Nevada County Tax Collector

The Nevada County Tax Collector's Office is an essential government agency responsible for efficiently managing tax collections and providing vital services to the residents and businesses of Nevada County, California. With a focus on transparency, customer service, and effective tax administration, the office plays a crucial role in the county's financial stability and economic growth. This article aims to delve into the various aspects of the Nevada County Tax Collector's operations, shedding light on its key responsibilities, services, and the impact it has on the local community.

A Comprehensive Overview of the Nevada County Tax Collector’s Office

The Nevada County Tax Collector’s Office, headed by the elected County Treasurer-Tax Collector, is dedicated to ensuring the timely and accurate collection of taxes, fees, and assessments mandated by state and local laws. The office serves as a crucial link between the government and taxpayers, facilitating the smooth flow of revenue to fund essential public services and infrastructure projects.

One of the primary functions of the Nevada County Tax Collector's Office is the collection of property taxes. This involves assessing the value of properties within the county, sending out tax bills, and ensuring timely payment. Property taxes are a significant source of revenue for the county, supporting vital services such as education, public safety, and infrastructure maintenance.

Property Tax Assessment and Collection Process

The office follows a systematic approach to property tax assessment and collection. It begins with the evaluation of properties based on factors like location, size, improvements, and market value. This data is then used to calculate the tax liability for each property owner. The tax bills are mailed out annually, detailing the amount due and the payment due dates.

Nevada County offers various payment options to taxpayers, including online payment portals, payment by mail, and in-person payments at the Tax Collector's Office. The office also provides assistance to taxpayers who may be facing financial difficulties, offering payment plans and relief programs to ensure that everyone has the opportunity to meet their tax obligations.

| Property Tax Cycle | Timeline |

|---|---|

| Assessment | January - March |

| Tax Bills Sent | Late March - April |

| First Installment Due | April 10 |

| Second Installment Due | November 1 |

In addition to property taxes, the Nevada County Tax Collector's Office is responsible for collecting various other taxes and fees. These include:

- Personal Income Tax: The office collaborates with the state and federal tax agencies to process and collect personal income taxes from Nevada County residents.

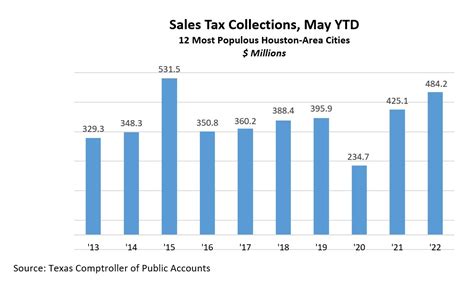

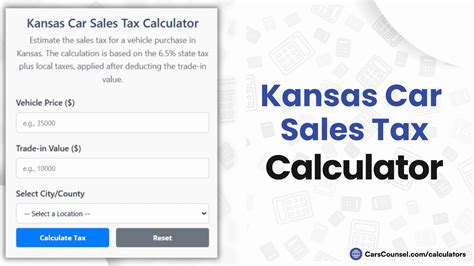

- Business Taxes: It administers and collects taxes from businesses operating within the county, including sales taxes, business license fees, and other applicable levies.

- Special Assessments: The office handles the collection of special assessments, such as those for infrastructure projects or maintenance of common areas within the county.

- Vehicle Registration Fees: Nevada County residents register their vehicles and pay associated fees through the Tax Collector's Office.

Services and Support for Taxpayers

The Nevada County Tax Collector’s Office goes beyond mere tax collection. It offers a range of services and support to ensure that taxpayers have the information and resources they need to fulfill their tax obligations smoothly.

Taxpayer Assistance and Education

The office prioritizes taxpayer education and assistance, recognizing that informed taxpayers are essential for an efficient tax system. It provides comprehensive resources and guides on its website, covering various tax-related topics such as property tax assessments, payment options, and tax relief programs.

Additionally, the Tax Collector's Office hosts regular workshops and informational sessions, inviting taxpayers to learn about the tax process, ask questions, and gain a better understanding of their rights and responsibilities. These events create a platform for open dialogue between taxpayers and tax officials, fostering a collaborative environment.

Tax Relief Programs

Understanding that unforeseen circumstances can impact a taxpayer’s ability to meet their tax obligations, the Nevada County Tax Collector’s Office offers a range of tax relief programs. These programs aim to provide assistance to those facing financial hardship, ensuring that they can access support without compromising the county’s revenue.

- Senior Citizen's Property Tax Postponement Program: This program allows eligible senior citizens to postpone the payment of their property taxes until the property is sold, providing financial relief to those on fixed incomes.

