Does Florida Have An Estate Tax

The state of Florida has a unique position when it comes to estate taxes, with a history that has evolved over time. Florida's estate tax landscape is an intriguing one, offering certain advantages and considerations for its residents and those looking to relocate. This article aims to delve into the specifics of Florida's estate tax situation, providing a comprehensive guide for individuals seeking clarity on this matter.

Understanding Florida's Estate Tax Laws

Florida's approach to estate taxes is notably different from many other states. As of [current year], Florida does not impose an estate tax at the state level. This means that when a resident of Florida passes away, their estate is not subject to taxation by the state government. This is a significant advantage for high-net-worth individuals and those with substantial assets, as it eliminates a potentially large tax burden.

However, it's important to note that Florida's absence of a state estate tax does not shield residents from federal estate tax obligations. The Internal Revenue Service (IRS) enforces a federal estate tax, which applies to estates valued above a certain threshold. As of [current year], the federal estate tax exemption is set at $[current exemption amount], meaning estates valued below this amount are not subject to federal estate tax. This exemption amount is adjusted periodically to account for inflation.

The absence of a state estate tax in Florida is a strategic move by the state government to attract wealthy individuals and businesses. It positions Florida as an attractive destination for those seeking to minimize their tax liabilities upon their passing. This strategy has proven successful, contributing to Florida's reputation as a favorable state for retirees and those seeking to protect their wealth.

Estate Planning in Florida: A Comprehensive Approach

While Florida's lack of a state estate tax is a significant advantage, it's crucial for residents to understand that estate planning goes beyond tax considerations. A comprehensive estate plan in Florida should address various aspects to ensure the smooth transfer of assets and the protection of one's legacy.

Will and Testament

A will is a legal document that outlines how an individual wants their assets distributed after their death. In Florida, it is essential to have a properly drafted will to ensure that one's wishes are carried out. A will also appoints an executor, who is responsible for managing the estate and carrying out the instructions outlined in the will.

Florida's Probate Code governs the process of will validation and estate administration. It is advisable to consult with an estate planning attorney who is well-versed in Florida's specific laws to ensure that the will is valid and meets all the necessary requirements.

Trusts

Trusts are legal entities that hold assets on behalf of beneficiaries. They offer a range of benefits, including asset protection, privacy, and the ability to control how and when assets are distributed. In Florida, trusts are a popular estate planning tool, as they can help avoid probate and ensure a more efficient transfer of assets.

There are various types of trusts that can be utilized in Florida, each with its own advantages and considerations. Some common types include:

- Revocable Living Trusts: These trusts can be modified or revoked during the grantor's lifetime. They offer flexibility and can help avoid probate, as the assets are transferred directly to the beneficiaries upon the grantor's death.

- Irrevocable Trusts: Unlike revocable trusts, irrevocable trusts cannot be modified or revoked once established. They offer asset protection and can be useful for tax planning purposes.

- Special Needs Trusts: These trusts are designed to provide for individuals with special needs without disrupting their eligibility for government benefits.

The choice of trust depends on the individual's specific circumstances and goals. It is recommended to seek guidance from a qualified estate planning professional to determine the most suitable trust structure.

Power of Attorney

A power of attorney is a legal document that allows an individual (the principal) to appoint someone (the agent) to make financial and legal decisions on their behalf if they become incapacitated. In Florida, there are different types of powers of attorney, including durable and springing powers of attorney.

A durable power of attorney remains effective even if the principal becomes incapacitated, while a springing power of attorney only takes effect upon the occurrence of a specific event, such as the principal's incapacity.

Healthcare Directives

Healthcare directives, such as living wills and healthcare powers of attorney, are essential components of estate planning. They ensure that an individual's wishes regarding medical treatment are respected if they are unable to communicate their decisions. In Florida, these documents are governed by the Florida Statutes and must be properly executed to be valid.

The Impact of Florida's Estate Tax Laws on Residents

Florida's estate tax laws have a significant impact on its residents, particularly those with substantial assets. The absence of a state estate tax provides a notable advantage, as it eliminates the need to plan for and pay a state-level tax on one's estate. This can result in substantial savings for high-net-worth individuals and their heirs.

However, it is important for residents to be aware of the federal estate tax threshold. While Florida does not impose a state estate tax, failing to plan for the federal estate tax could result in a significant tax liability. This is where comprehensive estate planning becomes crucial. By utilizing strategies such as gifting, charitable contributions, and trust planning, individuals can potentially reduce their federal estate tax burden.

