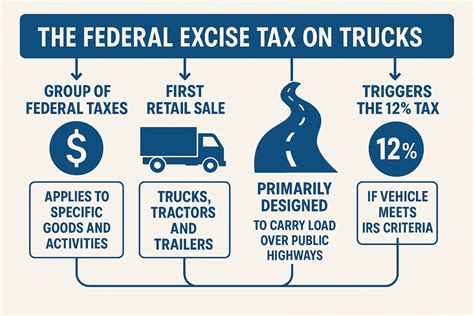

Federal Excise Tax

The Federal Excise Tax (FET) is an important revenue source for the United States government, impacting various industries and consumers across the country. It is a tax levied on specific goods and services, primarily those considered luxuries or harmful to health. This article aims to delve into the intricacies of the Federal Excise Tax, exploring its history, current implications, and future prospects.

Understanding Federal Excise Tax

The Federal Excise Tax is a crucial component of the US tax system, distinct from income taxes and sales taxes. It is a consumption tax, imposed on the sale or use of certain goods and services, making it an indirect tax paid by consumers. FET is governed by the Internal Revenue Code (IRC), specifically Chapter 32, and is administered by the Internal Revenue Service (IRS). The tax is often included in the price of the product, ensuring that consumers pay it indirectly when making purchases.

Historical Perspective

The roots of the Federal Excise Tax can be traced back to the early 20th century when the US government sought to diversify its revenue sources beyond income taxes. The first FET was introduced in 1901 on tobacco products, marking the beginning of a system that has since expanded to cover a wide range of goods and services. Over the years, the tax has been used as a tool to promote public health, discourage certain behaviors, and generate revenue for specific purposes.

For instance, the Revenue Act of 1917, enacted during World War I, expanded the scope of FET to include items like tires, automobiles, and telephone services. This act demonstrated the government's ability to use excise taxes as a means to generate significant revenue during times of economic strain and national emergency.

Taxable Items and Rates

FET is applicable to a diverse range of goods and services, each with its own specific tax rate. Some common categories include:

- Tobacco Products: Cigarettes, cigars, and smokeless tobacco are subject to FET, with rates varying based on the type of product. For example, the tax on small cigars is 0.0566 per cigar, while the rate for roll-your-own tobacco is 24.78 per pound.

- Alcoholic Beverages: Excise taxes on alcohol vary depending on the type of beverage. For instance, beer is taxed at 18 per barrel, while the tax on distilled spirits is 13.50 per proof gallon.

- Transportation: FET is imposed on various transportation-related items, such as airline tickets, gasoline, and heavy trucks. The tax rate on gasoline, for instance, is $0.184 per gallon.

- Communications: Certain communication services and products, like airtime and prepaid calling cards, are subject to FET.

- Environmental Taxes: The government levies FET on items that have a significant environmental impact, such as ozone-depleting chemicals and indoor tanning services.

| Category | Tax Rate |

|---|---|

| Small Cigars | $0.0566 per cigar |

| Roll-Your-Own Tobacco | $24.78 per pound |

| Beer | $18 per barrel |

| Distilled Spirits | $13.50 per proof gallon |

| Gasoline | $0.184 per gallon |

The Impact of Federal Excise Tax

FET has a significant impact on both businesses and consumers, influencing purchasing decisions, industry practices, and government revenue.

Revenue Generation

The primary purpose of FET is to generate revenue for the federal government. In the fiscal year 2021, the IRS collected over $81 billion in excise taxes, with a significant portion coming from FET on tobacco, alcohol, and transportation.

This revenue is often used to fund specific government programs and initiatives. For example, the Highway Trust Fund, which is used to maintain and improve the nation's highways, receives a large share of the FET revenue from gasoline and heavy truck taxes.

Behavioral Influence

FET is not solely about revenue generation; it also serves as a tool to influence consumer behavior and promote public health. By imposing higher taxes on items like tobacco and alcohol, the government aims to discourage their consumption, leading to potential health benefits for the population.

Additionally, FET can be used to promote certain industries or technologies. For instance, the government might reduce the tax rate on electric vehicles to encourage their adoption, thus promoting a more sustainable transportation sector.

Industry Implications

The introduction or change in FET rates can have significant implications for industries. Higher taxes can increase production costs, leading to potential price hikes for consumers. Conversely, lower taxes can stimulate demand and encourage industry growth.

For example, the FET on indoor tanning services, which was introduced in 2010, led to a decline in the number of tanning salons across the country. This tax, aimed at discouraging the use of tanning beds due to their potential health risks, had a direct impact on the tanning industry's revenue and operations.

Future of Federal Excise Tax

As the US tax landscape continues to evolve, the future of FET is likely to be shaped by a combination of economic, social, and political factors.

Potential Reforms

There have been ongoing discussions about reforming the excise tax system to make it more efficient and equitable. Some proposals include simplifying the tax code by reducing the number of taxable items or adjusting rates to reflect current economic realities.

For instance, the idea of a "carbon tax" has gained traction in recent years, with proponents arguing that it could encourage a transition to cleaner energy sources and reduce carbon emissions. Such a tax would be a significant shift in the FET landscape, targeting an entirely new category of goods and services.

Technological Advancements

The rise of digital technologies and e-commerce has presented new challenges for FET collection. The IRS is continually working to adapt its systems and processes to ensure accurate tax collection in the digital age.

One potential solution is the use of blockchain technology, which could provide a secure and transparent way to track and collect FET on digital goods and services. This would not only improve tax collection efficiency but also reduce the risk of tax evasion.

Public Health and Social Issues

FET is likely to continue playing a role in public health initiatives. As new health concerns emerge, such as the potential risks associated with vaping, the government might consider introducing FET on e-cigarettes and similar products.

Additionally, with the increasing focus on social issues like climate change and income inequality, FET could be used as a tool to address these challenges. For example, a carbon tax could generate revenue to fund environmental initiatives, while a progressive tax system could help redistribute wealth and reduce income disparities.

Conclusion

The Federal Excise Tax is a complex and dynamic component of the US tax system, with far-reaching implications for businesses, consumers, and the government. As the tax landscape continues to evolve, it is crucial for stakeholders to stay informed about FET changes and their potential impact.

Whether it's understanding the tax rates on specific goods, recognizing the behavioral influence of FET, or staying updated on potential reforms, a comprehensive knowledge of Federal Excise Tax is essential for navigating the US tax system effectively.

How often are Federal Excise Tax rates updated?

+The IRS adjusts excise tax rates periodically, typically to account for inflation and other economic factors. These adjustments are usually made annually, and the new rates are effective from January 1st of the following year.

Are there any industries that are exempt from Federal Excise Tax?

+While most goods and services are subject to FET, there are certain exemptions. For example, some nonprofit organizations are exempt from paying excise tax on certain activities. Additionally, certain exports and goods used for research and development purposes may also be exempt.

How does the government ensure compliance with Federal Excise Tax laws?

+The IRS employs a range of measures to ensure compliance with FET laws. This includes audits, investigations, and educational initiatives to help taxpayers understand their obligations. Additionally, the IRS works closely with state and local tax authorities to coordinate enforcement efforts.