Washington State Liquor Tax

The liquor tax in Washington State is an important revenue source for the government and has a significant impact on the alcohol industry within the state. With a rich history dating back to the end of Prohibition, the state's liquor tax system has evolved over the years, shaping the availability and pricing of alcoholic beverages for consumers. This comprehensive guide aims to delve into the intricacies of the Washington State Liquor Tax, exploring its history, current structure, and the implications it has on both consumers and businesses.

A Historical Perspective

The story of Washington State’s liquor tax begins with the repeal of Prohibition in 1933. As the nation embraced the return of legal alcohol, Washington State established its Liquor Control Board (LCB) to regulate the distribution and sale of liquor. The initial focus was on ensuring a fair and controlled environment for alcohol sales, with the tax system primarily designed to generate revenue for the state.

Over the decades, the liquor tax system has undergone several transformations. In the early days, the tax was levied on the wholesale price of liquor, creating a straightforward structure. However, as the alcohol industry grew and diversified, so did the tax system. Today, the tax is imposed on various stages of the supply chain, from producers and importers to retailers, ensuring a comprehensive approach to taxation.

A significant milestone in the history of Washington State's liquor tax was the privatization of liquor sales in 2012. Prior to this, the state-run LCB was the sole distributor of liquor, and its stores were the primary source for consumers to purchase spirits. The privatization process aimed to introduce competition and choice, leading to a more consumer-friendly market while maintaining a robust tax system.

The Current Structure: A Comprehensive Overview

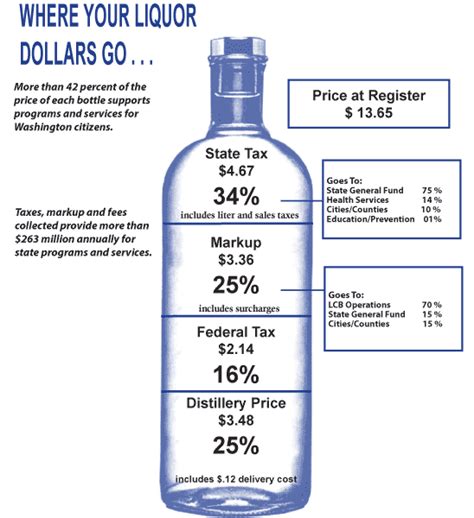

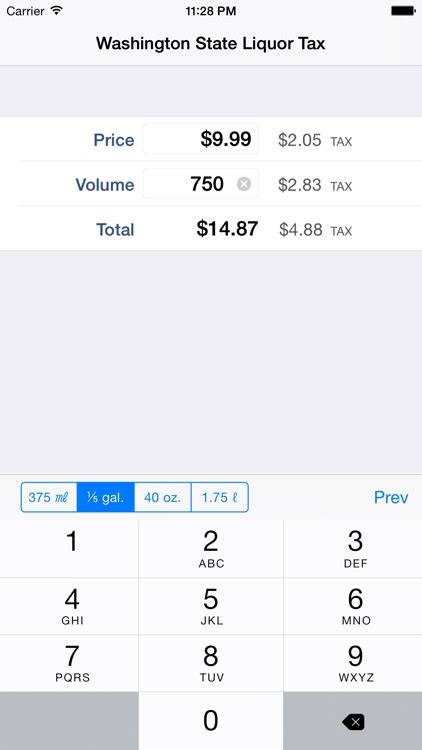

Washington State’s liquor tax system is designed to capture revenue from the production, distribution, and sale of alcoholic beverages. Here’s a detailed breakdown of the current structure:

Producer and Importer Taxes

Producers and importers of alcoholic beverages are subject to a basic liquor tax of 21.90 per liter of absolute alcohol</strong>. This tax is applied to the first sale or transfer of the product within the state. Additionally, there are <strong>supplemental taxes</strong> that vary based on the type of beverage:</p> <ul> <li>Wine: 0.27 per liter.

These supplemental taxes ensure that different types of alcoholic beverages contribute proportionally to the state's revenue.

Wholesale Distribution

When liquor is distributed from producers/importers to wholesalers or retailers, an additional distribution tax is levied. This tax is calculated as a percentage of the wholesale selling price and varies depending on the beverage type:

- Wine: 14.8% of wholesale selling price.

