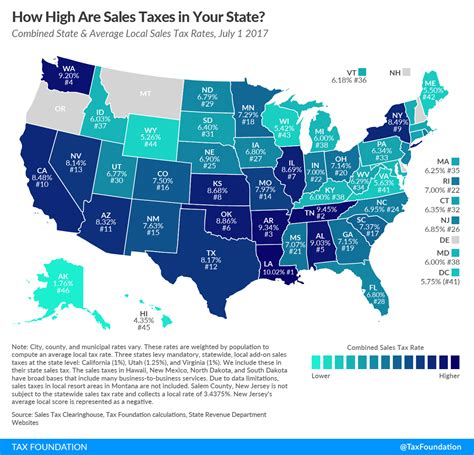

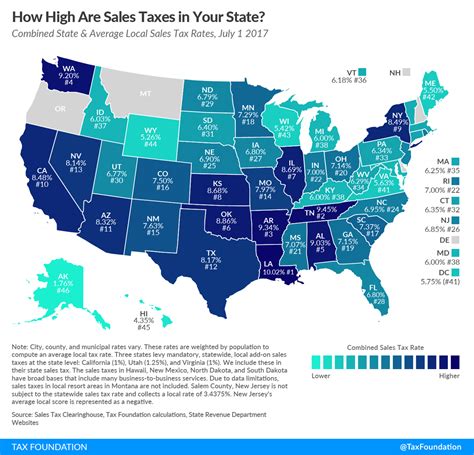

Sales Tax In Louisiana

Louisiana's sales tax system is a complex yet crucial component of the state's revenue stream, impacting both businesses and consumers. With a unique blend of state, local, and special district taxes, understanding the intricacies of Louisiana's sales tax landscape is essential for effective financial planning and compliance. This article aims to provide an in-depth analysis of Louisiana's sales tax, offering a comprehensive guide to its structure, rates, exemptions, and collection processes.

Understanding Louisiana’s Sales Tax Structure

Louisiana’s sales tax is a combined state and local tax, meaning it consists of a state-level tax rate and additional local taxes levied by parishes and municipalities. This two-tiered structure allows for a certain degree of flexibility, as local governments can set their own tax rates to cater to specific community needs and initiatives.

State Sales Tax

The state-level sales tax in Louisiana is set at a 4.45% rate. This rate is uniform across the state and applies to most tangible personal property and certain services. It is important to note that this state tax rate is subject to change, with recent legislative sessions proposing modifications to the tax structure.

| State Sales Tax Rate | Percentage |

|---|---|

| State Sales Tax | 4.45% |

The state sales tax is collected and administered by the Louisiana Department of Revenue, which ensures compliance and manages the distribution of funds to various state programs and services.

Local Sales Taxes

In addition to the state sales tax, local parishes and municipalities have the authority to impose their own sales taxes. These local taxes can significantly impact the overall sales tax rate a consumer pays, as they are added on top of the state tax.

For instance, in the city of New Orleans, the local sales tax is set at 5.85%, bringing the total sales tax rate to 10.30% when combined with the state tax. Similarly, in Baton Rouge, the local sales tax is 5.00%, resulting in a total sales tax rate of 9.45%.

| Location | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| New Orleans | 5.85% | 10.30% |

| Baton Rouge | 5.00% | 9.45% |

Special District Taxes

Louisiana also has special tax districts that can impose additional sales taxes for specific purposes, such as funding transportation projects or supporting cultural initiatives. These special district taxes can further increase the sales tax rate in certain areas.

For example, the River Parishes Special Tax District has a sales tax rate of 0.50%, bringing the total sales tax rate in this district to 10.85% when combined with the state and local taxes.

| Special District | Special District Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| River Parishes Special Tax District | 0.50% | 10.85% |

Sales Tax Exemptions and Special Considerations

While Louisiana’s sales tax applies to a broad range of goods and services, there are several notable exemptions and special considerations that businesses and consumers should be aware of.

Exemptions

Louisiana offers sales tax exemptions for certain goods and services, including:

- Food for Home Consumption: Prepared foods, produce, and other groceries purchased for home consumption are generally exempt from sales tax.

- Prescription Drugs: Sales tax does not apply to prescription medications and certain medical devices.

- Clothing and Shoes: Louisiana exempts clothing and footwear items priced under $25 from sales tax.

- Certain Manufacturing Equipment: Sales tax is waived for the purchase of certain machinery and equipment used in manufacturing processes.

Special Considerations

Louisiana’s sales tax system also includes several special considerations, such as:

- Remote Sellers: Out-of-state sellers who make sales to Louisiana residents must collect and remit sales tax if they meet certain economic thresholds. This is known as the Economic Nexus rule.

