Arkansas Tax Calculator

The Arkansas Tax Calculator is an essential tool for individuals and businesses residing or operating in the state of Arkansas. With a unique tax structure, understanding and calculating the various taxes applicable in Arkansas can be a complex task. This article aims to provide a comprehensive guide to the Arkansas tax system, offering insights, calculations, and real-world examples to help you navigate the tax landscape with ease.

Understanding the Arkansas Tax System

Arkansas, known for its vibrant economy and diverse industries, has a tax system that reflects its unique characteristics. The state levies taxes on income, sales, property, and various other activities. For residents and businesses, it is crucial to grasp the intricacies of these taxes to ensure compliance and optimize their financial strategies.

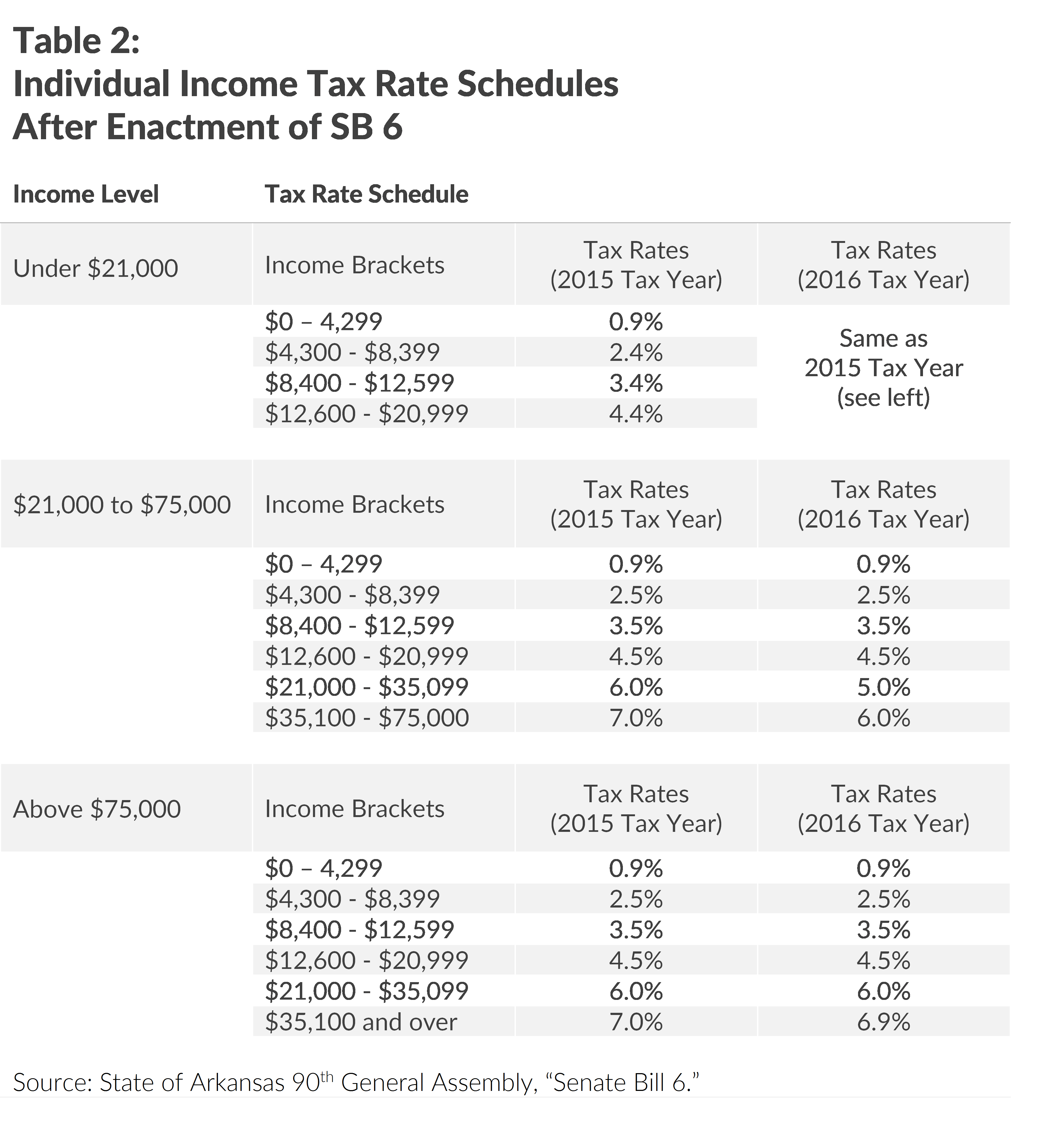

Income Tax: A Personalized Approach

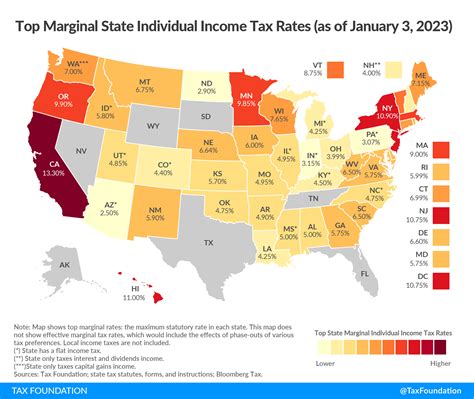

The Arkansas individual income tax is a progressive system, meaning the tax rate increases as income rises. As of the 2023 tax year, Arkansas has five income tax brackets ranging from 0% to 6.9%. These rates apply to taxable income, which is the amount left after deductions and exemptions are taken into account.

| Tax Bracket | Tax Rate |

|---|---|

| First $1,000 of taxable income | 0% |

| Next $2,000 of taxable income | 2% |

| Next $3,000 of taxable income | 3% |

| Next $4,000 of taxable income | 4% |

| All taxable income over $10,000 | 6.9% |

For instance, consider a single taxpayer with a gross income of $50,000. After standard deductions and personal exemptions, their taxable income is $45,000. This income would fall into each bracket consecutively, with the applicable tax rates calculated as follows:

- $1,000 at 0% = $0

