California State Tax Due Date

The California State Tax Due Date is an important deadline for residents and businesses alike, as it marks the culmination of a fiscal year and the beginning of the tax filing process. This deadline, which varies based on the type of taxpayer and the nature of their taxes, is crucial for maintaining compliance with the state's tax regulations and avoiding penalties. In this comprehensive guide, we will delve into the specifics of the California State Tax Due Date, exploring its significance, key dates, and the implications for taxpayers.

Understanding the California State Tax Due Date

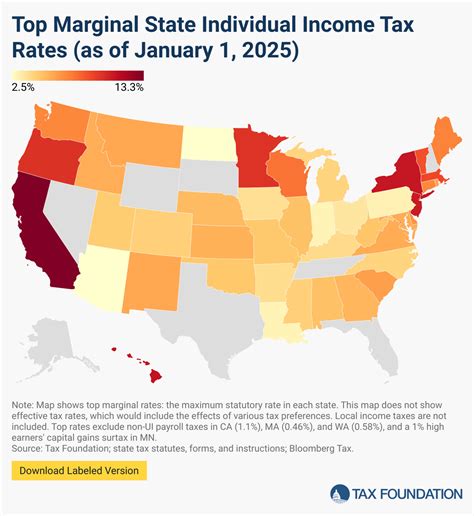

California, known for its vibrant economy and diverse population, imposes a range of taxes on its residents and businesses. These taxes, which include income tax, sales tax, property tax, and various other levies, contribute to the state’s revenue and fund essential services and infrastructure. The California State Tax Due Date is the deadline by which taxpayers must remit their tax obligations to the state’s tax authorities.

The due date is a critical milestone in the tax calendar, as it signals the end of the fiscal year and the start of the tax filing process. It is a time when taxpayers must carefully review their financial records, calculate their tax liabilities, and ensure that they meet their obligations to the state. Failure to meet this deadline can result in penalties, interest charges, and other legal repercussions.

Key Dates and Deadlines

The California State Tax Due Date varies depending on the type of tax and the taxpayer’s status. Here are some of the key deadlines that taxpayers should be aware of:

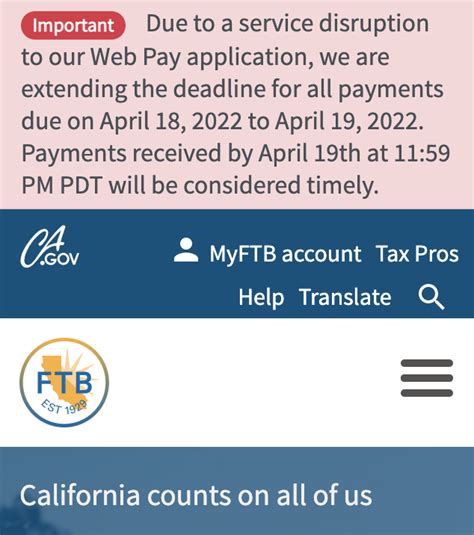

- Income Tax: The standard due date for individual income tax returns is April 15th. However, if this date falls on a weekend or a holiday, the deadline is typically extended to the next business day. For example, in 2023, the due date for individual income tax returns was April 18th due to the Emancipation Day holiday.

- Business Taxes: Businesses in California have varying due dates for their tax obligations. For instance, quarterly estimated tax payments for businesses are typically due on the 15th day of the 4th, 6th, 9th, and 12th months of the fiscal year. Additionally, certain business taxes, such as sales and use tax, have their own specific due dates.

- Property Tax: Property taxes in California are typically due in two installments. The first installment is due on December 10th, while the second installment is due on April 10th of the following year. However, if either of these dates falls on a weekend or a holiday, the due date is adjusted accordingly.

- Special Taxes: California imposes a variety of special taxes, such as fuel taxes, tobacco taxes, and environmental taxes. Each of these taxes has its own unique due date, which can be found on the California Department of Tax and Fee Administration's website.

| Tax Type | Due Date |

|---|---|

| Individual Income Tax | April 15th (or the next business day if a holiday) |

| Business Estimated Tax | 4th, 6th, 9th, and 12th months of the fiscal year |

| Property Tax | December 10th (1st installment) and April 10th (2nd installment) |

| Special Taxes (e.g., fuel, tobacco) | Varies based on the specific tax |

Preparing for the California State Tax Due Date

Preparing for the California State Tax Due Date requires careful planning and organization. Taxpayers should take the following steps to ensure a smooth and compliant tax filing process:

- Gather Tax Documents: Collect all relevant tax documents, including W-2 forms, 1099 forms, receipts, invoices, and any other records related to income, deductions, and expenses.

