Ms Tax Return

The world of finance and tax management is ever-evolving, with new strategies and tools emerging to simplify the often daunting task of filing taxes. Among the many innovations in this field, Ms Tax Return stands out as a groundbreaking solution, offering an efficient and user-friendly approach to tax filing. This article delves into the intricacies of Ms Tax Return, exploring its features, benefits, and impact on the tax landscape.

Revolutionizing Tax Filing with Ms Tax Return

In the realm of tax preparation, Ms Tax Return has emerged as a trailblazer, challenging traditional methods and paving the way for a more streamlined and accessible tax filing process. With its innovative features and intuitive design, Ms Tax Return has quickly gained recognition as a trusted partner for individuals and businesses alike.

The genesis of Ms Tax Return can be traced back to the vision of its founders, who recognized the need for a more modern and efficient tax filing solution. With a team of experienced tax professionals and software developers, they set out to create a platform that would revolutionize the way taxes are managed.

Key Features of Ms Tax Return

Ms Tax Return boasts an array of features that set it apart from conventional tax filing methods. Here are some of its standout capabilities:

- Intelligent Data Capture: Utilizing advanced optical character recognition (OCR) technology, Ms Tax Return can extract relevant data from various documents, including receipts, invoices, and previous tax filings. This significantly reduces the time and effort required for data entry.

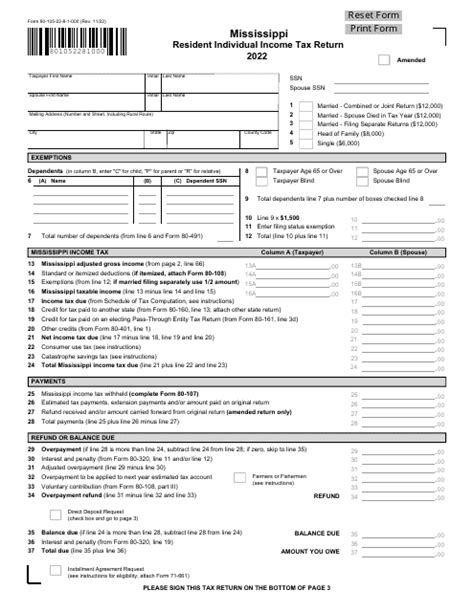

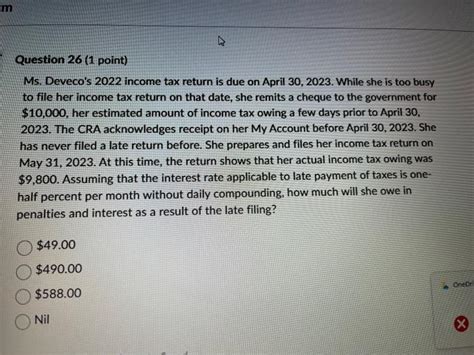

- Smart Tax Calculations: The platform employs sophisticated algorithms to calculate taxes accurately and efficiently. It takes into account the latest tax laws and regulations, ensuring compliance and minimizing the risk of errors.

- User-Friendly Interface: Ms Tax Return is designed with a user-centric approach, making it incredibly easy to navigate. The intuitive interface guides users through the filing process step by step, providing clear instructions and explanations along the way.

- Secure Cloud Storage: All user data is stored securely in the cloud, ensuring accessibility and peace of mind. Users can access their tax information from anywhere, at any time, making it convenient for remote collaboration and access to historical data.

- Real-Time Updates: Ms Tax Return stays up-to-date with the latest tax laws and regulations, providing users with accurate and timely information. This feature ensures that users are always working with the most current tax guidelines.

These features, combined with a commitment to user experience and simplicity, have made Ms Tax Return a preferred choice for tax professionals and individuals seeking a more efficient tax filing solution.

Benefits of Using Ms Tax Return

The advantages of adopting Ms Tax Return are multifaceted and extend to both individuals and businesses. Here are some key benefits:

- Time Savings: Ms Tax Return's automated data capture and streamlined filing process significantly reduce the time spent on tax preparation. This allows users to focus on other aspects of their business or personal lives.

- Accuracy and Compliance: With its intelligent tax calculation capabilities, Ms Tax Return ensures accurate and compliant tax filings. This minimizes the risk of errors and potential penalties, providing users with peace of mind.

