Vt Sales Tax

Welcome to an in-depth exploration of the Vermont Sales Tax, a critical aspect of the state's revenue system and a key component in understanding the economic landscape of this beautiful northeastern US state. This article aims to provide a comprehensive guide, offering an insightful journey through the intricacies of Vermont's sales tax, its history, current regulations, and its impact on both businesses and consumers.

Unraveling the Complexities of Vermont Sales Tax

Vermont’s sales tax is a consumption tax levied on the sale of tangible personal property and certain services within the state. It is an essential revenue stream for the state government, contributing significantly to the funding of public services and infrastructure development. With a rich history dating back to the early 20th century, Vermont’s sales tax has evolved over the years, adapting to the changing economic landscape and consumer behavior.

As of my last update in January 2023, Vermont imposes a state-wide sales and use tax rate of 6% on most retail sales, leases, and rentals of tangible personal property, as well as certain specified services. This rate, however, is subject to change and may vary depending on local taxes, which can be imposed by municipalities or counties. For instance, the city of Burlington levies an additional 1% local option tax, bringing the total sales tax rate within the city to 7%.

A Historical Perspective

The history of Vermont’s sales tax can be traced back to the early 1960s when the state first introduced a general sales tax as a way to diversify its revenue sources. Initially, the tax rate was set at a modest 3%, but over the years, it has been adjusted multiple times to meet the state’s changing fiscal needs. One of the significant changes occurred in 1993 when the state increased the rate to 5% to support education funding, a move that was met with some resistance but ultimately passed, highlighting the importance of the sales tax in Vermont’s fiscal strategy.

Understanding the Current Sales Tax Structure

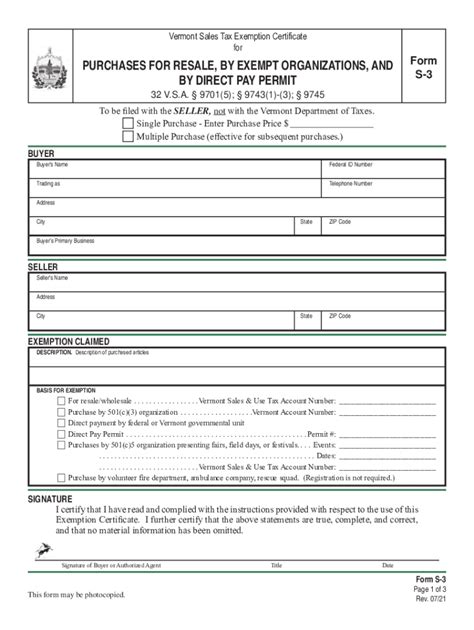

Today, Vermont’s sales tax is a comprehensive tax, covering a wide range of goods and services. However, there are certain exemptions and special provisions in place to accommodate specific industries and consumer needs. For instance, groceries, prescription drugs, and medical supplies are exempt from sales tax, a measure that provides relief to consumers and supports the state’s commitment to healthcare accessibility.

Furthermore, Vermont's sales tax includes a use tax, which is applied to goods and services purchased outside the state for use, storage, or consumption within Vermont. This ensures that Vermont residents and businesses pay their fair share of taxes, even if they make purchases online or out-of-state. The use tax rate mirrors the sales tax rate, currently set at 6%, ensuring consistency in tax collection.

| Sales Tax Type | Tax Rate |

|---|---|

| State Sales Tax | 6% |

| Local Option Tax | Varies (up to 1%) |

| Use Tax | 6% |

Impact on Businesses and Consumers

Vermont’s sales tax has a significant impact on both businesses and consumers. For businesses, especially those in the retail sector, the sales tax is a critical consideration in their pricing strategies and overall financial planning. They are responsible for collecting the tax from customers and remitting it to the state, a process that requires careful record-keeping and compliance with state regulations.

For consumers, the sales tax adds to the cost of goods and services they purchase. While it may be an added expense, the tax revenue is crucial for funding essential services and infrastructure projects that benefit the community. Moreover, the tax structure, with its exemptions and special provisions, ensures that essential items like groceries and medical supplies remain affordable, providing a balance between revenue generation and consumer welfare.

Future Outlook and Potential Changes

As Vermont continues to navigate economic challenges and opportunities, the sales tax remains a critical tool for fiscal management. While the current rate of 6% is relatively stable, there are ongoing discussions and proposals for potential changes. These could include adjustments to the rate, further refinements to the list of taxable items, or the introduction of new tax incentives to stimulate specific sectors of the economy.

One potential area of focus is the state's commitment to environmental sustainability. With a growing emphasis on green initiatives, there could be considerations to introduce tax incentives or rebates for businesses and consumers who adopt eco-friendly practices. This could include rebates for the purchase of electric vehicles or incentives for businesses that implement sustainable waste management systems.

Additionally, as online commerce continues to grow, there may be a need to re-evaluate the state's use tax regulations to ensure they remain effective in capturing revenue from out-of-state purchases. This could involve exploring new technologies and data analytics to better track and manage online sales, ensuring that Vermont receives its fair share of tax revenue from this rapidly expanding sector.

Furthermore, with the ongoing COVID-19 pandemic, there is a potential need for temporary tax adjustments to support businesses and stimulate economic recovery. This could involve tax holidays or temporary rate reductions to encourage consumer spending and provide relief to businesses struggling to recover from the economic impact of the pandemic.

Potential Benefits of Future Changes

- Environmental Incentives: By offering tax incentives for green practices, Vermont could encourage businesses and consumers to adopt more sustainable habits, contributing to the state’s environmental goals.

- Online Sales Management: Improved use tax regulations could ensure that Vermont receives its share of tax revenue from online sales, providing a stable source of funding for public services despite the shift towards e-commerce.

- Economic Stimulus: Temporary tax adjustments, such as tax holidays or rate reductions, could boost consumer spending and provide much-needed support to businesses, aiding in economic recovery.

Conclusion

Vermont’s sales tax is a dynamic and integral part of the state’s fiscal strategy, continually adapting to meet the evolving needs of its residents and businesses. While the current structure provides a stable revenue stream, future changes could further enhance the tax system’s effectiveness, promote sustainability, and support economic growth. As Vermont navigates the complexities of its economic landscape, the sales tax will undoubtedly play a crucial role in shaping its future.

Frequently Asked Questions

What are the current sales tax rates in Vermont?

+As of my last update, the state-wide sales and use tax rate is 6%. However, local option taxes may be added, bringing the total rate to up to 7% in certain areas.

Are there any items exempt from sales tax in Vermont?

+Yes, several items are exempt from sales tax, including groceries, prescription drugs, and medical supplies. These exemptions are designed to reduce the tax burden on essential goods and services.

How does Vermont’s use tax work?

+The use tax is applied to goods and services purchased outside Vermont for use within the state. It ensures that Vermont residents and businesses pay taxes on items they acquire, regardless of where the purchase was made.

What are the consequences for non-compliance with Vermont’s sales tax regulations?

+Non-compliance can result in penalties, interest charges, and potential legal action. It is important for businesses to understand and adhere to the sales tax regulations to avoid these consequences.

How often are Vermont’s sales tax rates reviewed and adjusted?

+The sales tax rates are reviewed periodically, and adjustments are made based on the state’s fiscal needs and economic conditions. While the rates can change, they are typically stable for extended periods.