Sc Vehicle Property Tax

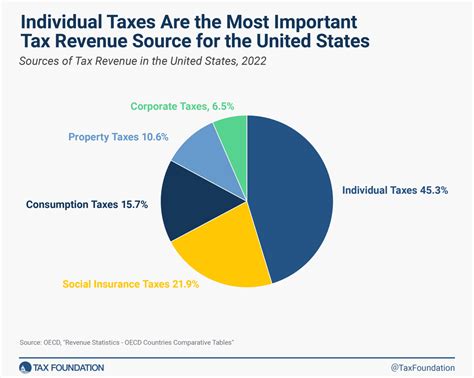

Vehicle property tax is an essential aspect of vehicle ownership in South Carolina, as it contributes to the state's revenue and ensures the maintenance of roads and infrastructure. This tax is an annual assessment based on the value of your vehicle, and it's important for residents to understand the process, rates, and exemptions to stay compliant with the law. Let's delve into the specifics of the South Carolina Vehicle Property Tax and explore its various aspects.

Understanding the SC Vehicle Property Tax

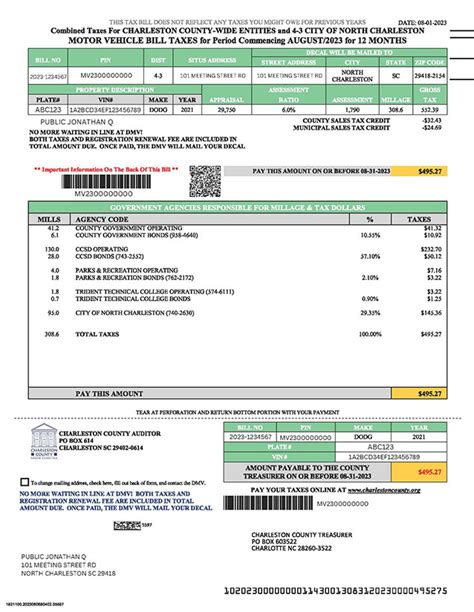

The Vehicle Property Tax in South Carolina is an ad valorem tax, meaning it is based on the assessed value of your vehicle. This tax is levied annually and is due by January 15th of each year. Failure to pay the tax on time may result in penalties and interest, and it’s crucial to stay informed about the process to avoid any legal repercussions.

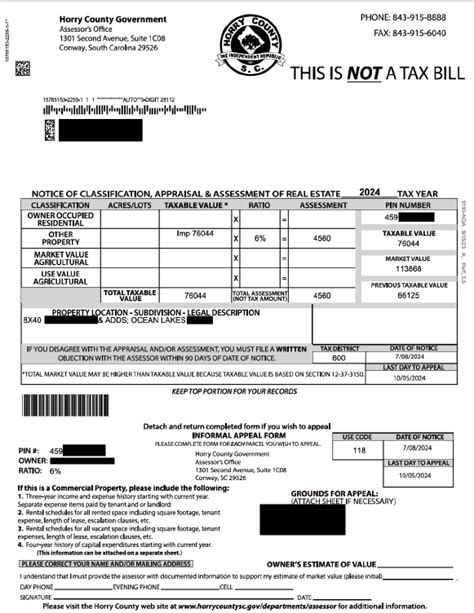

The South Carolina Department of Revenue (SCDOR) is responsible for administering the vehicle property tax. They provide detailed guidelines and resources to help taxpayers understand their obligations. The tax is calculated based on the vehicle's taxable value, which is determined by the vehicle's make, model, and age. This value is then multiplied by the applicable tax rate to arrive at the final tax amount.

It's important to note that South Carolina offers a 5% discount on vehicle property taxes if the payment is made before January 1st. This incentive encourages timely payments and provides a financial benefit to taxpayers.

Tax Rates and Assessments

The tax rates for the SC Vehicle Property Tax vary depending on the county in which the vehicle is registered. Each county has its own tax rate, which is set by the county council or governing body. These rates can be found on the SCDOR website, providing transparency and allowing taxpayers to calculate their expected tax liability accurately.

| County | Tax Rate |

|---|---|

| Charleston | 1.5% |

| Greenville | 1.3% |

| Horry | 1.2% |

| Richland | 1.6% |

| Spartanburg | 1.4% |

The taxable value of a vehicle is determined by the SCDOR using a formula that considers the vehicle's original purchase price, its age, and any applicable depreciation factors. This assessment ensures that the tax is fair and proportional to the vehicle's value. The assessed value is then used to calculate the tax amount for each county.

Exemptions and Special Cases

South Carolina offers certain exemptions and special provisions for vehicle property taxes. These exemptions are designed to provide relief to specific groups of taxpayers and promote equity in the tax system.

- Military Exemption: Active-duty military personnel and their spouses are eligible for a full exemption from vehicle property taxes while stationed in South Carolina. This exemption is a way to show gratitude for their service and support military families.

- Disabled Veteran Exemption: Veterans with a service-connected disability of 100% are entitled to a full exemption. Additionally, veterans with a disability rating of 50% or more can receive a partial exemption.

- Senior Citizen Exemption: South Carolina residents aged 65 or older may be eligible for an exemption if their annual household income is below a certain threshold. This exemption provides relief to seniors who may be on a fixed income.

- Disabled Persons Exemption: Individuals with a permanent and total disability can apply for a full exemption. This exemption ensures that those with significant disabilities are not disproportionately burdened by vehicle property taxes.

It's important to note that exemptions must be applied for annually and may require specific documentation to prove eligibility. The SCDOR provides detailed guidelines and application forms for each exemption category on their website.

