When Do Taxes Have To Be Filed 2025

Taxes are an essential aspect of financial management, and understanding the deadlines for filing your taxes is crucial to ensure compliance with the law and avoid any penalties. In this comprehensive guide, we will delve into the specifics of tax filing deadlines for the year 2025, providing you with all the information you need to stay organized and on top of your financial responsibilities.

Understanding the Tax Filing Deadlines for 2025

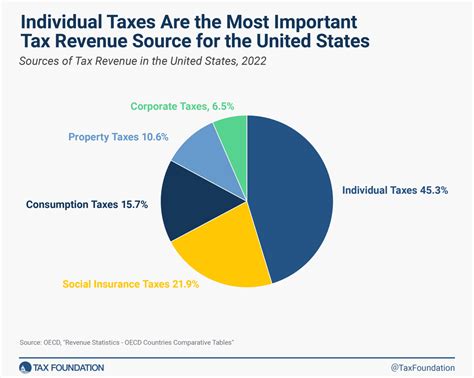

The Internal Revenue Service (IRS) sets specific deadlines for taxpayers to file their annual tax returns. These deadlines are designed to ensure a smooth and efficient tax filing process, allowing the IRS to process returns and issue refunds in a timely manner. For the tax year ending December 31, 2025, the key dates to keep in mind are as follows:

- Regular Filing Deadline: April 15, 2026 - This is the standard deadline for most taxpayers to file their federal income tax returns. It is important to note that this date is a general guideline, and certain circumstances may require earlier or later filing.

- Extension Deadline: October 15, 2026 - If you are unable to meet the regular filing deadline, you may request an extension of time to file your return. However, it's crucial to understand that an extension only provides more time to file, not to pay any taxes owed. Interest and penalties may still apply if you have a tax liability.

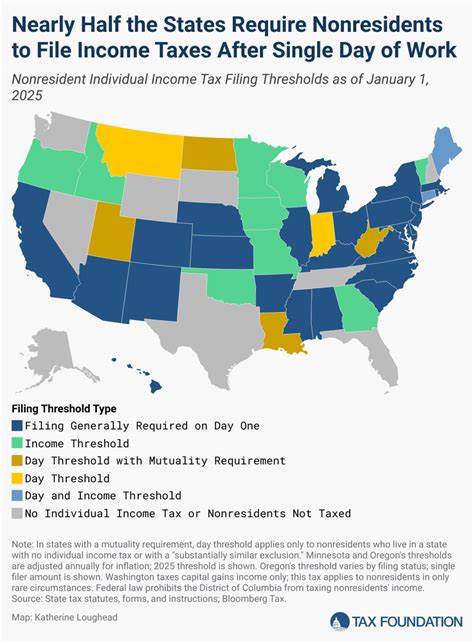

- State Tax Deadlines: State tax deadlines may vary, so it's essential to check the specific regulations in your state. Some states follow the federal deadline, while others may have earlier or later due dates. Stay informed about your state's tax requirements to avoid any surprises.

Special Considerations for Tax Filing

While the above deadlines provide a general framework, there are certain situations that may warrant special consideration when it comes to tax filing:

- Military Personnel: Active-duty military personnel serving outside the United States may be eligible for an extended filing deadline. The IRS recognizes the unique circumstances of military service and provides additional time to file tax returns. Check the IRS website for specific guidelines and instructions.

- Affected by Natural Disasters: In the event of a federally declared disaster, the IRS may offer special tax relief to affected individuals and businesses. This may include extended filing deadlines and other forms of assistance. Keep an eye on IRS announcements and updates related to any natural disasters that may impact your area.

- Foreign Residents and Non-Resident Aliens: Foreign residents and non-resident aliens may have different tax filing requirements and deadlines. It's crucial to consult the IRS website or seek professional tax advice to ensure compliance with the specific regulations that apply to your situation.

Preparing for Tax Season: A Comprehensive Guide

To ensure a smooth tax filing process, it’s beneficial to start preparing well in advance. Here are some key steps to help you get ready for tax season in 2025:

- Gather Your Documents: Collect all the necessary documents, such as W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial records. Having your paperwork organized will make the filing process more efficient.

