Sales Tax In Pasadena Ca

Understanding sales tax in Pasadena, California, is crucial for both businesses and consumers. Sales tax is an essential component of the local economy, contributing to the city's revenue and funding various public services and infrastructure. In this comprehensive guide, we will delve into the specifics of sales tax in Pasadena, exploring its rates, regulations, and impact on the community.

Sales Tax Rates in Pasadena

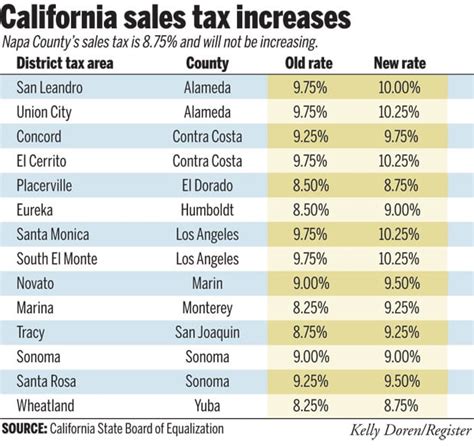

The sales tax in Pasadena, like in many other jurisdictions, is comprised of several tax rates that are layered to form the total sales tax. These rates include state, county, and city-specific taxes, each serving a unique purpose in funding different aspects of government operations.

As of the most recent information, the state sales tax rate in California stands at 7.25%. This rate is uniform across the state and is imposed on most retail sales, including tangible personal property and some services. However, it's important to note that certain items, such as groceries, are exempt from this tax, providing much-needed relief to households.

In addition to the state sales tax, Pasadena imposes a city sales tax of 1.25%. This additional tax is used to fund various city-specific projects and initiatives, ensuring that Pasadena can maintain and improve its infrastructure, public services, and quality of life for residents and businesses alike.

The city of Pasadena also levies a utility users tax (UUT), which is a tax on the consumption of utility services, such as electricity, gas, and water. This tax rate currently stands at 9%, and it is applied to the monthly utility bills of residents and businesses. The revenue generated from the UUT is a significant source of income for the city, supporting essential services and infrastructure development.

| Tax Category | Tax Rate (%) |

|---|---|

| State Sales Tax | 7.25 |

| City Sales Tax | 1.25 |

| Utility Users Tax (UUT) | 9 |

It's important to remember that sales tax rates are subject to change, so it's advisable to refer to official sources for the most up-to-date information. The city of Pasadena provides resources and tools to help businesses and consumers stay informed about the latest tax rates and regulations.

Sales Tax Exemptions and Special Considerations

While sales tax is applied to a wide range of goods and services, there are certain items and transactions that are exempt from this tax. Understanding these exemptions is crucial for businesses and consumers alike to ensure compliance and avoid unnecessary tax burdens.

Groceries and Food

One of the most significant sales tax exemptions in Pasadena (and throughout California) is for groceries and unprepared food items. This exemption provides a much-needed relief for households, especially those on a tight budget. It ensures that the basic necessities of life, such as food, remain more affordable and accessible to all residents.

However, it's important to note that this exemption applies only to certain food categories. For instance, prepared foods, such as hot meals from restaurants or delis, are subject to sales tax. Additionally, non-food grocery items, like toiletries, household supplies, and pet food, may also be taxed depending on their specific nature and use.

Clothing and Shoes

Another notable exemption in Pasadena is for clothing and footwear purchases. Under California law, sales tax is not applied to the sale of clothing and footwear items priced at $110 or less per item. This exemption provides a significant savings for families, especially during back-to-school seasons or when shopping for special occasions.

However, it's crucial to understand the specifics of this exemption. Sales tax may still apply to clothing and footwear items priced above $110, as well as to certain accessories and footwear inserts. It's always advisable to check with the retailer or consult official tax guides to ensure accurate understanding and compliance.

Special Events and Exemptions

Pasadena, being a vibrant city with a rich cultural heritage, often hosts special events and festivals that attract visitors from near and far. During these events, certain temporary sales tax exemptions or reduced rates may be implemented to encourage spending and support local businesses. These exemptions can vary depending on the event and its nature, so it’s essential to stay informed about any applicable tax changes during such occasions.