- Cost Efficiency: By automating various aspects of tax filing, Ms Tax Return helps reduce the overall cost of tax preparation. This is especially beneficial for small businesses and individuals who may not have the resources to engage expensive tax professionals.

- Improved Cash Flow Management: The platform's real-time updates and tax planning tools enable users to better manage their cash flow. By staying on top of tax obligations and potential refunds, users can optimize their financial strategies.

- Enhanced Collaboration: Ms Tax Return's cloud-based nature facilitates seamless collaboration between users and their tax advisors. Multiple users can access and work on the same tax files simultaneously, streamlining the review and approval process.

These benefits have led to widespread adoption of Ms Tax Return, as users recognize the value it brings to their tax management practices.

Performance and Case Studies

The success of Ms Tax Return is evident in its performance and the positive outcomes it has delivered for its users. Here are some real-world examples of how Ms Tax Return has made a difference:

| Case Study | Results |

|---|---|

| Small Business Tax Savings | Ms Tax Return helped a local bakery reduce its tax liability by 15% in the first year of use, resulting in significant cost savings and improved cash flow. |

| Individual Tax Refund | A working professional using Ms Tax Return was able to claim a substantial refund, recovering overpayments made in previous years. This unexpected windfall allowed them to invest in a long-awaited vacation. |

| Complex Business Structure | A large corporation with complex tax obligations found Ms Tax Return to be an invaluable tool. The platform's ability to handle multiple entities and intricate tax scenarios simplified their tax filing process, saving them valuable time and resources. |

These case studies highlight the versatility and effectiveness of Ms Tax Return, demonstrating its ability to cater to diverse user needs.

Future Implications and Industry Impact

The impact of Ms Tax Return extends beyond its immediate users. As the platform continues to gain traction, it is shaping the future of tax management and influencing industry practices. Here are some potential implications:

- Standardization of Tax Filing: Ms Tax Return's success may lead to a shift towards more standardized and digital tax filing processes. This could simplify compliance for tax authorities and reduce the administrative burden on businesses and individuals.

- Enhanced Tax Awareness: By providing users with real-time updates and educational resources, Ms Tax Return promotes a higher level of tax awareness. This empowers individuals and businesses to make more informed financial decisions.

- Innovation in Tax Technology: The success of Ms Tax Return is likely to inspire further innovation in tax technology. As more players enter the market, competition will drive the development of even more advanced and user-friendly tax filing solutions.

- Collaboration between Tax Professionals: Ms Tax Return's collaborative features encourage greater collaboration between tax professionals and their clients. This could lead to more efficient and effective tax planning and advisory services.

As Ms Tax Return continues to evolve and adapt to the changing tax landscape, its impact on the industry and society as a whole is expected to grow.

Frequently Asked Questions

Is Ms Tax Return suitable for small businesses with limited financial resources?

+Absolutely! Ms Tax Return is designed with cost efficiency in mind. Its automated features and user-friendly interface make it an ideal solution for small businesses looking to save time and money on tax preparation. With its competitive pricing plans, Ms Tax Return offers an affordable and effective tax filing option.

Can Ms Tax Return handle complex tax scenarios, such as international tax obligations or multiple business entities?

+Yes, Ms Tax Return is built to accommodate complex tax situations. It has advanced features to handle international tax compliance and can manage multiple business entities within the same platform. The platform’s flexibility and adaptability make it suitable for a wide range of tax scenarios.

How secure is Ms Tax Return’s data storage system?

+Ms Tax Return places a high priority on data security. The platform utilizes advanced encryption protocols and robust cloud infrastructure to protect user data. Regular security audits and compliance with industry standards ensure that user information remains safe and confidential.

What support options are available for users of Ms Tax Return?

+Ms Tax Return provides comprehensive support to its users. This includes an extensive knowledge base, video tutorials, and a dedicated customer support team. Users can also connect with tax professionals through the platform for personalized assistance and guidance.

Can Ms Tax Return integrate with other financial management software or accounting systems?

+Absolutely! Ms Tax Return is designed to integrate seamlessly with popular financial management and accounting software. This integration allows for a smooth flow of data between systems, streamlining the tax filing process and reducing the need for manual data entry.