- Use Tax: Louisiana residents who purchase goods from out-of-state sellers and do not pay sales tax are required to pay a Use Tax on those purchases.

- Tax Holidays: Louisiana occasionally offers tax-free periods for specific items, such as school supplies or hurricane preparedness items. During these periods, qualifying items are exempt from sales tax.

Sales Tax Collection and Compliance

For businesses operating in Louisiana, understanding the sales tax collection and compliance process is crucial. The Louisiana Department of Revenue provides guidelines and resources to assist businesses in meeting their sales tax obligations.

Registration and Permits

Businesses are required to register for a sales tax permit with the Louisiana Department of Revenue. This permit allows businesses to collect and remit sales tax to the state and local governments.

Sales Tax Calculation and Remittance

Businesses must calculate the sales tax on each transaction by applying the appropriate tax rates (state, local, and special district) based on the customer’s shipping or delivery address. The collected sales tax must then be remitted to the appropriate tax jurisdictions on a regular basis, typically monthly or quarterly.

Sales Tax Filing

In addition to remitting the collected sales tax, businesses are required to file sales tax returns with the Louisiana Department of Revenue. These returns provide a detailed breakdown of the sales tax collected, including the amounts allocated to the state, local, and special district taxes.

Sales Tax Audits

The Louisiana Department of Revenue conducts sales tax audits to ensure compliance. These audits can involve a review of a business’s sales tax records, including invoices, receipts, and tax returns. It is important for businesses to maintain accurate records and have a clear understanding of their sales tax obligations to avoid penalties and fines.

Impact on Businesses and Consumers

Louisiana’s sales tax system has a significant impact on both businesses and consumers in the state.

Businesses

For businesses, navigating Louisiana’s sales tax landscape can be complex, especially with the varying local and special district tax rates. However, a well-informed and compliant sales tax strategy can help businesses avoid penalties and ensure a positive relationship with tax authorities.

Additionally, businesses can leverage sales tax exemptions and special considerations to their advantage. For instance, businesses can pass on sales tax savings to customers through promotional campaigns, enhancing their competitive edge in the market.

Consumers

Consumers in Louisiana are impacted by the sales tax in several ways. The varying tax rates across the state can influence purchasing decisions, with consumers potentially choosing to shop in areas with lower tax rates.

Understanding the sales tax exemptions can also benefit consumers, as they can make more informed choices about their purchases. For example, knowing that certain items like clothing and groceries are exempt from sales tax can help consumers plan their spending more effectively.

Future Outlook and Potential Changes

Louisiana’s sales tax system is subject to ongoing discussions and potential changes. With the state’s evolving economic landscape and the impact of e-commerce, the sales tax structure may undergo modifications to ensure fairness and adaptability.

One potential change could involve simplifying the sales tax structure by reducing the number of local and special district taxes. This could make it easier for businesses to comply with sales tax regulations and provide a more consistent experience for consumers across the state.

Additionally, the continued growth of e-commerce may lead to further discussions around remote seller sales tax collection and the implementation of new tax policies to ensure a level playing field for in-state and out-of-state businesses.

Conclusion

Louisiana’s sales tax system is a complex yet integral part of the state’s financial landscape. By understanding the state, local, and special district tax rates, as well as the exemptions and special considerations, businesses and consumers can navigate this system more effectively.

Staying informed about potential changes and keeping up with sales tax compliance ensures a positive contribution to Louisiana's economy while avoiding unnecessary penalties. For businesses, a strategic approach to sales tax can also enhance their competitive positioning and customer relationships.

What is the overall sales tax rate in Louisiana, including state and local taxes?

+The overall sales tax rate in Louisiana varies depending on the location. It includes the state sales tax rate of 4.45% and local sales tax rates, which can range from 0% to 5.85%. Some areas also have special district taxes, which can further increase the total sales tax rate. Therefore, the overall sales tax rate can range from 4.45% to over 10%, depending on the specific location.

Are there any items exempt from sales tax in Louisiana?

+Yes, Louisiana offers sales tax exemptions for certain items, including food for home consumption, prescription drugs, clothing and shoes under $25, and certain manufacturing equipment. These exemptions can vary depending on the specific circumstances and items involved.

How often do businesses need to remit sales tax in Louisiana?

+Businesses in Louisiana are generally required to remit sales tax on a monthly or quarterly basis. The frequency of remittance depends on the business’s sales volume and can be determined by the Louisiana Department of Revenue. It’s important for businesses to stay compliant with these remittance schedules to avoid penalties.