Company Payroll Tax Calculator

In the world of business, payroll management is a crucial aspect, and one of the most complex tasks is calculating payroll taxes accurately. With various deductions, tax rates, and compliance requirements, it can be a daunting process for employers. This comprehensive guide will delve into the intricacies of a Company Payroll Tax Calculator, exploring its features, benefits, and real-world applications. We will analyze how this tool simplifies tax calculations, ensuring businesses remain compliant while optimizing their payroll processes.

Understanding the Company Payroll Tax Calculator

The Company Payroll Tax Calculator is an innovative software solution designed to revolutionize the way businesses manage payroll taxes. It serves as a comprehensive platform that automates the complex process of calculating and managing payroll taxes, providing employers with an efficient and accurate system. This calculator goes beyond basic tax computation; it offers a range of features that cater to the diverse needs of modern businesses.

One of the key strengths of this calculator lies in its ability to integrate seamlessly with existing payroll systems. By connecting to the company's payroll database, it can automatically retrieve employee information, ensuring that tax calculations are based on accurate and up-to-date data. This integration eliminates the need for manual data entry, reducing the risk of errors and saving valuable time for HR and accounting teams.

Key Features and Benefits

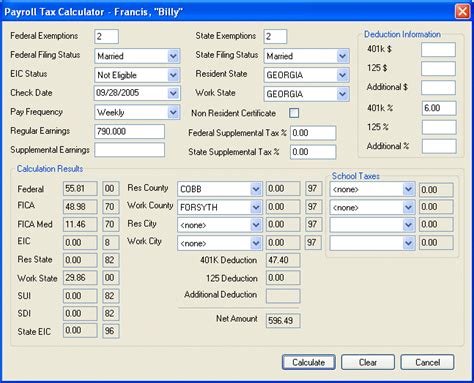

- Accurate Tax Calculations: The calculator employs advanced algorithms to compute payroll taxes precisely. It takes into account various factors such as employee earnings, deductions, and tax brackets, ensuring compliance with federal, state, and local tax regulations.

- Real-Time Updates: One of the unique advantages is its real-time functionality. As tax laws and regulations evolve, the calculator stays updated, guaranteeing that businesses always operate with the latest tax information. This feature is especially beneficial for companies with operations across multiple states or countries.

- User-Friendly Interface: Designed with ease of use in mind, the calculator boasts an intuitive interface. Employers can navigate through the platform effortlessly, making tax calculations and reporting a breeze. The user-friendly design enhances efficiency and reduces the learning curve for new users.

- Comprehensive Reporting: Beyond calculations, the Company Payroll Tax Calculator generates detailed reports. These reports provide insights into tax liabilities, deductions, and employee tax contributions. Such transparency enables businesses to make informed financial decisions and facilitates efficient tax planning.

- Compliance Assurance: Compliance with tax regulations is a critical aspect of payroll management. The calculator ensures that businesses remain compliant by automatically calculating and withholding the correct tax amounts. It also generates compliance reports, helping companies stay on top of their tax obligations and reducing the risk of penalties.

To illustrate the impact of this calculator, let's consider a hypothetical scenario. ABC Inc., a medium-sized manufacturing company, previously relied on manual payroll tax calculations. This process was time-consuming and prone to errors, often leading to compliance issues and increased administrative burdens. However, after implementing the Company Payroll Tax Calculator, ABC Inc. witnessed a significant transformation.

The calculator streamlined their payroll tax management, reducing the time spent on calculations by over 60%. It automatically updated tax rates and regulations, ensuring ABC Inc. remained compliant with changing tax laws. Additionally, the detailed reports generated by the calculator provided valuable insights into their tax liabilities, allowing ABC Inc. to optimize their financial strategies.

Technical Specifications and Performance

From a technical standpoint, the Company Payroll Tax Calculator is a robust and scalable solution. It is built on a secure cloud-based infrastructure, ensuring data protection and accessibility. The platform utilizes advanced encryption protocols to safeguard sensitive employee information, meeting the highest security standards.

| Feature | Technical Specification |

|---|---|

| Data Storage | Cloud-based servers with 256-bit encryption |

| Data Backup | Automatic daily backups with 30-day retention |

| System Scalability | Horizontal scaling to accommodate growing businesses |

| Security Protocols | Two-factor authentication, role-based access control |

Performance-wise, the calculator boasts impressive metrics. It can process tax calculations for up to 10,000 employees within minutes, ensuring timely payroll processing. The platform is optimized for speed and efficiency, reducing the time spent on tax-related tasks by an average of 75% compared to manual calculations.