- $2,000 at 2% = $40

- $3,000 at 3% = $90

- $4,000 at 4% = $160

- $35,000 at 6.9% = $2,415

The total income tax liability for this taxpayer would be $2,605.

Sales Tax: A Statewide Standard

Arkansas imposes a statewide sales and use tax of 6.5% on most tangible personal property and certain services. However, local jurisdictions can also levy additional taxes, resulting in a combined sales tax rate that varies across the state.

For instance, the city of Little Rock has a local sales tax rate of 2.25%, making the total sales tax rate in the city 8.75%. This means that a purchase of a laptop priced at $1,000 would incur a sales tax of $87.50 in Little Rock.

Property Tax: Assessing Real Estate

Property taxes in Arkansas are primarily assessed at the county level, with rates varying across the state. These taxes are levied on real estate, including land and improvements, and are a significant source of revenue for local governments.

The assessment ratio, which determines the taxable value of property, is set at 20% of the fair market value. This means that a property with a fair market value of $200,000 would have an assessed value of $40,000 for tax purposes.

| County | Property Tax Rate (per $1,000) |

|---|---|

| Pulaski County | $5.50 |

| Benton County | $3.80 |

| Washington County | $4.20 |

Using the example above, a property owner in Pulaski County with a $200,000 fair market value property would pay an annual property tax of $1,100 ($40,000 x $5.50/1,000).

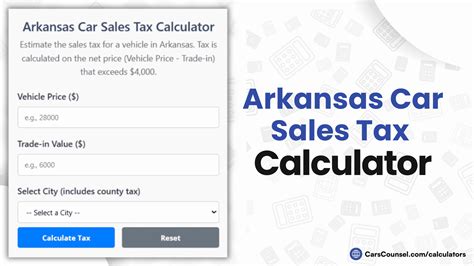

Using the Arkansas Tax Calculator

Navigating the Arkansas tax system can be simplified with the use of an Arkansas Tax Calculator. These calculators, available online, are designed to estimate tax liabilities based on various factors such as income, sales, and property values.

