Mileage Tax California

In the realm of transportation and taxation, California has proposed a novel approach to address the complexities of funding infrastructure and managing vehicle usage: the Mileage Tax. This concept, which has been gaining traction in various states across the US, aims to revolutionize the way we think about road financing and could potentially reshape the future of driving in the Golden State. As we delve into the specifics of this proposed tax, we uncover a fascinating blend of technological innovation, economic strategy, and environmental considerations.

The Mileage Tax: A Paradigm Shift in Transportation Funding

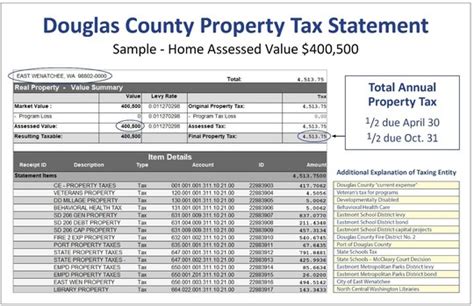

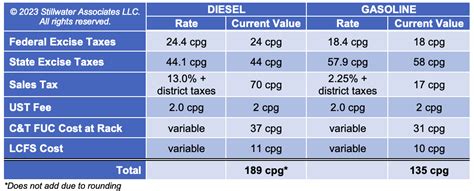

The Mileage Tax, often referred to as a vehicle mileage tax (VMT), is a bold initiative that California is considering to replace the traditional gas tax as a means of funding road maintenance and infrastructure development. This shift is primarily driven by the declining effectiveness of the gas tax in the face of evolving vehicle technologies and changing driving behaviors.

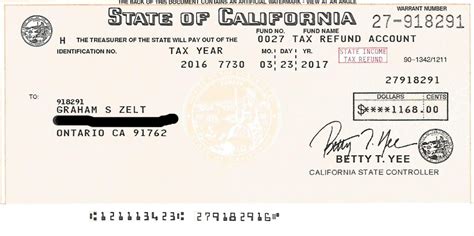

The traditional gas tax, a long-standing method of funding road projects, faces significant challenges due to the rise of electric vehicles (EVs) and improved fuel efficiency. As more drivers opt for EVs or hybrid vehicles, the gas tax revenue diminishes, creating a funding gap for essential road projects. This gap has prompted states like California to explore innovative alternatives, and the Mileage Tax has emerged as a leading contender.

Understanding the Mileage Tax Model

At its core, the Mileage Tax is a user-based system where drivers are charged based on the number of miles they travel. This approach is designed to be more equitable and sustainable, ensuring that all road users contribute proportionally to the costs of maintaining and improving the road network.

The tax rate is typically set at a certain amount per mile, which can vary depending on factors such as vehicle type, time of day, and road conditions. This dynamic pricing structure aims to encourage efficient driving patterns and reduce congestion during peak hours. For instance, drivers might be charged a higher rate during rush hour to incentivize off-peak travel.

| Vehicle Type | Mileage Tax Rate (per mile) |

|---|---|

| Passenger Car | $0.03 |

| Light Truck | $0.04 |

| Heavy Truck | $0.05 |

To implement the Mileage Tax, vehicles would be equipped with GPS-enabled devices that track mileage. These devices, which could be integrated into vehicles or provided by the state, would transmit data to a central system, allowing for precise tax calculation and billing.

Benefits and Challenges of the Mileage Tax

The Mileage Tax offers several advantages. Firstly, it ensures a stable and sustainable revenue stream for road funding, accommodating the changing landscape of vehicle technologies. Secondly, it promotes road usage equity, as all drivers contribute based on their actual mileage, regardless of their vehicle’s fuel type.

However, challenges exist. Privacy concerns are at the forefront, with critics questioning the potential for government surveillance through mileage tracking. Additionally, the cost of implementing and maintaining the necessary infrastructure for this system could be significant. There's also the risk of overburdening low-income drivers who may have to pay more under this system.

Exploring the Environmental Impact

Beyond the fiscal benefits, the Mileage Tax holds significant potential in promoting environmentally conscious driving habits. By incentivizing efficient driving and discouraging excessive mileage, this system could contribute to reducing greenhouse gas emissions and improving air quality, particularly in urban areas.