- Beer: 14.8% of wholesale selling price.

- Spirits: 16.2% of wholesale selling price.

Retail Sales

Retailers selling alcoholic beverages to consumers are subject to a sales tax on the final selling price. This tax is set at 10.5% for most regions in Washington State. However, it’s important to note that certain counties and cities may have additional local sales taxes, leading to a higher overall tax rate for consumers.

| Beverage Type | Producer/Importer Tax | Wholesale Distribution Tax | Retail Sales Tax |

|---|---|---|---|

| Wine | $0.27/liter | 14.8% of wholesale price | 10.5% |

| Beer | $0.26/liter | 14.8% of wholesale price | 10.5% |

| Spirits | $8.41/liter of absolute alcohol | 16.2% of wholesale price | 10.5% |

Special Considerations

It’s worth noting that Washington State offers tax incentives for certain types of alcohol production. For instance, there are reduced tax rates for producers of craft beer and hard cider, aiming to promote local businesses and encourage innovation in these sectors.

Impact on Consumers and Businesses

The liquor tax system in Washington State has a dual impact on both consumers and businesses. For consumers, the taxes contribute to the final price of alcoholic beverages, influencing purchasing decisions and overall affordability. The tax structure ensures that different beverage types are taxed proportionally, providing a balanced approach.

From a business perspective, the liquor tax is a significant cost consideration. Producers, importers, and retailers must carefully manage their pricing strategies to remain competitive while meeting their tax obligations. The tax system's complexity, with its various stages of taxation, requires businesses to maintain meticulous records and adhere to strict reporting guidelines.

Competitive Advantage and Innovation

Washington State’s liquor tax system also creates opportunities for businesses. The reduced tax rates for craft beer and hard cider producers, for instance, have fostered a vibrant local industry. This incentive structure has led to an increase in craft breweries and cideries, offering consumers a wide range of unique, locally produced beverages. The tax system, therefore, not only generates revenue but also promotes innovation and economic growth.

Future Implications and Considerations

As the alcohol industry continues to evolve, Washington State’s liquor tax system will need to adapt to remain effective. Here are some key considerations for the future:

Online Sales and E-Commerce

The rise of online sales and e-commerce platforms has transformed the alcohol industry. Washington State will need to carefully consider how to tax these sales, ensuring fairness and compliance while not stifling the growth of this emerging market.

Sustainability and Environmental Impact

With a growing focus on sustainability, the state may explore incentivizing eco-friendly practices within the alcohol industry. This could include tax breaks for producers using sustainable packaging or implementing environmentally friendly production methods.

Public Health and Responsible Consumption

The state may also consider adjusting tax rates to promote responsible consumption. For instance, higher taxes on certain types of beverages could be implemented to discourage excessive drinking, while lower taxes on lower-alcohol content beverages could encourage moderation.

Economic Impact Analysis

Regular economic impact analyses of the liquor tax system are crucial. These analyses should assess the tax system’s effectiveness in generating revenue, its impact on the alcohol industry, and its influence on consumer behavior. Such analyses will ensure that the tax system remains aligned with the state’s economic goals and social priorities.

How does Washington State’s liquor tax compare to other states in the US?

+

Washington State’s liquor tax structure is relatively unique, with a focus on taxing different stages of the supply chain. While some states have similar tax rates for certain beverages, the combination of producer, distributor, and retail taxes is less common. This makes Washington’s tax system more comprehensive and ensures a broader revenue base.

Are there any tax incentives for alcohol producers in Washington State?

+

Yes, Washington State offers reduced tax rates for craft beer and hard cider producers. This incentive aims to promote local businesses and encourage innovation in these sectors, leading to a vibrant craft beverage industry within the state.

How does the privatization of liquor sales impact the tax system?

+

The privatization of liquor sales in 2012 introduced competition and choice for consumers. While the tax system remains robust, the increased competition among retailers has led to more consumer-friendly pricing, ensuring that the tax burden is not solely borne by consumers.

What are the potential future developments for Washington State’s liquor tax system?

+

Washington State may explore further incentives for eco-friendly practices and sustainable production methods within the alcohol industry. Additionally, the state could adjust tax rates to promote responsible consumption, potentially targeting certain beverage types or alcohol strengths.