Mn State Tax Rates

Minnesota, known as the "Land of 10,000 Lakes," boasts a vibrant economy and a robust tax system. Understanding the state's tax rates is crucial for residents, businesses, and investors alike. In this comprehensive guide, we delve into the intricacies of Minnesota's tax landscape, shedding light on its unique features and providing valuable insights for those navigating the state's financial terrain.

Unraveling Minnesota’s Tax Structure

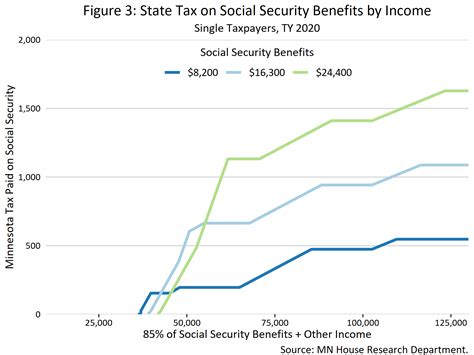

Minnesota operates under a progressive income tax system, which means that as your income increases, so does your tax rate. This approach aims to ensure fairness and provide a balanced approach to taxation. The state categorizes income into six brackets, each with its own tax rate, ranging from 5.35% to 9.85% for single filers and 5.35% to 10.85% for married couples filing jointly.

Beyond income tax, Minnesota imposes a sales tax rate of 6.875%, which applies to most tangible personal property and services. However, it's important to note that certain essential items like food, clothing, and prescription drugs are exempt from this tax. Additionally, local governments may add their own sales tax, resulting in a combined state and local sales tax rate that can vary across the state.

Exploring the Income Tax Brackets

Minnesota’s income tax brackets are designed to cater to a range of income levels. Here’s a breakdown of the current tax rates for the 2023 tax year:

| Tax Rate | Single Filers | Married Filing Jointly |

|---|---|---|

| 5.35% | Up to $24,650 | Up to $36,975 |

| 7.05% | $24,651 - $74,000 | $36,976 - $111,000 |

| 7.85% | $74,001 - $150,000 | $111,001 - $225,000 |

| 8.65% | $150,001 - $233,500 | $225,001 - $350,750 |

| 9.85% | $233,501 and above | $350,751 and above |

These brackets are subject to periodic adjustments to account for inflation and changing economic conditions. It's essential for taxpayers to stay updated with the latest tax rates to ensure accurate filings.

Property Tax: A Significant Component

Property taxes play a significant role in Minnesota’s tax system, with rates varying across counties and municipalities. The state’s average effective property tax rate stands at 1.14%, which is slightly above the national average. However, this rate can differ significantly based on the location and the property’s assessed value.

Minnesota employs a unique classification system for property taxes, dividing properties into different classes. This system ensures that certain types of properties, such as homesteads and agricultural lands, receive favorable tax treatment. Understanding these classifications is crucial for property owners to assess their tax liabilities accurately.

Corporate Tax Environment

Minnesota imposes a corporate income tax on businesses operating within its borders. The tax rate for corporations is 9.8% on taxable income, with additional surcharges applicable for income exceeding $500,000. This rate is relatively competitive compared to other states, providing a stable business environment for corporations.

Moreover, Minnesota offers a range of tax incentives and credits to attract and support businesses. These incentives include research and development credits, job creation credits, and tax exemptions for certain industries. Such initiatives aim to foster economic growth and encourage investment in the state.

Sales and Use Tax: A Comprehensive Overview

Minnesota’s sales and use tax system is designed to generate revenue for the state while ensuring compliance. The state’s 6.875% sales tax applies to most retail transactions, including online purchases. However, certain services, such as legal and medical services, are exempt from this tax.

Businesses operating in Minnesota must register for a sales tax permit and collect the appropriate tax from customers. Failure to comply with sales tax regulations can result in penalties and interest charges. It's crucial for businesses to understand their obligations and stay updated with any changes in the tax laws.

| Sales Tax Rate | Effective Date |

|---|---|

| 6.875% | July 1, 2023 |

How often are Minnesota's tax rates adjusted?

+Minnesota's tax rates are typically adjusted annually to account for inflation and economic changes. The state legislature reviews and approves these adjustments, ensuring that the tax system remains fair and up-to-date.

Are there any tax incentives for renewable energy projects in Minnesota?

+Yes, Minnesota offers various tax incentives for renewable energy projects, including production tax credits and investment tax credits. These incentives aim to promote sustainable energy initiatives and reduce the state's carbon footprint.

What is the deadline for filing Minnesota income taxes?

+The deadline for filing Minnesota income taxes typically aligns with the federal tax filing deadline. For the 2023 tax year, the deadline is April 18, 2024.

Can I deduct my property taxes from my federal income taxes if I live in Minnesota?

+Yes, Minnesota residents can deduct their state and local property taxes from their federal income taxes, provided they itemize their deductions on their federal tax return.

In conclusion, Minnesota’s tax system is a complex yet fair and balanced approach to taxation. By understanding the various tax rates and incentives, individuals and businesses can navigate the state’s financial landscape with confidence. Whether it’s income tax, property tax, or sales tax, staying informed is key to ensuring compliance and optimizing financial strategies.