Payment Options and Online Services

South Carolina offers convenient payment options for vehicle property taxes to cater to different preferences and needs. Taxpayers can choose to pay their taxes online, by mail, or in person at designated locations.

Online Payment

The SCDOR’s online payment portal is a secure and efficient way to pay vehicle property taxes. Taxpayers can access their account, view their tax liability, and make payments using a credit or debit card. This option provides a fast and convenient way to settle tax obligations without the need for physical visits.

Mail-In Payment

For those who prefer traditional methods, South Carolina allows taxpayers to pay their vehicle property taxes by mailing a check or money order to the SCDOR. The payment should be accompanied by the appropriate form and mailed to the address provided on the SCDOR website. This option ensures privacy and security for those who are cautious about online transactions.

In-Person Payment

South Carolina also offers the option to pay vehicle property taxes in person at designated locations. Taxpayers can visit their local county treasurer’s office or an authorized payment center to make their payment. This option provides an opportunity for taxpayers to seek assistance and clarification directly from tax officials.

Vehicle Registration and Renewal

The vehicle property tax is closely tied to the process of vehicle registration and renewal in South Carolina. When registering a new vehicle or renewing an existing registration, taxpayers must provide proof of payment or exemption from the vehicle property tax.

The South Carolina Department of Motor Vehicles (DMV) handles vehicle registration and renewal. They work closely with the SCDOR to ensure that taxpayers are aware of their tax obligations and that the registration process is seamless.

Registration Process

When registering a new vehicle, taxpayers must provide the necessary documentation, including proof of insurance, title, and registration fee. Additionally, they must provide evidence of vehicle property tax payment or exemption. The DMV staff can assist taxpayers in understanding their tax obligations and ensuring compliance.

Renewal Process

Vehicle registration renewal typically occurs annually, and taxpayers must renew their registration by the expiration date. Similar to the registration process, taxpayers must provide proof of vehicle property tax payment or exemption when renewing their registration. The DMV provides online and in-person options for renewal, making it convenient for taxpayers to stay up to date with their obligations.

Future Implications and Potential Changes

As South Carolina’s economy and vehicle ownership landscape evolve, the vehicle property tax system may undergo changes to adapt to new circumstances. The SCDOR and relevant authorities continuously evaluate the tax system to ensure fairness, efficiency, and compliance.

Potential future changes could include adjustments to tax rates, assessment methods, or the introduction of new exemptions. These changes aim to keep the tax system up-to-date and responsive to the needs of taxpayers and the state's revenue requirements.

It's important for taxpayers to stay informed about any updates or announcements regarding the vehicle property tax. The SCDOR's website and official communication channels are the primary sources for such information, ensuring that taxpayers can adapt to any changes smoothly.

Conclusion

The SC Vehicle Property Tax is a crucial component of vehicle ownership in South Carolina, contributing to the state’s revenue and infrastructure development. Understanding the tax rates, assessment methods, and exemptions is essential for taxpayers to fulfill their obligations and stay compliant with the law.

South Carolina's approach to vehicle property taxes, with its county-specific rates and various exemptions, ensures a balanced and equitable system. The SCDOR's efforts to provide resources and guidance make the tax process transparent and accessible to all residents. By staying informed and utilizing the available payment options, taxpayers can efficiently manage their vehicle property tax obligations.

FAQ

What happens if I miss the vehicle property tax payment deadline?

+If you miss the January 15th deadline, you may be subject to penalties and interest. It’s important to pay the tax as soon as possible to avoid additional fees and maintain compliance with the law.

How can I estimate my vehicle property tax before receiving the official assessment?

+You can use the SCDOR’s online calculator to estimate your vehicle property tax. This tool considers your vehicle’s make, model, age, and county tax rate to provide an approximate tax amount. It’s a useful tool for budgeting and planning.

Are there any discounts or incentives for paying the vehicle property tax early?

+Yes, South Carolina offers a 5% discount on vehicle property taxes if you pay before January 1st. This incentive encourages timely payments and can save you a significant amount on your tax liability.

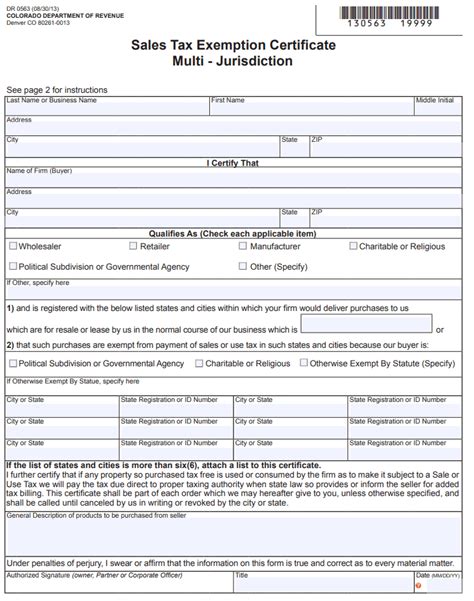

How do I apply for a vehicle property tax exemption?

+To apply for a vehicle property tax exemption, you must meet the specific eligibility criteria for the exemption you’re applying for. The SCDOR provides detailed guidelines and application forms on their website. It’s important to review the requirements and submit the necessary documentation to ensure a successful application.

Can I pay my vehicle property tax in installments?

+South Carolina does not offer an official installment plan for vehicle property taxes. However, if you’re facing financial difficulties, you may discuss your situation with the SCDOR to explore potential payment arrangements. It’s important to maintain open communication and seek assistance when needed.