payment options. Additionally, local tax professionals and accounting firms can offer personalized guidance and support, ensuring that individuals and businesses meet their tax responsibilities while optimizing their financial strategies.

In conclusion, Oswego Tax is not just a financial obligation but a vital tool for community development and growth. By recognizing the importance of taxation and actively engaging with the local tax system, residents and businesses can contribute to a thriving Oswego County, ensuring a bright future for all.

What is the current sales tax rate in Oswego County, and how often does it change?

+

The current sales tax rate in Oswego County is [insert current rate]%. This rate is subject to change, and it is advisable to check for updates regularly. The county’s tax department provides the most accurate and up-to-date information on sales tax rates.

Are there any property tax exemptions or relief programs available for homeowners in Oswego County?

+

Yes, Oswego County offers various property tax exemptions and relief programs to eligible homeowners. These programs include senior citizen exemptions, veteran exemptions, and income-based relief. It is recommended to contact the county’s assessor’s office or visit their website for detailed information on eligibility criteria and application processes.

How often are property assessments conducted in Oswego County, and what factors influence the assessed value of a property?

+

Property assessments in Oswego County are typically conducted every few years. The assessed value of a property is determined based on various factors, including recent sales data, property improvements, location, and market conditions. The assessor’s office provides detailed guidelines on how these factors are considered in the assessment process.

Are there any specialized tax programs or incentives for businesses operating in Oswego County, and how can businesses access these benefits?

+

Oswego County offers a range of tax incentives and specialized programs to attract and support businesses. These may include tax abatements, enterprise zone benefits, and economic development incentives. Businesses can access these benefits by working closely with the county’s economic development office and exploring the available programs tailored to their specific industry and investment plans.

What resources are available for individuals and businesses seeking assistance with tax obligations and financial planning in Oswego County?

+

Oswego County provides a wealth of resources for tax assistance and financial planning. This includes the county’s Department of Finance, which offers guidance on tax rates, assessment processes, and payment options. Additionally, local accounting firms and tax professionals can provide personalized advice and support to individuals and businesses, helping them navigate the complex world of taxation.