Income Tax Calculator

An income tax calculator for Arkansas can help taxpayers estimate their annual income tax liability. Users input their gross income, applicable deductions, and exemptions, and the calculator applies the relevant tax rates to determine the estimated tax due.

For instance, a married couple filing jointly with a total gross income of $80,000 and claiming the standard deduction could use the calculator to estimate their tax liability. The calculator would factor in the Arkansas income tax brackets and rates to provide an estimated tax amount.

Sales Tax Calculator

A sales tax calculator is a valuable tool for businesses and consumers alike. By inputting the purchase price and the applicable sales tax rate, the calculator provides an estimate of the sales tax due. This is particularly useful for businesses to ensure compliance and for consumers to budget accurately.

Consider a business located in Fort Smith, Arkansas, with a product priced at $500. By entering this information into a sales tax calculator along with the applicable rate (6.5% state tax + 1.25% local tax), the calculator would estimate the sales tax to be $42.50.

Property Tax Calculator

Property tax calculators can assist homeowners in estimating their annual property tax liability. Users input their property’s fair market value and the applicable tax rate, and the calculator estimates the annual tax due.

For example, a homeowner in Washington County with a property valued at $300,000 could use a property tax calculator to estimate their tax liability. With a tax rate of $4.20 per $1,000 of assessed value, the calculator would estimate an annual property tax of $1,260 ($300,000 x 20% x $4.20/1,000).

The Benefits of Using a Tax Calculator

Arkansas Tax Calculators offer numerous advantages to taxpayers and businesses:

- Accuracy: Calculators ensure precision in tax calculations, reducing the risk of errors that could lead to financial penalties.

- Time Efficiency: By automating the tax calculation process, calculators save valuable time, allowing users to focus on other financial matters.

- Budgeting: For individuals and businesses, tax calculators provide an estimate of tax liabilities, aiding in financial planning and budgeting.

- Compliance: Ensuring tax compliance is crucial. Calculators help taxpayers meet their obligations and avoid legal issues.

- Comparison: By inputting different scenarios, calculators allow users to compare tax liabilities, helping them make informed financial decisions.

Conclusion: Empowering Taxpayers with Knowledge

Understanding and managing taxes is a crucial aspect of financial health. The Arkansas Tax Calculator serves as a powerful tool, empowering individuals and businesses to navigate the complex tax landscape with confidence. By leveraging these calculators, taxpayers can ensure compliance, optimize their financial strategies, and make informed decisions.

Frequently Asked Questions

Are there any tax credits or deductions available in Arkansas?

+Yes, Arkansas offers various tax credits and deductions to reduce tax liabilities. These include credits for education expenses, property taxes, and certain types of business investments. Deductions are available for medical expenses, mortgage interest, and charitable contributions, among others.

How often are tax rates updated in Arkansas?

+Arkansas tax rates are typically updated annually to align with legislative changes and economic factors. It is important to refer to the most recent tax guidelines and rates to ensure accurate calculations.

Are there any special tax considerations for small businesses in Arkansas?

+Arkansas provides certain tax incentives for small businesses, such as tax credits for job creation and investment in certain industries. Additionally, small businesses may qualify for reduced sales tax rates or other tax benefits depending on their industry and location.

How can I stay updated on tax changes in Arkansas?

+To stay informed about tax changes in Arkansas, it is recommended to subscribe to updates from the Arkansas Department of Finance and Administration (DFA) and consult reputable tax resources. Additionally, tax professionals and financial advisors can provide valuable insights and guidance.

Are there any tax incentives for renewable energy projects in Arkansas?

+Yes, Arkansas offers tax incentives for renewable energy projects, including tax credits and exemptions. These incentives aim to encourage the development of clean energy sources and reduce the tax burden for businesses and individuals investing in renewable technologies.