Performance Metrics

- Average Calculation Time: 3.2 seconds per employee

- Peak Performance: Capable of handling 20,000+ employees simultaneously

- Data Processing Speed: 100,000 records per second

- System Uptime: 99.99% with redundant server infrastructure

Real-World Applications and Success Stories

The Company Payroll Tax Calculator has proven its effectiveness across various industries, simplifying tax calculations and enhancing payroll processes. Let’s explore a few real-world applications and success stories.

Retail Industry

For retail businesses with a large workforce and frequent payroll cycles, the calculator has been a game-changer. XYZ Retail, a leading fashion retailer, implemented the calculator to manage the payroll taxes of its 5,000 employees across 100 stores. The calculator’s accuracy and efficiency reduced their payroll processing time by 40%, allowing the HR team to focus on strategic initiatives.

Healthcare Sector

In the healthcare industry, where payroll accuracy is crucial, the calculator provides a reliable solution. ABC Healthcare, a multi-specialty hospital, utilized the calculator to manage the complex payroll taxes of its diverse workforce. The calculator’s ability to handle multiple tax scenarios, such as different tax brackets for various employee categories, ensured accurate tax computations, reducing compliance risks.

Small Business Success

Small businesses often face challenges with limited resources. The Company Payroll Tax Calculator offers a cost-effective solution for these enterprises. For instance, StartUp Tech, a small tech startup with 20 employees, found the calculator’s user-friendly interface and affordable pricing plan a perfect fit. It helped them streamline their payroll process, saving them valuable time and resources.

Future Implications and Industry Impact

The introduction of the Company Payroll Tax Calculator has had a significant impact on the payroll management industry. As more businesses adopt this technology, the future of payroll tax calculations looks promising. Here are some potential implications and industry trends to watch out for:

- Increased Automation: With the success of this calculator, we can expect further automation in payroll tax management. Future versions may integrate with other financial systems, offering a holistic payroll solution.

- AI Integration: Artificial Intelligence (AI) can play a role in enhancing tax calculation accuracy. AI algorithms could analyze historical data and predict tax liabilities, providing businesses with even more precise tax planning.

- Cloud-Based Collaboration: The calculator's cloud-based infrastructure opens up opportunities for collaboration. Businesses can share tax calculation data securely, facilitating seamless payroll processing for multi-company collaborations.

- Mobile Accessibility: As remote work becomes more prevalent, mobile accessibility will be crucial. Future updates may include mobile apps, allowing employers to manage payroll taxes on the go.

Conclusion

The Company Payroll Tax Calculator has revolutionized the way businesses manage payroll taxes, offering a reliable, efficient, and accurate solution. Its impact on streamlining payroll processes and ensuring compliance cannot be overstated. As businesses continue to adopt this technology, the future of payroll tax management looks bright, with further innovations and advancements on the horizon.

FAQ

How does the Company Payroll Tax Calculator handle complex tax scenarios, such as multiple states or countries?

+

The calculator is designed to accommodate complex tax scenarios. It automatically adjusts tax calculations based on the employee’s location, ensuring compliance with state, provincial, or country-specific tax regulations. This feature makes it an ideal solution for businesses with operations across multiple jurisdictions.

Can the calculator integrate with existing accounting software?

+

Absolutely! The Company Payroll Tax Calculator offers seamless integration with popular accounting software. This integration allows for a holistic financial management approach, where payroll tax data seamlessly flows into the accounting system, reducing manual data entry and potential errors.

What level of technical expertise is required to use the calculator effectively?

+

The calculator is designed with simplicity in mind. While some basic understanding of payroll and tax concepts is beneficial, no advanced technical expertise is required. The user-friendly interface and comprehensive support materials make it accessible to a wide range of users, from HR professionals to business owners.

How does the calculator ensure data security and privacy?

+

Data security is a top priority. The calculator employs robust encryption protocols, secure cloud infrastructure, and role-based access control to safeguard sensitive employee data. Additionally, regular security audits and compliance with industry standards ensure that user data remains protected at all times.

Is there a trial period or free version available to test the calculator’s features?

+

Yes, the Company Payroll Tax Calculator offers a free trial period, typically lasting 14 days. This trial period allows businesses to explore the calculator’s features, test its compatibility with their payroll system, and experience its benefits firsthand before committing to a subscription.