Studies have shown that the Mileage Tax can lead to a decrease in vehicle miles traveled (VMT), as drivers become more conscious of their mileage-based expenses. This reduction in VMT not only benefits the environment but also helps alleviate congestion, leading to improved traffic flow and reduced travel times.

Embracing a Greener Future

The environmental advantages of the Mileage Tax are further enhanced by its ability to differentiate tax rates based on factors like vehicle emissions. For instance, higher tax rates could be applied to vehicles with higher emissions, encouraging drivers to consider more eco-friendly options. This strategy, known as “green pricing,” has the potential to accelerate the transition to electric and low-emission vehicles.

| Vehicle Emissions Category | Mileage Tax Rate (per mile) |

|---|---|

| Electric Vehicles | $0.02 |

| Hybrid Vehicles | $0.03 |

| Conventional Vehicles | $0.04 |

Furthermore, the data collected from mileage tracking devices can provide valuable insights into driving patterns, allowing for better planning and management of road infrastructure. This data-driven approach can lead to more efficient road maintenance and construction, reducing the environmental impact of these activities.

Implementing the Mileage Tax: A Step-by-Step Guide

The transition to a Mileage Tax system is a complex process that requires careful planning and execution. Here’s a step-by-step breakdown of how California could potentially implement this innovative tax:

1. Legislative Approval

The first step is gaining legislative support. This involves drafting and passing a bill that outlines the details of the Mileage Tax, including tax rates, vehicle classifications, and privacy protections. The bill should also address the concerns of various stakeholder groups, such as transportation experts, environmental organizations, and the automotive industry.

2. Technology Infrastructure

Once the legislation is in place, the state needs to invest in the necessary technology infrastructure. This includes developing a robust GPS tracking system that can accurately record mileage data. The system should be designed with privacy and security in mind, ensuring that personal data is protected and used solely for tax purposes.

3. Vehicle Registration Process

During vehicle registration or re-registration, drivers would be informed about the new Mileage Tax system and provided with options for installing tracking devices. These devices could be integrated into the vehicle’s onboard diagnostics (OBD) system or provided as separate units that drivers can install themselves.

4. Public Education and Outreach

A comprehensive public education campaign is crucial to ensure widespread acceptance and understanding of the Mileage Tax. This campaign should explain the benefits of the system, address common concerns, and provide clear instructions on how to comply with the new tax.

5. Pilot Programs

Before full-scale implementation, pilot programs can be conducted in select regions or with specific vehicle types to test the system’s effectiveness and gather feedback. These trials allow for fine-tuning of the tax rates and technology, ensuring a smoother rollout when the system goes live.

6. Data Management and Analysis

The data collected from the tracking devices will need to be securely stored and analyzed. This data can provide valuable insights into driving behaviors, helping to identify areas where congestion is high or where infrastructure improvements are needed. It can also assist in evaluating the success of the Mileage Tax in terms of revenue generation and environmental impact.

7. Tax Collection and Billing

The final step is the actual collection of the Mileage Tax. This process can be integrated into the existing tax system, with drivers receiving regular bills based on their recorded mileage. The billing system should be designed to be user-friendly, allowing drivers to easily understand their tax obligations and make payments.

Addressing Privacy Concerns

One of the most significant challenges in implementing the Mileage Tax is addressing privacy concerns. The idea of government-mandated tracking devices raises questions about surveillance and data protection. To alleviate these concerns, California can adopt several measures to ensure privacy and security.

1. Data Encryption and Anonymization

All data collected from the tracking devices should be encrypted to prevent unauthorized access. Additionally, the data should be anonymized, meaning that it is not directly linked to an individual driver. This ensures that the data can be used for tax purposes without revealing personal information.

2. Limited Data Retention

The state should implement policies that limit the retention period of mileage data. For example, data could be stored for only a year, after which it is securely deleted. This reduces the risk of long-term surveillance and ensures that the data is used solely for its intended purpose.

3. Audit and Oversight

An independent audit committee can be established to oversee the collection, storage, and use of mileage data. This committee would ensure that the data is handled securely and in accordance with privacy laws. Regular audits can provide transparency and build public trust in the Mileage Tax system.

