Does Doordash Take Out Taxes

For anyone earning an income through gig work, understanding the tax implications is crucial. This is especially true for delivery drivers working with popular food delivery platforms like Doordash. In this article, we will delve into the question: "Does Doordash take out taxes?" We'll explore the tax landscape for Doordash drivers, provide insights into tax responsibilities, and offer guidance on managing your finances as an independent contractor in the gig economy.

Taxation and Doordash: An Overview

Doordash, like other gig economy platforms, operates within a unique framework when it comes to taxes. Unlike traditional employment, where taxes are typically withheld by the employer, Doordash drivers are considered independent contractors. This means that the platform itself does not withhold taxes from your earnings. However, this does not absolve you of your tax responsibilities as a self-employed individual.

As a Doordash driver, you are responsible for paying taxes on your earnings, which include income tax, self-employment tax, and any applicable state and local taxes. The platform does provide some tools and resources to help you understand and manage your tax obligations, but ultimately, it is up to you to ensure compliance with tax laws.

Independent Contractor Status and Tax Implications

Doordash drivers are classified as independent contractors, which means you have a high degree of autonomy in how and when you work. This status offers flexibility but also comes with additional tax responsibilities. Here’s a breakdown of the key tax considerations:

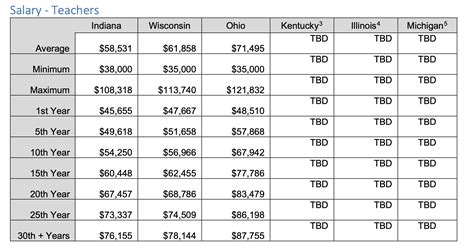

- Income Tax: You are required to pay income tax on your Doordash earnings. The amount of income tax you owe depends on your overall income, deductions, and tax bracket. It's important to accurately report your earnings to the IRS to avoid penalties.

- Self-Employment Tax: As an independent contractor, you are responsible for both the employer and employee portions of Social Security and Medicare taxes. This is commonly known as self-employment tax and is calculated as a percentage of your net earnings.

- State and Local Taxes: Depending on your location, you may also need to pay state and local taxes. These can include income taxes, sales taxes, or other regional levies. It's crucial to understand the tax regulations in your state and city to ensure compliance.

To help you navigate these tax responsibilities, Doordash provides tax resources and guides on their website. They offer information on tax basics, estimated tax payments, and even partner with tax preparation services to provide discounts for drivers. However, it's important to note that these resources are meant as a guide, and you should consult a tax professional for personalized advice.

Record-Keeping and Tax Preparation

Proper record-keeping is essential for Doordash drivers to stay on top of their tax obligations. Here are some tips to help you organize your financial records:

- Keep track of your earnings: Save all payment summaries and statements provided by Doordash. These documents will help you calculate your total income for the year.

- Track expenses: As a business expense, you can deduct certain costs associated with your work, such as vehicle maintenance, fuel, phone bills, and delivery bags. Keep receipts and records of these expenses to maximize your deductions.

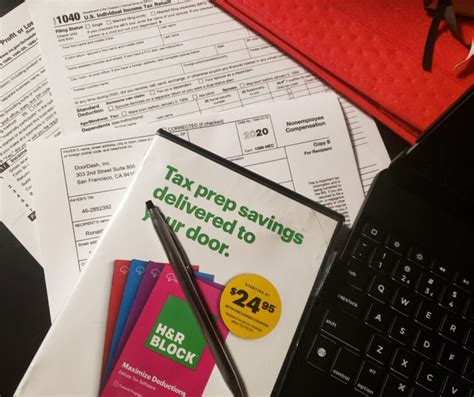

- Use tax preparation software: Consider using dedicated tax software designed for independent contractors. These tools can help you organize your income and expenses, estimate your taxes, and even prepare your tax returns.

- Seek professional advice: If you have complex financial situations or are unsure about tax laws, consult a tax professional. They can provide tailored advice and ensure you are maximizing your deductions while staying compliant with tax regulations.

Managing Your Finances as a Doordash Driver

In addition to understanding your tax responsibilities, it’s important to manage your finances effectively as a Doordash driver. Here are some strategies to help you stay on top of your financial obligations:

- Set aside funds for taxes: It's a good practice to set aside a portion of your earnings specifically for taxes. This ensures that you have the funds available when tax time comes around.

- Estimate your tax liability: Use online calculators or consult a tax professional to estimate your tax liability for the year. This will give you a rough idea of how much you need to set aside for taxes.

- Make estimated tax payments: If you expect to owe more than $1,000 in taxes for the year, you may need to make estimated tax payments quarterly. Doordash provides resources on how to calculate and pay these estimates.