Furthermore, Florida's estate tax laws also impact the state's economy and attractiveness as a retirement destination. The absence of a state estate tax, combined with other tax advantages like the lack of income tax, has made Florida a desirable location for retirees and those seeking to minimize their tax obligations. This, in turn, has contributed to the state's economic growth and development.

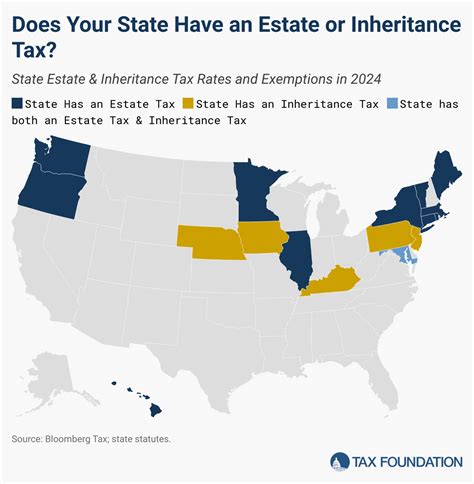

Florida's Estate Tax Laws: A Comparison

To provide a comprehensive understanding, it is beneficial to compare Florida's estate tax laws with those of other states. While Florida stands out for its absence of a state estate tax, many other states do impose such taxes, often with varying thresholds and rates.

For instance, neighboring states like Georgia and Alabama have their own estate tax laws. Georgia, as of [current year], has an estate tax threshold of $[Georgia threshold amount], while Alabama's threshold is set at $[Alabama threshold amount]. This means that estates valued above these thresholds in these states may be subject to state estate taxes, in addition to federal estate taxes.

On the other hand, Texas and South Carolina follow a similar approach to Florida, with no state estate tax in place. Like Florida, these states rely on the federal estate tax exemption to shield their residents from state-level estate taxes. This makes them attractive destinations for those seeking to minimize their tax liabilities.

The table below provides a comparison of estate tax laws in Florida and its neighboring states, as well as a few other notable states:

| State | Estate Tax Threshold | Estate Tax Rate |

|---|---|---|

| Florida | No State Estate Tax | N/A |

| Georgia | $[Georgia threshold amount] | Up to [Georgia tax rate]% |

| Alabama | $[Alabama threshold amount] | Up to [Alabama tax rate]% |

| Texas | No State Estate Tax | N/A |

| South Carolina | No State Estate Tax | N/A |

| California | $[California threshold amount] | Up to [California tax rate]% |

| New York | $[New York threshold amount] | Up to [New York tax rate]% |

The Future of Florida's Estate Tax Laws

The estate tax landscape is subject to change, and Florida is no exception. While the state currently does not impose a state estate tax, there have been discussions and proposals in the past to introduce such a tax. These proposals have often been met with opposition, particularly from those concerned about the potential impact on the state's economy and its attractiveness as a retirement destination.

However, with the evolving nature of tax laws and the ongoing debate surrounding estate taxes, it is important for Florida residents to stay informed and proactive in their estate planning. The state's tax laws may undergo changes in the future, and being prepared for potential shifts can ensure that individuals' estates are adequately protected and managed.

Additionally, the federal estate tax landscape is also subject to change. The federal estate tax exemption amount and rates are periodically reviewed and adjusted, which can impact the tax liability of estates. Staying up-to-date with federal tax reforms is crucial for effective estate planning.

Frequently Asked Questions

Is Florida's lack of a state estate tax a permanent feature?

+While Florida currently does not have a state estate tax, tax laws can change over time. It is important to stay informed and consult with tax professionals to understand any potential future changes.

<div class="faq-item">

<div class="faq-question">

<h3>How does Florida's estate tax situation compare to other states?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Florida's absence of a state estate tax sets it apart from many other states. While some states impose their own estate taxes, Florida relies solely on the federal estate tax exemption, providing a significant advantage for residents.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any estate planning strategies to minimize federal estate tax liability in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, there are several strategies that can be employed to potentially reduce federal estate tax liability. These include gifting, charitable contributions, and the use of certain types of trusts. Consulting with an estate planning professional is recommended to explore these options.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the current federal estate tax exemption amount?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>As of [current year], the federal estate tax exemption amount is $[current exemption amount]. This amount is adjusted periodically to account for inflation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any estate planning tools that can help avoid probate in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, trusts are a popular tool in Florida to avoid probate. Revocable living trusts, in particular, can ensure a more efficient transfer of assets upon the grantor's death, bypassing the probate process.</p>

</div>

</div>