Nj Income Tax Brackets

The state of New Jersey operates a progressive income tax system, meaning that the level of tax you pay depends on your taxable income. Understanding the income tax brackets and the associated tax rates is crucial for individuals and businesses alike, as it can greatly impact financial planning and budgeting. This article delves into the intricacies of the New Jersey income tax brackets, providing a comprehensive guide to help taxpayers navigate the state's tax landscape.

Taxable Income Brackets and Rates

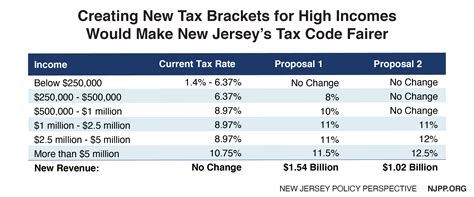

As of 2023, New Jersey’s income tax brackets and rates are as follows:

| Taxable Income | Tax Rate |

|---|---|

| $0 - $20,000 | 1.4% |

| $20,001 - $35,000 | 3.5% |

| $35,001 - $40,000 | 5.52% |

| $40,001 - $75,000 | 6.37% |

| $75,001 - $150,000 | 7.65% |

| $150,001 - $500,000 | 8.97% |

| $500,001 and above | 10.75% |

These brackets are applicable to single filers, married couples filing jointly, and heads of households. It's important to note that the tax rates are applied progressively, meaning that income within each bracket is taxed at the corresponding rate, and income exceeding a bracket threshold is taxed at the next higher rate.

Taxable Income Calculation

Determining your taxable income involves several steps. Firstly, you need to calculate your gross income, which includes all income sources such as wages, salaries, tips, interest, dividends, and capital gains. From this gross income, you can deduct any applicable exemptions and deductions to arrive at your taxable income.

Personal Exemptions

New Jersey allows personal exemptions for each taxpayer and their dependents. For tax year 2023, the personal exemption amount is 1,500 per person. This means that for a married couple filing jointly with two children, they can claim a total of 6,000 in personal exemptions, reducing their taxable income by this amount.

Standard Deductions

In addition to personal exemptions, taxpayers can also claim standard deductions. These deductions reduce taxable income and vary depending on the filing status. For 2023, the standard deductions are:

- Single: $3,800

- Married Filing Jointly: $7,600

- Head of Household: $5,700

Taxpayers can choose to itemize their deductions instead of claiming the standard deduction if it results in a higher total deduction. Itemized deductions may include medical expenses, charitable contributions, state and local taxes, and mortgage interest, among others.

Tax Filing and Payment

New Jersey taxpayers must file their income tax returns by the annual deadline, which is typically April 15th. However, this deadline may be extended by the state tax authority. Tax returns can be filed electronically or by mail, and taxpayers have the option to pay their taxes due through various methods, including direct debit, credit card, or electronic funds transfer.

Estimated Tax Payments

If you have income from sources other than wages, such as self-employment, rental properties, or investments, you may be required to make estimated tax payments throughout the year. These payments help ensure that you are meeting your tax obligations and avoid penalties for underpayment.

Tax Withholding

For taxpayers with wages or salaries, tax withholding is a common practice. Employers are required to withhold income tax from employees’ paychecks based on the information provided on their W-4 forms. This withholding amount is then applied towards the taxpayer’s annual tax liability.

Tax Credits and Incentives

New Jersey offers various tax credits and incentives to promote specific behaviors or support certain groups. Some common tax credits include the Property Tax Credit, which provides relief to eligible homeowners, and the Earned Income Tax Credit, which benefits low- and moderate-income workers.

Research and Development Tax Credit

One notable tax incentive is the Research and Development Tax Credit, which encourages businesses to invest in research and development activities within the state. Eligible businesses can claim a credit against their corporate income tax liability, promoting innovation and economic growth.

Film and Digital Media Tax Credit

The state also offers the Film and Digital Media Tax Credit, designed to attract film and television productions to New Jersey. This credit provides a significant incentive for productions to choose the state as their filming location, benefiting the local economy and creating job opportunities.

Tax Planning and Strategies

Understanding the New Jersey income tax brackets is a crucial step in effective tax planning. By being aware of the brackets and associated rates, taxpayers can make informed decisions to minimize their tax liability. Some common tax planning strategies include:

- Maximizing Deductions and Credits: Take advantage of all applicable deductions and credits to reduce your taxable income and overall tax burden.

- Strategic Income Management: Plan income streams to fall within lower tax brackets or take advantage of bracket thresholds.

- Retirement Account Contributions: Contributions to retirement accounts, such as 401(k)s or IRAs, can reduce taxable income and provide long-term tax benefits.

- Tax-Efficient Investment Strategies: Consider tax-efficient investment options to minimize capital gains and dividend taxes.

Future Implications

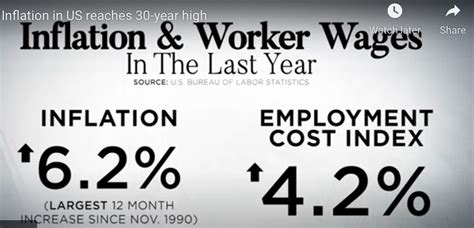

The state of New Jersey has a history of adjusting its tax brackets and rates to align with economic trends and budget needs. As such, taxpayers should expect periodic changes to the tax landscape. These adjustments can impact not only individual taxpayers but also businesses and the overall economic climate of the state.

In recent years, there has been a growing focus on tax reform and simplification. While specific reforms have not yet been implemented, discussions around flattening tax brackets, reducing tax rates, and simplifying the tax code are ongoing. These potential changes could significantly impact the state's tax structure and the financial planning strategies of taxpayers.

Furthermore, the state's economic recovery efforts post-pandemic may also influence future tax policies. New Jersey, like many other states, faces the challenge of balancing revenue needs with the desire to support economic growth and provide tax relief to residents and businesses.

Staying informed about these potential changes and their implications is crucial for effective tax planning and ensuring compliance with the state's tax laws.

Conclusion

Navigating the New Jersey income tax brackets is an essential aspect of financial planning for individuals and businesses in the state. By understanding the progressive nature of the tax system and staying informed about the latest tax laws and incentives, taxpayers can make informed decisions to optimize their tax strategies. As the state’s tax landscape continues to evolve, taxpayers should remain vigilant and adaptable to ensure they are prepared for any changes that may impact their financial well-being.

How often are New Jersey’s income tax brackets updated?

+New Jersey’s income tax brackets are typically updated annually to account for inflation and economic changes. The state tax authority releases the updated brackets and tax rates before the start of each tax year.

Are there any income tax exemptions for certain professions or industries in New Jersey?

+While New Jersey does not offer specific income tax exemptions based on profession or industry, certain tax credits and incentives are available for businesses operating in targeted sectors, such as renewable energy or research and development.

What happens if I don’t pay my New Jersey income taxes on time?

+Late payment of New Jersey income taxes can result in penalties and interest charges. The state tax authority may also impose additional fees for late filing or non-compliance. It’s crucial to pay your taxes on time to avoid these penalties.