- Disabled Veteran's Property Tax Exemption: Nevada County honors disabled veterans by offering a partial or full exemption from property taxes, depending on the extent of their disability.

- Unemployment Relief Program: For taxpayers who have become unemployed or experienced a significant reduction in income, the office may offer temporary relief from property tax payments, providing much-needed financial breathing room.

The Tax Collector's Office also works closely with community organizations and financial institutions to ensure that taxpayers are aware of these relief programs and can access the support they need.

Online Services and Payment Options

In today’s digital age, the Nevada County Tax Collector’s Office recognizes the importance of offering convenient online services. The office’s website provides a secure and user-friendly platform for taxpayers to access their accounts, view tax bills, and make payments.

The online portal offers a range of features, including:

- Real-time tax bill information and payment status.

- Secure payment methods, including credit/debit card and e-check.

- E-mail and text message alerts for upcoming due dates and payment confirmations.

- Downloadable tax documents and payment receipts.

- Access to property tax histories and assessment records.

These online services not only enhance convenience but also contribute to a more sustainable and environmentally friendly approach to tax administration.

Community Engagement and Transparency

The Nevada County Tax Collector’s Office places a strong emphasis on community engagement and transparency. It understands that effective tax administration relies on a collaborative relationship between the government and taxpayers.

Community Outreach and Events

The office actively participates in community events and initiatives, providing tax-related information and support. This includes attending local festivals, town hall meetings, and educational fairs, ensuring that taxpayers have access to accurate and up-to-date information.

Through these community engagements, the Tax Collector's Office aims to build trust and foster a sense of ownership among taxpayers. It encourages residents to voice their concerns, ask questions, and provide feedback, creating a more inclusive and responsive tax administration system.

Transparency in Tax Administration

Transparency is a cornerstone of the Nevada County Tax Collector’s Office’s operations. The office maintains an open and accessible approach to tax information, ensuring that taxpayers can easily understand the tax process and their obligations.

Key aspects of transparency include:

- Clear Communication: The office uses plain language in all its communications, avoiding technical jargon that may be confusing to taxpayers.

- Online Transparency: The website provides detailed information on tax rates, assessment processes, and payment due dates, ensuring that taxpayers have access to the data they need.

- Public Records: Tax records and assessment data are made available to the public, promoting accountability and trust in the tax administration system.

By embracing transparency, the Nevada County Tax Collector's Office fosters a culture of trust and accountability, encouraging taxpayers to actively participate in the tax process and contribute to the county's growth and development.

Conclusion: The Impact of Effective Tax Administration

The Nevada County Tax Collector’s Office plays a pivotal role in the county’s financial health and economic prosperity. Through its efficient tax collection processes, taxpayer support, and community engagement, the office ensures that the county receives the revenue it needs to provide essential services and maintain its infrastructure.

By understanding the unique needs and challenges of its taxpayers, the office has developed a range of services and programs that make tax compliance more accessible and manageable. This approach not only enhances the county's revenue stream but also strengthens the bond between the government and its residents, fostering a sense of shared responsibility and community.

As Nevada County continues to grow and evolve, the Tax Collector's Office remains dedicated to adapting its services to meet the changing needs of the community. Through innovation, transparency, and a commitment to excellence, the office strives to make tax administration a seamless and beneficial process for all.

How can I pay my property taxes in Nevada County?

+You can pay your property taxes in Nevada County through the online portal, by mail, or in person at the Tax Collector’s Office. The office accepts payments by credit/debit card, e-check, cash, and check. Online payments are secure and provide instant confirmation.

What happens if I miss the property tax payment deadline?

+If you miss the property tax payment deadline, a penalty of 10% of the unpaid amount or 10, whichever is greater, will be added. You have the option to pay the penalty and avoid further interest by paying within the first two weeks of the delinquency period. After this period, interest will be charged on the unpaid balance.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any tax relief programs available for low-income residents?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, Nevada County offers the Low Income Senior Exemption Program, which provides a property tax exemption of up to 7,000 for eligible low-income seniors. Additionally, the Disabled Veteran’s Property Tax Exemption and Senior Citizen’s Property Tax Postponement Program are also available to provide financial relief.

How can I access my tax records and payment history?

+You can access your tax records and payment history through the Nevada County Tax Collector’s online portal. Simply log in to your account using your unique user ID and password. If you don’t have an online account, you can create one using your property’s Assessor’s Parcel Number (APN) and other identifying information.

Can I request a tax bill to be sent to a different address?

+Yes, you can request to have your tax bill sent to an alternate address. You will need to complete a Change of Address form and provide supporting documentation, such as a lease agreement or a utility bill showing your new address. The Tax Collector’s Office will process your request and update your records accordingly.