Compliance and Reporting for Businesses

For businesses operating in Pasadena, understanding and complying with sales tax regulations is a critical aspect of their financial operations. Sales tax compliance ensures that businesses fulfill their legal obligations, maintain a positive relationship with the community, and avoid potential penalties or legal issues.

Registering for Sales Tax

All businesses in Pasadena that engage in taxable sales or provide taxable services are required to register for a seller’s permit with the California Department of Tax and Fee Administration (CDTFA). This permit authorizes the business to collect and remit sales tax on behalf of the state and city. The registration process involves providing essential business information and selecting the appropriate tax rates and filing frequencies.

Sales Tax Collection and Remittance

Once registered, businesses must collect sales tax from customers at the point of sale, based on the applicable tax rates. It’s crucial for businesses to accurately calculate the tax amount and provide transparent information to customers regarding the tax breakdown. The collected sales tax must then be remitted to the appropriate tax authorities on a regular basis, typically monthly or quarterly, depending on the business’s tax liability and filing frequency.

Record-Keeping and Reporting

Maintaining accurate records of sales transactions is essential for businesses to ensure compliance and facilitate accurate tax reporting. Businesses must keep detailed records of taxable sales, including the date, amount, and applicable tax rates. These records are crucial for preparing sales tax returns and verifying the accuracy of tax calculations.

Sales tax returns must be filed with the CDTFA on the designated due dates. These returns provide a summary of the taxable sales made during the reporting period and the corresponding tax liability. Late filing or non-compliance with sales tax regulations can result in penalties and interest charges, so it's vital for businesses to stay organized and meet their reporting obligations.

Impact of Sales Tax on the Pasadena Economy

Sales tax plays a pivotal role in the economic landscape of Pasadena, contributing to the city’s financial stability and funding various initiatives that benefit the community.

Funding Public Services and Infrastructure

The revenue generated from sales tax in Pasadena is a significant source of income for the city, supporting a wide range of public services and infrastructure projects. These funds help maintain and improve essential services such as public safety, transportation, parks and recreation, and public health initiatives.

For instance, sales tax revenue can be allocated to upgrading roads and public transportation systems, making it easier and safer for residents and visitors to navigate the city. It can also be directed towards improving public spaces, such as parks and community centers, creating venues for social gatherings and recreational activities.

Supporting Local Businesses and Economic Growth

Sales tax revenue also has a positive impact on local businesses. By providing funding for public services and infrastructure, the city creates an environment that is conducive to business growth and development. Well-maintained infrastructure, efficient transportation systems, and a vibrant community can attract new businesses and encourage existing ones to expand, leading to increased job opportunities and economic prosperity.

Furthermore, the city's sales tax revenue can be utilized to support small businesses through grants and incentives. These initiatives can help businesses overcome financial hurdles, invest in growth, and contribute to the local economy.

Enhancing Community Well-Being

Beyond its economic implications, sales tax revenue in Pasadena has a direct impact on the well-being of the community. Funds from sales tax support various social programs and initiatives, such as affordable housing projects, youth development programs, and community outreach efforts. These programs aim to address social issues and create a more equitable and inclusive environment for all residents.

Sales tax revenue can also be allocated to emergency response and disaster preparedness, ensuring that the city is equipped to handle unforeseen events and protect the safety and welfare of its residents.

Sales Tax and Tourism in Pasadena

Pasadena, with its rich cultural heritage, beautiful architecture, and diverse attractions, is a popular destination for tourists from around the world. The city’s vibrant tourism industry contributes significantly to the local economy, and sales tax plays a vital role in this ecosystem.

Tourist Spending and Sales Tax

When tourists visit Pasadena, they contribute to the local economy through their spending on accommodations, dining, shopping, and various attractions. These transactions are subject to sales tax, which means that a portion of the money spent by tourists goes towards funding the city’s operations and initiatives.

