Tax Statute Of Limitations

The tax statute of limitations is a crucial aspect of tax law, providing a time limit for the Internal Revenue Service (IRS) to initiate tax-related actions against individuals or entities. Understanding the intricacies of this statute is essential for taxpayers, as it offers a level of protection and security against potential tax liabilities and audits. In this comprehensive article, we will delve into the world of tax statute of limitations, exploring its various aspects, real-world applications, and the critical implications it holds for taxpayers.

Understanding the Tax Statute of Limitations

The tax statute of limitations, often referred to as the SOL, is a legal provision that sets a specific timeframe within which the IRS can audit a taxpayer’s return, assess additional taxes, or take collection actions. This statute is designed to provide taxpayers with a sense of certainty and security, ensuring that they are not indefinitely liable for past tax years. The length of the statute of limitations can vary depending on several factors, including the type of tax, the nature of the issue, and certain specific circumstances.

Standard Statute of Limitations for Individual Income Taxes

For individual income taxes, the standard statute of limitations is typically three years from the date the tax return was filed. This means that the IRS generally has three years to examine the return, identify any errors or discrepancies, and make adjustments or assessments. If the IRS fails to take action within this timeframe, the taxpayer is no longer liable for additional taxes or penalties related to that tax year.

| Tax Type | Standard SOL |

|---|---|

| Individual Income Tax | 3 Years |

| Corporate Income Tax | 3 Years |

| Gift Tax | 3 Years |

| Estate Tax | 6 Years |

It's important to note that this three-year period can be extended in certain situations, such as when a taxpayer files an amended return or when there is a substantial understatement of income. In such cases, the IRS may have up to six years to audit and assess taxes.

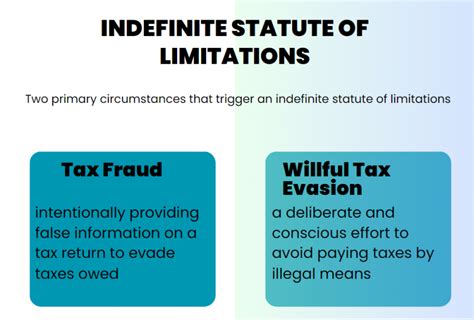

Extended Statute of Limitations

In addition to the standard statute of limitations, there are circumstances where the IRS may have an extended period to pursue tax-related actions. These extensions typically occur when there is fraud, willful attempts to evade tax, or a failure to file a tax return. In such cases, the statute of limitations can be indefinitely extended, allowing the IRS to take action at any time.

For example, if a taxpayer intentionally fails to report income or makes false statements on their tax return, the IRS can pursue an audit and assess taxes beyond the standard three-year period. This extended statute of limitations is a powerful tool for the IRS to combat tax fraud and ensure compliance with tax laws.

Real-World Applications and Case Studies

To illustrate the practical implications of the tax statute of limitations, let’s explore a few real-world scenarios:

Case Study: Accidental Omission of Income

Imagine a taxpayer, John, who inadvertently forgets to report a small side hustle income on his tax return for the year 2020. John files his return in April 2021 and later realizes his mistake. Under normal circumstances, the IRS would have until April 2024 (three years from the filing date) to audit John’s return and assess any additional taxes. However, John takes immediate action and files an amended return, including the omitted income.

By filing the amended return, John extends the statute of limitations to six years. This means that the IRS now has until April 2027 to review his return and make any necessary adjustments. This case study highlights the importance of being proactive and addressing errors promptly to avoid potential audits and penalties.

Case Study: Fraudulent Activity

In a different scenario, let’s consider a taxpayer, Emily, who intentionally underreports her income for several years. Emily uses complex offshore structures and false documentation to conceal her true earnings. In this case, the IRS may discover the fraud and have an indefinite statute of limitations to pursue tax liabilities and penalties. The extended SOL allows the IRS to investigate thoroughly and take appropriate action against Emily’s tax evasion activities.

Expert Insights and Strategies

As a tax expert, here are some key insights and strategies related to the tax statute of limitations:

- Timely Filing and Record-Keeping: Encouraging taxpayers to file their tax returns promptly and maintain accurate records is essential. This helps ensure compliance and reduces the risk of audits or penalties.

- Awareness of Extension Periods: Taxpayers should be aware of the potential extension of the statute of limitations, especially when filing amended returns or dealing with substantial income adjustments. Understanding these extensions can help taxpayers plan and prepare accordingly.

- Honesty and Transparency: Emphasizing the importance of honesty in tax reporting is crucial. Taxpayers should strive to accurately report their income and deductions to avoid potential fraud charges and the indefinite extension of the SOL.

- Seeking Professional Advice: For complex tax situations or when facing potential audits, taxpayers should consider seeking guidance from tax professionals. These experts can provide tailored advice and strategies to navigate the tax statute of limitations effectively.

Future Implications and Potential Changes

The tax statute of limitations is a dynamic aspect of tax law, and it can be subject to changes and updates over time. As tax policies evolve, taxpayers and tax professionals must stay informed about any modifications to the statute. Here are some potential future implications and considerations:

- Legislative Updates: Changes in tax laws and regulations can impact the statute of limitations. Taxpayers and professionals should monitor legislative updates to understand any alterations to the SOL and adjust their strategies accordingly.

- Technological Advancements: With the increasing use of technology in tax administration, the IRS may adopt more advanced tools for detecting errors and fraud. This could potentially impact the efficiency of audits and the statute of limitations.

- International Tax Developments: In an era of global taxation, changes in international tax agreements and treaties may influence the statute of limitations for cross-border tax issues. Taxpayers with international operations should stay updated on these developments.

Conclusion

The tax statute of limitations is a critical component of tax law, providing taxpayers with a measure of security and predictability. By understanding the intricacies of the SOL, taxpayers can navigate the tax landscape more confidently and make informed decisions. From the standard three-year period for individual income taxes to the extended statutes for specific circumstances, taxpayers and tax professionals must remain vigilant and aware of their rights and obligations.

As we've explored in this article, the tax statute of limitations is a complex yet essential aspect of tax administration. By staying informed and proactive, taxpayers can ensure compliance, avoid potential pitfalls, and maintain a healthy relationship with the IRS. Remember, tax laws are constantly evolving, so staying updated is key to successful tax management.

Can the tax statute of limitations be extended by mutual agreement between the taxpayer and the IRS?

+Yes, in certain situations, the taxpayer and the IRS can agree to extend the statute of limitations through a written agreement. This extension provides both parties with additional time to resolve tax issues or conduct further investigations.

What happens if the IRS fails to assess taxes within the statute of limitations period?

+If the IRS does not assess additional taxes or take collection actions within the specified statute of limitations period, the taxpayer is no longer liable for those taxes. This protection ensures that taxpayers are not indefinitely at risk for past tax years.

Are there any exceptions to the tax statute of limitations for specific tax types or situations?

+Yes, there are exceptions and variations to the statute of limitations for different tax types and situations. For example, the statute of limitations for estate and gift taxes is typically six years, while there are specific rules for trusts and certain international tax matters.