Co State Sales Tax

Welcome to a comprehensive exploration of the Colorado State Sales Tax, a crucial aspect of the state's revenue generation and an important consideration for businesses and consumers alike. This article aims to provide an in-depth understanding of Colorado's sales tax system, its rates, exemptions, and its impact on the state's economy.

Colorado, known for its stunning natural landscapes and vibrant cities, has a unique approach to sales taxation. The state's sales tax system is a complex yet well-regulated structure that contributes significantly to its fiscal stability. Understanding this system is essential for businesses operating within the state and for individuals making purchasing decisions.

Understanding the Colorado State Sales Tax

The Colorado State Sales Tax is a consumption tax imposed on the sale of tangible personal property and certain services within the state. It is a critical component of Colorado’s tax revenue, providing a stable source of funding for various state services and initiatives.

The tax is applied at the point of sale, with the burden often falling on the purchaser. However, it's the responsibility of the seller to collect and remit the tax to the appropriate authorities. Colorado's sales tax system is governed by the Department of Revenue, which sets the rules and regulations for tax compliance.

What sets Colorado's sales tax apart is its progressive nature. Unlike some states with a flat sales tax rate, Colorado's tax structure varies based on the type of goods or services being sold. This means that different items may be taxed at different rates, creating a more nuanced tax landscape.

Sales Tax Rates and Calculations

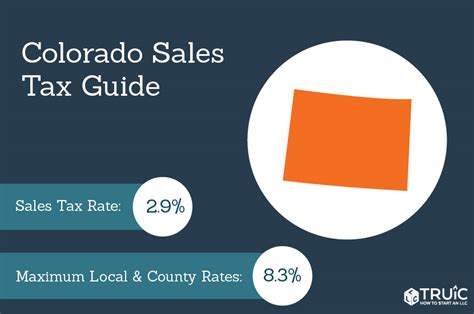

The sales tax rate in Colorado is composed of a statewide base rate and optional local rates imposed by counties, cities, and special districts. This combination of rates results in varying tax burdens across the state.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| Statewide Base Rate | 2.9% |

| Denver County | 7.62% |

| Boulder County | 7.68% |

| El Paso County | 6.2% |

| Larimer County | 7.25% |

| Jefferson County | 7.25% |

| More Local Jurisdictions | Varies |

For example, in the city of Denver, the total sales tax rate is 7.62%, comprising the statewide base rate and additional local taxes. This means that a $100 purchase in Denver would incur a sales tax of $7.62, while the same purchase in another county with a lower tax rate would result in a lower tax liability.

Calculating the sales tax is a straightforward process. The tax is typically calculated as a percentage of the purchase price, with the rate determined by the location of the sale. For businesses, this means understanding the tax rates in all the jurisdictions they operate in.

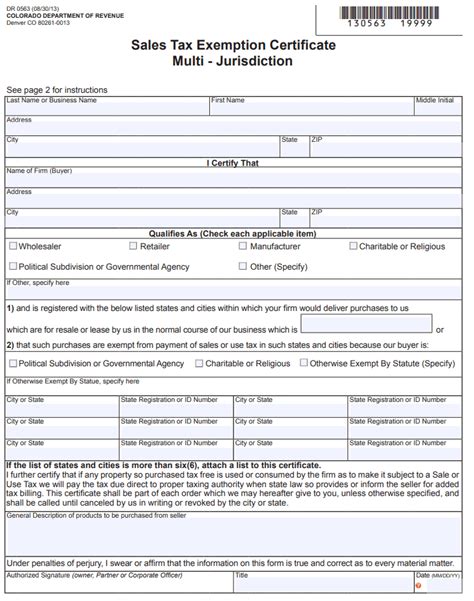

Exemptions and Special Considerations

Colorado’s sales tax system also includes a range of exemptions and special provisions that can significantly impact tax liabilities. These exemptions are designed to promote certain industries, support social causes, and encourage economic development.

One notable exemption is for groceries, which are tax-exempt in Colorado. This means that essential food items are not subject to the state's sales tax, providing a relief for households' grocery budgets.

Additionally, charitable organizations and non-profit entities often benefit from sales tax exemptions when they make purchases related to their missions. This encourages charitable activities and supports the state's non-profit sector.

However, it's important to note that while Colorado offers a wide range of exemptions, the state also has a use tax to ensure that all purchases, even those made outside the state, are taxed. This use tax applies to items purchased online or from out-of-state vendors, ensuring fairness and consistency in tax collection.

Impact on Businesses and Consumers

The Colorado State Sales Tax has a significant influence on both businesses and consumers within the state.

Businesses

For businesses, understanding and complying with the state’s sales tax regulations is a critical aspect of their operations. Accurate tax calculation and remittance are essential to avoid legal repercussions and maintain a positive relationship with the state.

Businesses often utilize sales tax automation tools to simplify the process of calculating and collecting sales tax. These tools help ensure compliance, especially in regions with varying tax rates. Additionally, staying informed about the state's tax incentives and exemptions can provide opportunities for cost savings and business growth.

Consumers

Consumers in Colorado play a vital role in the state’s economy through their purchasing decisions. The sales tax directly affects their spending power and budget planning. Understanding the tax rates and exemptions can help consumers make informed choices and manage their finances effectively.

The sales tax also influences consumer behavior. For instance, individuals may choose to shop in counties with lower tax rates to save money, or they may opt for tax-free items when possible. This dynamic can impact local economies and the distribution of tax revenue across the state.

The Future of Colorado’s Sales Tax

As Colorado’s economy continues to evolve, so too will its sales tax system. The state’s dynamic nature, with its growing population and diverse industries, presents both challenges and opportunities for tax policy.

One potential future development is the expansion of online sales tax collection. With the rise of e-commerce, ensuring that all online purchases are taxed fairly is a priority for state governments. Colorado may further refine its use tax regulations to adapt to the changing retail landscape.

Additionally, the state may consider adjusting its sales tax rates to respond to economic fluctuations or to support specific initiatives. For instance, increasing the sales tax temporarily to fund infrastructure projects or reduce the state's debt has been a strategy employed by other states.

In the long term, the integration of technology in tax administration is likely to play a significant role. Colorado could explore innovative solutions like blockchain technology for secure and transparent tax collection, or leverage artificial intelligence for more efficient tax audits and compliance checks.

Conclusion

The Colorado State Sales Tax is a vital component of the state’s fiscal health and economic stability. Its progressive nature, varying rates, and exemptions create a complex yet intriguing tax landscape. Understanding this system is crucial for businesses and consumers alike, as it directly impacts their operations and purchasing decisions.

As Colorado continues to thrive, its sales tax system will evolve to meet the needs of its growing economy. Staying informed about these changes will be essential for all stakeholders to navigate the state's tax landscape effectively.

What is the statewide base sales tax rate in Colorado?

+The statewide base sales tax rate in Colorado is 2.9% as of the latest available information.

Are there any sales tax holidays in Colorado?

+Yes, Colorado does have sales tax holidays. For instance, there’s an annual back-to-school sales tax holiday where certain school supplies and clothing items are exempt from sales tax for a designated period.

How often do sales tax rates change in Colorado?

+Sales tax rates can change periodically, typically as a result of legislative actions or voter-approved ballot measures. However, the statewide base rate has remained stable for several years.