Commercial Tax Officer Salary

The position of a Commercial Tax Officer is an important role within the tax administration and revenue collection system of many countries. These officers play a vital role in ensuring compliance with commercial tax laws and regulations, and their responsibilities can vary significantly depending on the jurisdiction and the specific department they work for.

Understanding the Role of a Commercial Tax Officer

Commercial Tax Officers are tasked with enforcing commercial tax laws, which include taxes levied on goods, services, and transactions. Their duties involve examining tax returns, conducting audits, and ensuring that businesses and individuals comply with the relevant tax regulations. They may also be involved in investigating tax evasion and fraud cases.

The complexity of their work depends on the tax system and the economy of the region they operate in. For instance, in regions with a diverse range of industries and complex tax structures, Commercial Tax Officers may need to have a deep understanding of various sectors and tax laws. In contrast, in simpler tax systems, their role might be more focused and straightforward.

Salary Structure and Factors Affecting Compensation

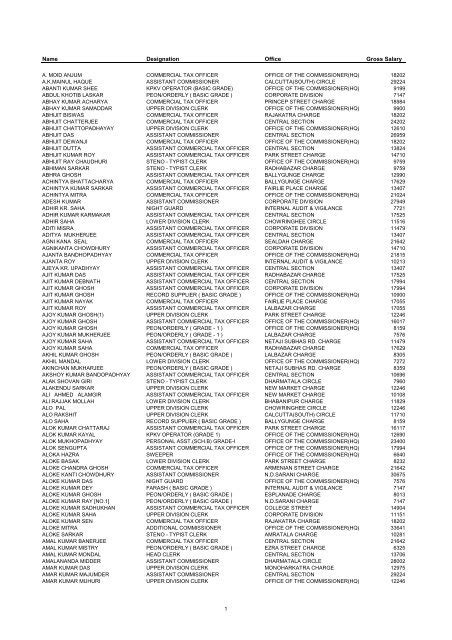

The salary of a Commercial Tax Officer can vary significantly based on several factors, including their level of experience, the region they work in, and the specific department or organization they are employed by. Additionally, the complexity of the tax system and the officer’s role within it can also influence their compensation.

Generally, Commercial Tax Officers are government employees and their salaries are often structured according to a standardized pay scale. This scale typically considers the officer's rank, years of service, and the complexity of their job duties. For instance, an officer with many years of experience and a senior rank might earn a significantly higher salary compared to a newly hired officer.

Geographical Variations in Salaries

Geographical location plays a crucial role in determining a Commercial Tax Officer’s salary. Officers working in urban areas or regions with a high cost of living often receive higher salaries to account for the increased living expenses. Conversely, those in rural areas or regions with a lower cost of living may receive slightly lower salaries.

| Region | Average Annual Salary (USD) |

|---|---|

| North America | $50,000 - $120,000 |

| Europe | €40,000 - €100,000 |

| Asia | ₹3,000,000 - ₹10,000,000 |

These ranges represent average salaries and can vary significantly based on the factors mentioned earlier.

Role and Responsibility Impact on Salary

The specific role and responsibilities of a Commercial Tax Officer can also impact their salary. For example, an officer specializing in auditing complex tax structures or investigating tax fraud might earn a higher salary due to the expertise and skills required for such roles. On the other hand, officers with more administrative duties might earn a slightly lower salary.

Comparative Analysis with Other Tax Professionals

When comparing the salaries of Commercial Tax Officers with other tax professionals, it’s important to consider the unique nature of their role. While tax consultants, accountants, and auditors also play vital roles in the tax ecosystem, their work often focuses on advising and assisting clients in compliance with tax laws, rather than enforcing them.

Commercial Tax Officers, on the other hand, are at the forefront of tax enforcement and collection. They ensure that tax laws are followed, which is a critical aspect of any country's economic stability and growth. This unique responsibility often commands a salary that reflects the importance and complexity of their work.

| Tax Professional Role | Average Annual Salary (USD) |

|---|---|

| Commercial Tax Officer | $50,000 - $120,000 |

| Tax Consultant | $60,000 - $150,000 |

| Tax Accountant | $45,000 - $100,000 |

| Tax Auditor | $55,000 - $130,000 |

The above table provides a comparative analysis of average salaries for various tax professionals. It's important to note that these figures are estimates and can vary significantly based on factors such as location, experience, and the specific responsibilities of each role.

Future Outlook and Career Progression

The future outlook for Commercial Tax Officers is generally positive. As economies continue to grow and tax systems become more complex, the demand for skilled tax professionals is expected to increase. Commercial Tax Officers with extensive experience and specialized skills will likely be in high demand, offering opportunities for career growth and higher salaries.

Career progression for Commercial Tax Officers often involves moving up the ranks within the tax department or organization. Officers can advance to supervisory or managerial roles, where they oversee a team of tax officers and make strategic decisions regarding tax enforcement and collection. Such promotions often come with significant salary increases and enhanced benefits.

Conclusion

The role of a Commercial Tax Officer is crucial for maintaining the integrity of tax systems and ensuring economic stability. Their salaries reflect the importance and complexity of their work, and can vary based on a multitude of factors. As economies evolve and tax systems adapt, the demand for skilled Commercial Tax Officers is expected to grow, offering promising career prospects and opportunities for professional growth.

What are the key responsibilities of a Commercial Tax Officer?

+Commercial Tax Officers are responsible for enforcing commercial tax laws, examining tax returns, conducting audits, and ensuring compliance with tax regulations. They may also investigate tax evasion and fraud cases.

How does experience impact a Commercial Tax Officer’s salary?

+Experience plays a significant role in determining a Commercial Tax Officer’s salary. Officers with more years of experience often earn higher salaries due to their expertise and the complexity of their job duties.

Are there opportunities for career growth within the field of Commercial Tax Officers?

+Yes, there are excellent opportunities for career growth. Commercial Tax Officers can advance to supervisory or managerial roles, overseeing teams and making strategic decisions. These promotions often come with significant salary increases.