For instance, when tourists stay in Pasadena hotels, they are typically charged a transient occupancy tax (TOT), which is a type of sales tax applied to lodging services. This tax rate varies depending on the location and type of accommodation, but it contributes significantly to the city's revenue stream.

Attracting and Supporting Tourism

The revenue generated from sales tax on tourism-related activities is reinvested into initiatives that enhance Pasadena’s appeal as a tourist destination. This includes funding for marketing campaigns, promoting the city’s attractions and events to a wider audience. It also supports the maintenance and improvement of tourist hotspots, such as the iconic Rose Bowl Stadium and the charming Old Town Pasadena.

Additionally, sales tax revenue can be directed towards cultural and historical preservation efforts, ensuring that Pasadena's rich heritage is celebrated and shared with visitors. This includes funding for museums, art galleries, and historical sites, providing tourists with a deeper understanding and appreciation of the city's unique character.

Future Implications and Potential Changes

As Pasadena continues to evolve and adapt to changing economic and social landscapes, the sales tax system may undergo modifications to meet emerging needs and challenges.

Potential Rate Adjustments

Sales tax rates are subject to change, and Pasadena may consider adjustments in response to various factors. For instance, if the city faces budgetary constraints or seeks to fund specific initiatives, it may propose an increase in the city sales tax rate. Similarly, if economic conditions improve and the city aims to provide tax relief to residents and businesses, it may consider a rate reduction.

Expanding Taxable Items

As consumer behavior and spending patterns evolve, the city may explore expanding the list of taxable items. For instance, with the rise of e-commerce and digital services, Pasadena may consider imposing sales tax on certain online transactions or digital goods and services. This could help capture revenue from a broader range of economic activities and ensure a more comprehensive tax system.

Exploring Innovative Tax Solutions

In an effort to stay ahead of the curve and adapt to technological advancements, Pasadena may explore innovative tax solutions. This could include implementing a digital sales tax or considering value-added tax (VAT) models, which are prevalent in many countries worldwide. These solutions could provide a more sustainable and adaptable tax system, especially as the economy becomes increasingly digitalized.

Conclusion: A Vital Component of Pasadena’s Economy

Sales tax in Pasadena is a multifaceted system that plays a crucial role in the city’s economic health and community well-being. It funds essential public services, supports local businesses, and enhances the city’s appeal as a vibrant and welcoming destination.

For businesses, understanding and complying with sales tax regulations is essential for legal and financial stability. For residents and visitors, sales tax provides a tangible connection to the city's vibrant economy and the services and initiatives that make Pasadena a great place to live, work, and explore.

As Pasadena continues to thrive and evolve, the sales tax system will remain a vital component of its economic landscape, adapting to meet the needs of a dynamic and ever-changing community.

What is the current sales tax rate in Pasadena, California?

+

As of the most recent information, the total sales tax rate in Pasadena, California, is 9.25%. This rate includes a state sales tax of 7.25% and a city sales tax of 1.25%.

Are there any sales tax exemptions in Pasadena?

+

Yes, there are several sales tax exemptions in Pasadena. Groceries and unprepared food items are exempt from sales tax, providing relief to households. Additionally, clothing and footwear items priced at $110 or less per item are also exempt from sales tax.

How often do businesses need to file sales tax returns in Pasadena?

+

The frequency of filing sales tax returns depends on the business’s tax liability and filing frequency selected during registration. Businesses with higher tax liabilities typically file monthly, while those with lower liabilities may file quarterly. It’s important for businesses to stay informed about their filing obligations.

What happens if a business fails to comply with sales tax regulations in Pasadena?

+

Non-compliance with sales tax regulations can result in penalties and interest charges. Businesses that fail to collect and remit sales tax accurately may face financial penalties and legal consequences. It’s crucial for businesses to understand and adhere to sales tax regulations to avoid these issues.

How does sales tax revenue benefit the Pasadena community?

+

Sales tax revenue in Pasadena is used to fund various public services and infrastructure projects. It supports initiatives such as public safety, transportation improvements, cultural programs, and social services. The revenue also helps maintain and enhance the city’s appeal as a tourist destination.