- Review Tax Laws and Regulations: Stay updated on the latest tax laws and regulations in California. This includes understanding any changes in tax rates, deductions, credits, and reporting requirements.

- Calculate Tax Liability: Determine your tax liability by carefully reviewing your income, deductions, and credits. Use tax software or consult a tax professional to ensure accuracy.

- Plan Your Payments: If you anticipate owing taxes, consider setting aside funds or making estimated tax payments throughout the year to avoid penalties and interest charges.

- Consider Professional Assistance: For complex tax situations or if you are unsure about your tax obligations, seeking the advice of a tax professional can be beneficial. They can provide guidance and ensure compliance with California's tax laws.

Electronic Filing and Payment Options

California offers convenient electronic filing and payment options to streamline the tax process. Taxpayers can utilize the following methods to file their returns and remit payments:

- Electronic Filing: The California Franchise Tax Board provides an online filing system called CalFile, which allows individual taxpayers to file their income tax returns electronically. This system is secure, efficient, and offers real-time error checking.

- Electronic Payment Options: California taxpayers can make their tax payments electronically through various methods, including direct debit, credit or debit cards, and electronic funds transfer (EFT). These options provide a secure and convenient way to remit taxes.

Implications of Missing the California State Tax Due Date

Missing the California State Tax Due Date can have significant implications for taxpayers. Here are some potential consequences:

- Late Filing Penalties: If you fail to file your tax return by the due date, you may be subject to late filing penalties. These penalties can range from a percentage of the unpaid tax to a flat fee, depending on the specific circumstances.

- Interest Charges: Unpaid taxes that are not remitted by the due date may incur interest charges. The interest rate is typically based on the federal short-term rate, with adjustments made periodically.

- Legal Repercussions: In cases of chronic non-compliance or deliberate tax evasion, taxpayers may face legal repercussions, including audits, criminal charges, and even imprisonment.

- Negative Impact on Credit: Late tax payments can have a negative impact on your credit score and credit report. This can affect your ability to obtain loans, mortgages, or other financial services in the future.

Extensions and Payment Plans

In certain situations, taxpayers may be eligible for extensions or payment plans to manage their tax obligations. Here are some options to consider:

- Extension of Time to File: Taxpayers can request an extension of time to file their tax return if they are unable to meet the standard due date. This extension provides additional time to file the return but does not extend the deadline for paying any taxes owed.

- Payment Plan Options: If you are unable to pay your tax liability in full by the due date, you may be eligible for a payment plan. The California Franchise Tax Board offers various payment plan options, including installment agreements and partial payment plans. These plans allow taxpayers to pay their taxes over an extended period, typically with a fee and interest charges.

Staying Informed and Seeking Assistance

Navigating the complexities of California’s tax system can be challenging, especially for individuals and businesses new to the state. It is crucial to stay informed about tax laws, deadlines, and compliance requirements. The following resources can provide valuable guidance:

- California Franchise Tax Board: The official website of the California Franchise Tax Board (FTB) offers a wealth of information, including tax forms, instructions, and updates on tax laws. The FTB also provides taxpayer assistance through their call center and online resources.

- California Department of Tax and Fee Administration: This department oversees various taxes, including sales and use tax, fuel tax, and tobacco tax. Their website provides detailed information on tax rates, due dates, and filing requirements for these taxes.

- Tax Professionals: Engaging the services of a tax professional, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA), can provide specialized expertise and guidance. These professionals can help with tax planning, compliance, and resolving complex tax issues.

Conclusion

The California State Tax Due Date is a critical deadline for taxpayers, as it marks the culmination of a fiscal year and the initiation of the tax filing process. By understanding the key dates, preparing adequately, and seeking professional assistance when needed, taxpayers can ensure compliance with California’s tax laws and avoid penalties. Staying informed, utilizing electronic filing and payment options, and exploring extensions or payment plans when necessary can help taxpayers navigate the complexities of California’s tax system successfully.

What happens if I miss the California State Tax Due Date for my income tax return?

+If you miss the due date for filing your income tax return, you may be subject to late filing penalties and interest charges. It is important to file your return as soon as possible to minimize these penalties. You can request an extension of time to file, but this does not extend the deadline for paying any taxes owed.

Are there any exceptions to the California State Tax Due Date for individuals?

+Yes, there are certain exceptions and special circumstances that may apply to individuals. For example, military personnel stationed outside the United States may be eligible for a filing extension. Additionally, individuals who are victims of certain natural disasters or other qualifying events may also be granted an extension.

How can I stay updated on changes to California’s tax laws and regulations?

+To stay informed about changes to California’s tax laws, you can subscribe to updates and newsletters from the California Franchise Tax Board and the California Department of Tax and Fee Administration. These agencies regularly provide updates on tax law changes, new regulations, and important deadlines.