Exempt From Withholding Tax Meaning

When it comes to taxes and financial transactions, understanding the implications of various terms and concepts is crucial. One such term is "exempt from withholding tax," which carries significant importance in the world of finance and investments. This article aims to delve into the intricacies of this concept, shedding light on its meaning, applicability, and impact on individuals and entities.

Understanding the Term: Exempt From Withholding Tax

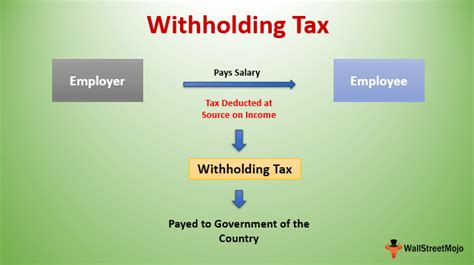

In the realm of taxation, withholding tax refers to the practice of deducting a certain percentage of an individual’s or entity’s income at the source, often by the payer, before it is paid to the recipient. This tax is typically withheld to ensure that the government receives its share of the income tax due from the recipient. However, in certain circumstances, individuals or entities may be granted an exemption from this withholding tax.

Being exempt from withholding tax implies that the payer is not required to deduct any amount from the recipient's payment for the purpose of tax collection. This exemption is usually granted based on specific criteria, which can vary depending on the jurisdiction and the nature of the transaction or income.

Types of Withholding Tax Exemptions

There are several types of exemptions from withholding tax, each with its own set of conditions and requirements. Some common types include:

- Tax Treaty Exemptions: Many countries have entered into bilateral tax treaties to avoid double taxation and promote cross-border investments. These treaties often include provisions for withholding tax exemptions, allowing residents of one country to be exempt from withholding tax in the other country under certain circumstances.

- Domestic Law Exemptions: Some jurisdictions have domestic laws or regulations that provide exemptions from withholding tax for specific types of income or transactions. For example, certain types of interest income or dividends may be exempt from withholding tax under domestic tax laws.

- Qualified Investor Exemptions: In some cases, individuals or entities that meet certain criteria, such as being accredited or institutional investors, may be granted exemptions from withholding tax on certain types of income. This is often done to encourage investment and promote economic growth.

- Foreign Status Exemptions: Non-residents or foreign entities may be eligible for withholding tax exemptions in certain jurisdictions. This is particularly common in the context of cross-border transactions, where the recipient’s non-resident status may lead to a reduced or nil withholding tax rate.

The Process of Obtaining Withholding Tax Exemptions

Obtaining an exemption from withholding tax typically involves a formal application process. Individuals or entities seeking such an exemption must provide relevant documentation and information to the tax authorities or the payer to demonstrate their eligibility.

The required documentation can vary depending on the jurisdiction and the type of exemption sought. Common documents include:

- Tax residency certificates

- Proof of qualification as an accredited or institutional investor

- Financial statements or other evidence of eligibility

- Certificates of exemption issued by tax authorities

Once the application is submitted, it undergoes a review process by the tax authorities. If the application is approved, the recipient is granted the exemption, and the payer is informed accordingly. It is important to note that exemptions are usually time-bound and may require periodic renewal to remain valid.

The Benefits of Withholding Tax Exemptions

Being exempt from withholding tax can offer several advantages to individuals and entities. Some key benefits include:

- Increased Cash Flow: Without the deduction of withholding tax, recipients receive the full amount of their income, which can improve cash flow and financial planning.

- Simplified Tax Compliance: Exemptions can reduce the administrative burden associated with withholding tax compliance, as the recipient is not required to submit additional tax filings related to the withheld amount.

- International Investment Opportunities: Withholding tax exemptions, particularly those derived from tax treaties, can make cross-border investments more attractive by reducing the tax burden and promoting economic cooperation between countries.

- Competitive Advantage: In certain industries or sectors, withholding tax exemptions can provide a competitive edge, attracting investors and promoting business growth.

Challenges and Considerations

While withholding tax exemptions offer significant benefits, they also come with certain challenges and considerations:

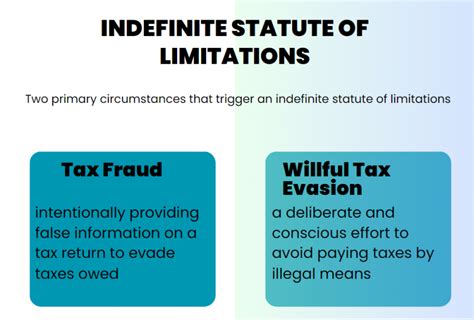

- Compliance Requirements: Obtaining and maintaining exemptions require careful compliance with tax laws and regulations. Failure to meet the necessary criteria or provide accurate information can result in penalties and legal consequences.

- Time and Resource Intensity: The application and renewal processes for withholding tax exemptions can be time-consuming and resource-intensive, particularly for entities with complex tax structures or international operations.

- Jurisdictional Differences: Withholding tax exemptions can vary significantly between jurisdictions, making it essential for individuals and entities to understand the specific requirements and limitations of each jurisdiction they operate in.

Expert Insights

Conclusion

The concept of being exempt from withholding tax carries significant implications for individuals and entities involved in various financial transactions. By understanding the types of exemptions, the application process, and the benefits and challenges associated with them, stakeholders can make informed decisions to optimize their tax strategies and financial planning.

Frequently Asked Questions

What happens if I am exempt from withholding tax but still have tax liabilities?

+Being exempt from withholding tax means that the payer does not deduct tax at the source. However, you may still have tax liabilities that need to be reported and paid directly to the tax authorities. It is important to understand your overall tax obligations and ensure compliance with all relevant tax laws.

Can I apply for a withholding tax exemption retroactively?

+Retroactive applications for withholding tax exemptions are generally not allowed. Exemptions are typically time-bound and must be applied for before the income or transaction occurs. However, it is always advisable to consult with tax professionals to explore any potential avenues for retroactive applications or to address specific circumstances.

Are there any penalties for not complying with withholding tax exemption requirements?

+Yes, failure to comply with withholding tax exemption requirements can result in penalties and legal consequences. These may include fines, interest charges, or even criminal charges in severe cases. It is crucial to ensure compliance with all applicable laws and regulations to avoid such penalties.