- Consider tax-advantaged accounts: Explore options like Health Savings Accounts (HSAs) or Individual Retirement Accounts (IRAs) to maximize your tax savings. These accounts offer tax benefits and can help you save for the future while reducing your taxable income.

By staying organized, understanding your tax obligations, and seeking professional advice when needed, you can effectively manage your finances as a Doordash driver. Remember, being proactive about your taxes not only ensures compliance but also helps you make the most of your earnings.

Doordash’s Role in Tax Compliance

While Doordash does not withhold taxes from your earnings, they do play a role in promoting tax compliance among their drivers. Here’s how the platform supports drivers in meeting their tax responsibilities:

- Tax Resources: Doordash provides a dedicated section on their website with tax resources and guides. These resources cover topics like tax basics, estimated tax payments, and tax deductions. They aim to educate drivers about their tax obligations and provide practical advice.

- Partnerships with Tax Services: Doordash partners with tax preparation services to offer discounts and special rates to their drivers. This ensures that drivers have access to professional tax advice and assistance at a reduced cost.

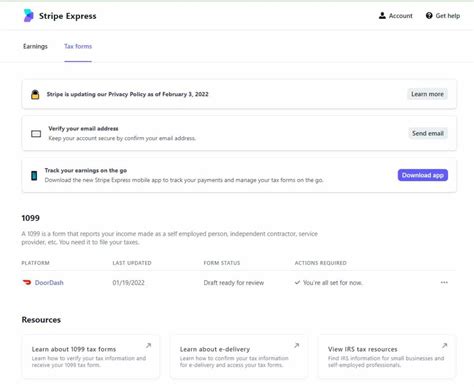

- Payment Summaries: The platform provides detailed payment summaries to drivers, outlining their earnings for the year. These summaries are crucial for accurate tax reporting and help drivers keep track of their income.

- Education and Support: Doordash conducts educational webinars and workshops to help drivers understand their tax responsibilities. They also offer customer support to address tax-related queries and provide guidance on using their tax resources effectively.

While Doordash's support is valuable, it's important for drivers to take an active role in understanding and managing their tax obligations. The platform's resources are meant as a starting point, and drivers should seek additional guidance from tax professionals to ensure they are complying with all relevant tax laws.

Future Implications and Tax Reform

The gig economy, including platforms like Doordash, has sparked discussions about tax reform and the changing nature of work. As the gig economy continues to grow, policymakers and tax authorities are reevaluating the tax implications for independent contractors. Here are some potential future developments to watch:

- Tax Simplification: There are ongoing efforts to simplify tax laws and make them more accessible for independent contractors. This could involve streamlining tax forms, providing clearer guidelines, and potentially reducing the administrative burden on gig workers.

- Tax Reform for Gig Workers: Some proposals suggest treating gig workers as a distinct category, with their own set of tax rules and regulations. This could involve changes to how income is taxed, the calculation of self-employment tax, and potentially providing additional benefits or protections for gig workers.

- Platform Responsibilities: There is a growing debate about the role and responsibilities of platforms like Doordash in tax compliance. Some argue that platforms should have a more active role in withholding taxes or providing better support to their workers. This could lead to changes in how platforms operate and their relationship with independent contractors.

While the future of tax reform for gig workers is uncertain, it's important for Doordash drivers to stay informed about any developments. Keeping up with tax laws and regulations ensures that you can adapt to any changes and continue to manage your finances effectively.

Conclusion

As a Doordash driver, understanding your tax responsibilities is a crucial aspect of managing your financial well-being. While Doordash does not take out taxes from your earnings, they provide valuable resources and support to help you navigate the tax landscape. By staying organized, seeking professional advice, and staying informed about tax laws, you can ensure compliance and make the most of your earnings as an independent contractor in the gig economy.

How often should I check my tax obligations as a Doordash driver?

+It’s a good practice to review your tax obligations at least quarterly. This helps you stay on top of any changes in tax laws and ensures you’re meeting your estimated tax payment requirements. Additionally, it’s a good idea to consult a tax professional annually to ensure you’re maximizing your deductions and complying with the latest regulations.

Can I deduct expenses as a Doordash driver?

+Yes, you can deduct certain expenses related to your work as a Doordash driver. This includes vehicle expenses like fuel, maintenance, and insurance. You can also deduct the cost of delivery bags, phone bills, and other tools necessary for your work. Keep records of these expenses to maximize your deductions.

What happens if I don’t pay my taxes as a Doordash driver?

+Failing to pay your taxes as a Doordash driver can result in significant penalties and interest charges from the IRS. It’s important to understand your tax obligations and take steps to comply. If you’re unsure about your tax liability, consult a tax professional to avoid any potential issues.