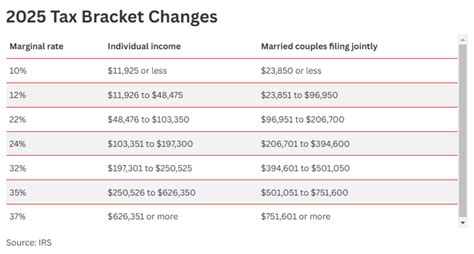

- Review Tax Changes: Stay updated on any changes to tax laws and regulations that may impact your tax situation. The IRS website provides comprehensive information on tax law changes, deductions, and credits. Understanding these changes can help you maximize your tax benefits.

- Consider Professional Assistance: If you have a complex tax situation or are unsure about certain aspects of your return, seeking professional tax advice can be beneficial. Tax professionals can help ensure accurate filing and maximize your deductions and credits.

- Choose Your Filing Method: Decide whether you prefer to file your taxes electronically or on paper. Electronic filing is generally faster and more secure, and the IRS encourages taxpayers to use this method. However, if you prefer a more traditional approach, paper filing is still an option.

- Understand Payment Options: If you anticipate owing taxes, explore the various payment options available. The IRS offers payment plans and installment agreements for taxpayers who cannot pay their tax liability in full. Understanding these options can help you manage your tax obligations effectively.

The Benefits of Early Tax Filing

While the official filing deadline is April 15, 2026, there are advantages to filing your taxes early. Here are some reasons why early tax filing can be beneficial:

- Faster Refund Processing: If you are entitled to a tax refund, filing early can expedite the process. The IRS typically issues refunds within 21 days of receiving an e-filed return, so you can receive your refund sooner.

- Reduced Error Risk: Filing early gives you more time to review your return carefully and identify any potential errors. By catching mistakes early on, you can avoid unnecessary delays or complications during the tax filing process.

- Peace of Mind: Getting your taxes filed early can provide a sense of relief and peace of mind. You won't have to worry about last-minute deadlines or the stress of completing your return at the last possible moment.

Stay Informed, Stay Compliant

Tax laws and regulations can be complex, and staying informed is essential to ensure compliance. The IRS website is a valuable resource, offering a wealth of information on tax-related topics. Additionally, seeking guidance from tax professionals or utilizing reputable tax preparation software can further assist in navigating the tax landscape.

By understanding the tax filing deadlines for 2025 and taking proactive steps to prepare, you can approach tax season with confidence. Remember, staying organized, gathering your documents, and seeking professional advice when needed can make the tax filing process more manageable and less stressful.

FAQ

What happens if I miss the tax filing deadline without an extension?

+

If you miss the tax filing deadline without a valid extension, you may face penalties and interest charges. The IRS may impose a failure-to-file penalty, which is typically 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%. Additionally, interest may accrue on any unpaid tax liability. It’s important to note that requesting an extension to file does not extend the deadline to pay any taxes owed.

Can I file my taxes electronically if I don’t have internet access at home?

+

Yes, you can still file your taxes electronically even if you don’t have internet access at home. You can visit a local tax preparation office, library, or community center that offers free tax filing assistance. These locations often provide computers and internet access for taxpayers to file their returns electronically. Alternatively, you can consider using tax preparation software that allows you to complete and file your return offline and then upload it to the IRS website when you have internet access.

Are there any advantages to filing a paper tax return instead of electronically filing?

+

While electronic filing is generally faster and more secure, there may be situations where filing a paper tax return is preferred. For instance, if you have complex tax situations or require special accommodations, filing a paper return may be more suitable. Additionally, some taxpayers may prefer the traditional approach or have concerns about data security. However, it’s important to note that electronic filing is encouraged by the IRS due to its efficiency and reduced error risk.

What should I do if I receive a notice from the IRS regarding my tax return?

+

If you receive a notice from the IRS, it’s important to respond promptly and carefully. The IRS sends notices for various reasons, such as missing information, discrepancies, or inquiries about your tax return. Read the notice thoroughly and take the necessary actions as requested. You may need to provide additional documentation or clarify certain aspects of your return. Seeking professional tax advice can be beneficial in understanding and responding to IRS notices.

Can I amend my tax return if I discover an error after filing?

+

Yes, you can amend your tax return if you discover an error or need to make changes after filing. The process for amending a return involves completing and submitting Form 1040X, which is the Amended U.S. Individual Income Tax Return. It’s important to note that there are time limits for amending returns, and you may be subject to additional taxes, penalties, or interest if the amendment results in a higher tax liability. Consult the IRS website or a tax professional for guidance on amending your tax return.