4. Opt-Out Options

To accommodate privacy-conscious individuals, the state could offer opt-out options. Drivers who prefer not to have their mileage tracked could choose to pay a flat rate based on average mileage or a higher tax rate to cover the administrative costs of managing opt-outs.

5. Public Education on Privacy Measures

A crucial aspect of addressing privacy concerns is educating the public about the measures taken to protect their data. Clear and concise information about data encryption, anonymization, and limited retention can help alleviate fears and build support for the Mileage Tax.

The Future of Transportation Funding

As California explores the Mileage Tax as a potential replacement for the gas tax, it is stepping into uncharted territory. This innovative approach has the potential to revolutionize how we fund and manage our transportation infrastructure, but it also presents a host of challenges and opportunities.

Equitable Funding for Infrastructure

One of the primary goals of the Mileage Tax is to ensure that road funding is equitable and sustainable. By charging drivers based on their actual mileage, the system can generate a more reliable revenue stream, especially as more drivers opt for electric or hybrid vehicles, which are not subject to the gas tax.

Encouraging Sustainable Transportation

The Mileage Tax has the potential to influence driving behaviors and encourage more sustainable transportation choices. For instance, drivers may opt for public transportation or carpooling to reduce their mileage and associated taxes. This shift could lead to a reduction in traffic congestion and a decrease in greenhouse gas emissions, contributing to a greener and more efficient transportation system.

Challenges and Adaptations

However, implementing the Mileage Tax is not without its challenges. As discussed earlier, privacy concerns and the cost of implementing the necessary technology are significant hurdles. Additionally, there is the risk of overburdening certain segments of the population, such as low-income drivers or those who live in rural areas with limited public transportation options.

To address these challenges, California may need to explore additional strategies, such as offering tax credits or rebates for low-income drivers or providing incentives for the adoption of electric vehicles. These adaptations could help ensure that the Mileage Tax is implemented fairly and does not disproportionately affect certain communities.

International Perspectives

California is not alone in its exploration of Mileage Tax systems. Several countries and states around the world have already implemented or are considering similar initiatives. For instance, the Netherlands has a road pricing system that charges drivers based on their mileage and the type of road they use. This system has successfully generated revenue for infrastructure maintenance and has led to a reduction in traffic congestion.

Learning from these international examples can provide valuable insights for California as it navigates the complexities of implementing the Mileage Tax. By studying the successes and challenges of other jurisdictions, California can refine its approach and develop a system that is tailored to its unique transportation needs and cultural context.

Frequently Asked Questions

How will the Mileage Tax impact my wallet?

+

The financial impact of the Mileage Tax will depend on your driving habits. If you drive fewer miles than the average driver, you may see a decrease in your transportation costs. However, if you drive significantly more, your costs may increase. The tax is designed to be fair and proportional, so it’s essential to consider your mileage when evaluating the potential financial impact.

What happens if I drive an electric vehicle under the Mileage Tax system?

+

Electric vehicle (EV) drivers will still be subject to the Mileage Tax, as the system is designed to ensure all road users contribute to infrastructure funding. However, EV drivers may benefit from lower tax rates, as the system often incentivizes environmentally friendly vehicles. This encourages the adoption of EVs and aligns with California’s environmental goals.

How will the Mileage Tax data be used, and is my privacy protected?

+

The data collected from the Mileage Tax system will be used primarily for calculating tax obligations and ensuring equitable road funding. To protect your privacy, the data is anonymized, meaning it is not linked to your personal identity. Additionally, the state will implement strict data security measures to prevent unauthorized access and ensure your information is safeguarded.

Can I opt out of the Mileage Tax if I’m concerned about privacy?

+

While the Mileage Tax is designed to be a fair and efficient system, California recognizes the importance of privacy. If you have strong privacy concerns, you may be able to opt out by paying a flat rate or a higher tax to cover administrative costs. However, it’s essential to note that this option may not be available to everyone, and the state is committed to addressing privacy concerns within the Mileage Tax system.

When can we expect the Mileage Tax to be implemented in California?

+

The implementation timeline for the Mileage Tax in California is still under discussion and depends on various factors, including legislative approval and the development of the necessary infrastructure. While it’s challenging to provide an exact date, the state is actively exploring this innovative tax system, and updates will be provided as the process progresses.